Treasury Secretary Scott Bessent says the U.S. economy is finishing the year with unexpected strength, a narrative that has grown louder as fresh data shows American growth holding firm even after months of gloomy forecasts from economists.

His comments on Sunday came as part of a broader attempt by the administration to push back against frustration over the cost of living and to assert that the worst of the inflation wave may be easing.

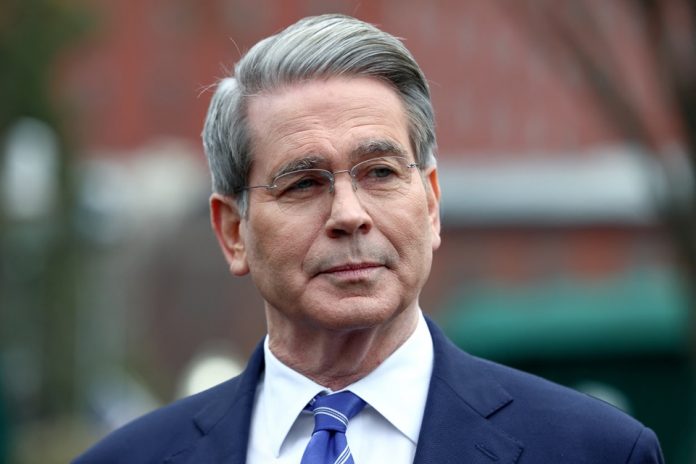

Speaking on CBS News’ Face the Nation, Bessent said holiday shopping so far has been “very strong” and argued that momentum has been building for months.

“The economy has been better than we thought. We’ve had 4% GDP growth in a couple of quarters,” he said.

He projected that the year would close with “3% real GDP growth,” noting that the pace remained intact even with the “Schumer shutdown” disrupting federal operations and delaying key reports.

His confidence rests partly on the contrast between real-world data and the predictions many analysts made earlier this year. For much of 2025, economists warned that inflation would flare again toward the end of the year, driven by a mix of global supply tensions, higher energy prices, and Trump’s escalating tariff battles with China and several other trading partners. Many predicted a visible surge in prices by November and December.

So far, the feared year-end spike has not materialized. The latest inflation report — postponed during the shutdown — still showed prices rising at 3% year-over-year in September, with food-at-home costs up 3.1%. Those increases remain stubborn but have not accelerated in the way analysts once believed they would.

But economists warn that the threat is not gone. The tariff confrontations themselves are unresolved, and trade experts say that further escalation between Washington and Beijing could reignite cost pressures across major consumer categories. This is part of why many analysts remain cautious: inflation has cooled, but the underlying risks have not. Bessent did not address those concerns directly in the interview, but his upbeat tone suggests he sees the numbers as evidence that the economy is weathering tariff-related turbulence better than earlier forecasts suggested.

The broader growth picture has also been more resilient than expected. The year opened on shaky ground, with GDP contracting 0.6% year-over-year in the first quarter. But the second quarter delivered a sharp rebound at 3.8%. Now, the Federal Reserve Bank of Atlanta’s early estimate pegs third-quarter growth at about 3.5%, with the official Bureau of Economic Analysis numbers coming on December 23. If that estimate holds, the U.S. will have logged a solid three-quarter recovery arc that few predicted during the harsher months of inflation.

Still, American households have not felt much relief. Consumer sentiment remains severely depressed. The University of Michigan’s December reading came in at 53.3 — an improvement from November but far below last year, underscoring how disconnected consumers feel from the headline numbers. Food, rent, insurance, and basic goods continue to absorb a larger share of monthly budgets. With households responsible for nearly 70% of U.S. GDP, the mood on Main Street has become a central pillar of the political debate.

President Donald Trump has rejected the idea that affordability has become a source of hardship. During a cabinet meeting on Tuesday, he dismissed the topic outright.

“The word ‘affordability’ is a con job by the Democrats,” he said. “The word ‘affordability’ is a Democrat scam.”

But recent polling tells a different story. NBC News found that about two-thirds of registered voters believe the administration has fallen short on the cost of living and the broader economy.

When asked about the public’s dissatisfaction, Bessent attributed the price pressures to problems carried over from the Biden era. He argued that earlier Democratic policies created the supply constraints and regulatory friction that are still haunting households.

“The American people don’t know how good they have it,” he said. “Now, Democrats created scarcity, whether it was in energy or over-regulation, that we are now seeing this affordability problem, and I think next year we’re going to move on to prosperity.”

The administration is currently using the current run of GDP numbers to reinforce its case that the economy is stronger than its critics claim. But analysts counter that everything depends on what happens next: whether inflation continues to ease or whether the unresolved tariff confrontations push prices back up. The coming BEA report on December 23 is expected to offer the clearest picture yet, revealing whether the year truly ended on solid ground — and whether Bessent’s optimism is built on an enduring turn in the economic tide or a temporary burst of good numbers.