The recent history of West African nations, specifically Guinea, Mali, Burkina Faso, and Niger, bears witness to a series of coups that have shaken the political landscape. These coups have left citizens questioning the stability of their democratically elected governments. Delving into the data and the societal response, it becomes evident that political and economic uncertainty played a pivotal role in facilitating these coups. This article explores how these uncertainties paved the way for military takeovers in these nations and examines the public’s attitude towards democracy during this tumultuous period.

The Unraveling of Stability

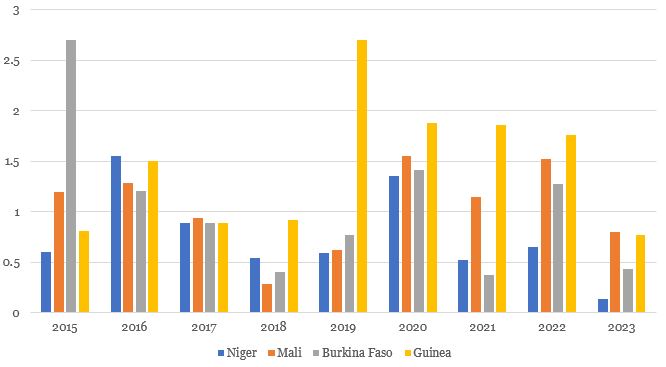

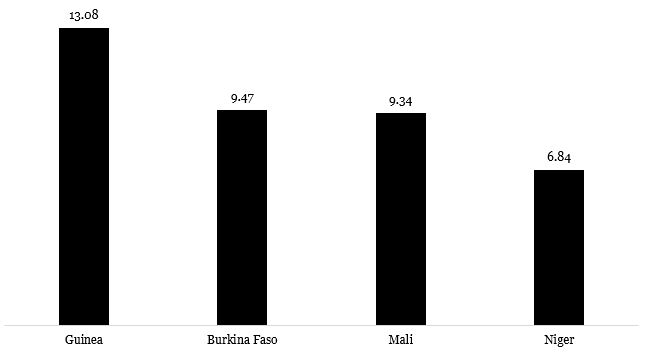

As we assess the trajectory of political and economic uncertainty in the four countries over the span of nine years, a distinct pattern emerges. Burkina Faso, Guinea, Mali, and Niger all witnessed varying degrees of instability during this period. Among them, Burkina Faso experienced the highest levels of uncertainty, notably in 2015, 2020, and 2022. Guinea followed closely with its peaks in 2019, 2020, and 2021. Mali and Niger displayed a more unsteady growth in uncertainty but shared their highest points in 2020 and 2021. These elevated levels of uncertainty have been instrumental in providing fertile ground for the growth of dissatisfaction and discontent among citizens.

The Nexus of Uncertainty and Coup d’état

The connection between political and economic uncertainty and the occurrence of coups is apparent when observing the timeline of these events. In each of these countries, the years of highest uncertainty often coincide with coup attempts. It is here that we find the intersection of public disillusionment, wavering confidence in the government’s ability to address socio-political challenges, and an environment conducive to a military intervention.

Guinea, Mali, Burkina Faso, and Niger all experienced their own unique challenges – from economic instability to corruption and lack of effective governance. In these environments, citizens often seek a semblance of stability and progress, two elements that are sorely lacking in times of high uncertainty. This vacuum leaves room for charismatic military leaders, promising swift solutions, to emerge as saviors of the nation. The dissatisfied masses, feeling abandoned by traditional democratic institutions, can be easily swayed to support military interventions.

Exhibit 1: Level of political and economic uncertainty between 2015 and 2023(Q2)

Exhibit 2: Cumulative level of political and economic uncertainty between 2015 and 2o23(Q2)

Citizen Attitudes: Democracy vs. Military

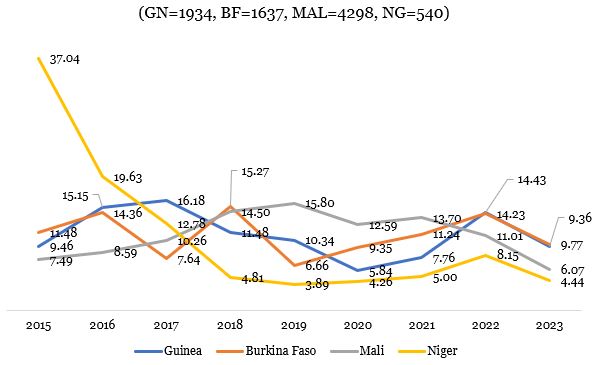

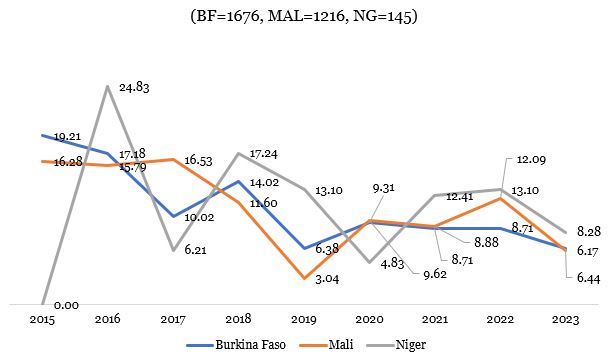

The citizens’ search behaviour on the Internet, as evidenced by Google search trends, provides valuable insights into their priorities and inclinations. Surprisingly, the data shows that throughout the period analyzed, citizens displayed greater interest in the military and armed forces rather than in democracy. This trend is consistent across all four countries, further underscoring the population’s growing disillusionment with the efficacy of democratic governance.

The public’s information-seeking behaviour reflects their yearning for stability and effective governance, even if it means resorting to military intervention. The military often portrays itself as a force capable of restoring order, promising swift and decisive actions that democratic governments may struggle to deliver.

Exhibit 3: Public interest in military between 2015 and 2023

Exhibit 4: Public interest in democracy between 2015 and 2023

The Imperative of Addressing Uncertainty

In the aftermath of these coups, it becomes clear that political and economic uncertainty has acted as a catalyst for the erosion of democratic norms and the rise of military interventions. The stability of nations rests on their ability to address socioeconomic and political challenges with sustainable strategies. Failure to do so not only perpetuate uncertainty but also exacerbates the potential for coups, further perpetuating a cycle of instability.

As West African nations grapple with the aftermath of coups, it is imperative for leaders and policymakers to recognize the critical role of uncertainty in shaping the political landscape. Strengthening democratic institutions, promoting transparent governance, and addressing economic disparities are essential steps toward fostering stability and avoiding the lure of military interventions. Only through these efforts can the region move forward toward a future of sustainable progress and democratic resilience.