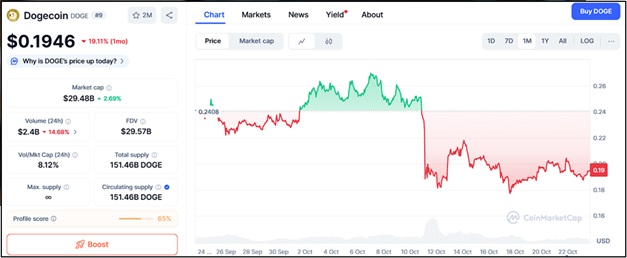

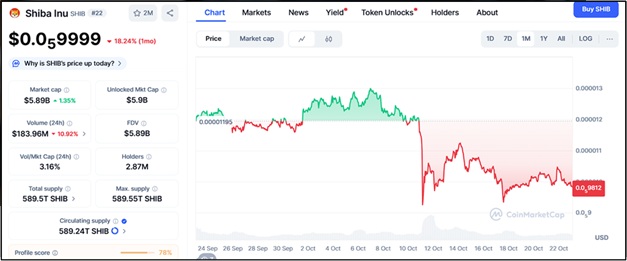

A recent report from blockchain intelligence firm TRM Labs confirms that cryptocurrency transaction volume in the US surged by approximately 50% in the first half of 2025 compared to the same period in 2024, reaching over $1 trillion.

This marks the US as the world’s largest crypto market by absolute volume, driven by a combination of retail investor enthusiasm and institutional momentum. The growth reflects a multi-year trend, with stablecoin transactions which account for about 30% of total crypto volume jumping 83% year-over-year to a record $4 trillion by August 2025.

Several policy and market shifts under the Trump administration have fueled this boom. The SEC launched “Project Crypto” in August 2025 to position the US as the “crypto capital of the world,” ending prior enforcement actions.

In April, the Department of Justice scaled back crypto prosecutions. The GENIUS Act, signed in July, established stablecoin reserve requirements. Exchange web traffic rose 30% in late 2024 and early 2025, signaling strong professional interest.

Individual-led transactions grew over 125% from January to September 2025, with memecoins playing a key role in onboarding new users. While the US leads in total volume, grassroots adoption is hotter elsewhere: India: Fastest-growing region in South Asia, with higher per-capita usage rates.

Egypt, Morocco, Algeria, and Tunisia rank in the global top 50 for crypto usage, despite bans. Europe: Ownership jumped sharply, e.g., UK from 18% to 24% and France from 18% to 21% of adults.

The $1 trillion transaction volume underscores crypto’s growing role in the US economy. Institutional inflows and retail enthusiasm 125% growth in individual-led transactions signal increased liquidity and market maturity, potentially attracting more traditional investors and boosting related industries like blockchain tech and fintech.

With stablecoins driving 30% of volume and growing 83% year-over-year, they’re becoming a backbone for practical applications like remittances, cross-border payments, and DeFi. This could challenge traditional financial systems, especially for dollar-based transactions.

While retail participation is up, the concentration of crypto wealth may exacerbate wealth gaps if speculative gains favor early adopters or high-risk investors. The Trump administration’s moves—SEC’s “Project Crypto,” DOJ’s reduced enforcement, and the GENIUS Act—signal a friendlier regulatory environment.

This could sustain growth but risks oversight gaps, potentially leading to fraud or market manipulation if not balanced with consumer protections. The US’s push to be the “crypto capital” may pressure other nations to clarify their regulations, fostering a global race for crypto-friendly policies.

However, this could also spark tensions with jurisdictions like the EU, which prioritize stricter oversight. Surging transaction volumes complicate tax reporting and anti-money laundering (AML) enforcement, requiring updated frameworks to track and regulate high-frequency crypto activity.

Rising ownership from 20% to 22% of US adults and a 30% spike in exchange traffic reflect crypto’s shift from niche to mainstream. Memecoins, despite volatility, are onboarding younger and less crypto-savvy users, reshaping financial literacy and investment culture.

While the US leads in volume, grassroots adoption is stronger in regions like India and North Africa. This highlights a divide where developing nations use crypto for necessity (e.g., remittances, inflation hedges), while US growth leans speculative, potentially influencing global perceptions of crypto’s utility.

The retail surge, particularly in memecoins, raises concerns about speculative bubbles, which could erode trust if crashes occur, especially among new investors drawn by hype. Crypto’s growth offers inclusion for underbanked populations but also exposes users to volatility and scams, especially without robust education or regulation.

Increased adoption could accelerate blockchain innovation, from DeFi to tokenized assets, but may strain infrastructure. The US’s crypto embrace could strengthen its financial dominance but risks alienating allies with stricter policies, impacting global trade and sanctions enforcement.

These implications suggest a transformative moment for crypto in the US, with benefits tied to innovation and access but tempered by risks of instability and regulatory challenges.

Other 2025 reports align on modest US ownership gains from 20% to 22% of adults, but TRM’s volume metric highlights the scale of activity. Overall, crypto’s mainstreaming continues, with stablecoins enabling practical uses like remittances and payments.