Bitcoin Cash is a Bitcoin hard fork created in 2017 following a disagreement over the Bitcoin network’s design. After getting off to an explosive start, the price has been unable to keep up with Bitcoin’s in recent years. However, that could all be about to change due to an interesting turn of events.

- Based on our Bitcoin Cash price prediction, the price of BCH will cross the $240 mark by the end of 2023.

- According to our BCH price prediction 2025, Bitcoin Cash’s future is bright, and it could hit $658 by the end of 2025.

- Our Bitcoin Cash prediction 2030 indicates that the coin might hit the maximum price level of $1120.

This Bitcoin Cash price prediction explores the BCH price potential, using fundamental and technical analysis to predict its price between 2023 and 2030.

Bitcoin Cash holds the potential to go up and could hit $458 by 2025. If you are looking for Bitcoin Cash predictions, our in-depth analysis aims to answer your questions like, Is Bitcoin Cash a good investment? How high will Bitcoin Cash go? Is Bitcoin Cash expected to rise? Before we start with a detailed Bitcoin Cash price forecast, let’s dive into the coin’s overview.

>>>Buy Bitcoin Cash Now<<<

Cryptoassets are a highly volatile unregulated investment product. No EU and UK investor protection. Your capital is at risk.

??Bitcoin Cash Price Prediction Summary

- BCH has outperformed the market recently due to institutional interest.

- Our Bitcoin Cash price forecast predicts an average price of $240 by the end of 2023.

- According to our Bitcoin Cash 2025 price prediction, BCH will have an average price of $628.5.

| Year |

Minimum Price |

Average Price |

Maximum Price |

| 2023 |

$135 |

$240 |

$345 |

| 2024 |

$200 |

$325 |

$450 |

| 2025 |

$450 |

$628.5 |

$807 |

| 2030 |

$500 |

$850 |

$1,200

|

What Coin Is BCH?

As you probably already know, Bitcoin Cash was created as a Bitcoin (BTC) hard fork — but to understand the different BCH price predictions, it’s important to recap exactly why the cryptocurrency was developed.

Like Bitcoin, Bitcoin Cash has a max supply of 21,000,000 and the smallest denomination is a ‘satoshi’, which equals 0.00000001 BCH (eight decimal places).

Bitcoin Cash Price Prediction 2023

The crypto market has made significant gains recently after Blackrock filed for a Bitcoin ETF. Following this, several other institutions like Fidelity filed for their own, causing a massive stir in the crypto markets.

Then in recent days, the announcement of Bitcoin Cash being listed on the EDX exchange caused the price to break its bear market resistance level.

The news proved significantly bullish for Bitcoin Cash because only four cryptocurrencies will be listed on the exchange – Bitcoin, Ethereum, Bitcoin Cash and Litecoin.

Leading institutional funds such as Fidelity, Citadel, and Charles Schwab are backing the exchange, meaning these coins could see a lot of new liquidity. Consequently, we could see lots of new demand for Bitcoin Cash from institutions looking to diversify from Bitcoin and Ethereum.

Considering the Bitcoin Cash price chart above, it is likely that in the near term, we will see a retest of the $135 level. However, we expect the price to bounce due to the newfound institutional interest, potentially reaching the key level of $345.

Therefore, our Bitcoin Cash price prediction estimates possible lows of $135, highs of $345 and an average price of $240 by the end of 2023.

| Month |

Potential Low |

Average Price |

Potential High |

| July 2023 |

$130 |

$150 |

$170 |

| August 2023 |

$115 |

$135 |

$155 |

| September 2023 |

$115 |

$180 |

$245 |

| October 2023 |

$110 |

$195 |

$280 |

| November 2023 |

$115 |

$220 |

$325 |

| December 2023 |

$135 |

$240 |

$345 |

>>>Buy Bitcoin Cash Now<<<

Cryptoassets are a highly volatile unregulated investment product. No EU and UK investor protection. Your capital is at risk.

Bitcoin Cash Price Prediction 2024

With experts predicting Bitcoin could reach $100,000 by the end of 2024, other coins will likely climb too. However, as we can see from the Bitcoin Cash price chart below, BCH could not regain its 2017 ATH in the 2021 bull market.

According to the macro trend line, BCH could reach highs of $297 by the end of 2024. Nevertheless, Bitcoin Cash has several fundamental factors currently working in its favor.

Firstly, as mentioned, Bitcoin Cash is a hard fork of Bitcoin that enables cheaper and faster transactions. It currently has a 32 MB block size limit compared to Bitcoin’s 1 MB.

Due to the introduction of Bitcoin Ordinals, transactions have gotten slower and more expensive on the Bitcoin network recently. This will likely amplify as the Bitcoin price increases in 2024, causing some investors to seek cheaper alternatives like Bitcoin Cash.

Another factor to consider is the SEC’s recent lawsuits against Coinbase and Binance for selling unregistered securities. The SEC chair, Gary Gensler, previously said that Proof-of-Stake cryptocurrencies are securities.

However, Bitcoin Cash uses a Proof-of-Work consensus mechanism, meaning it is better protected from regulatory attacks. With this in mind, it could become popular among institutions and less risk-averse investors who want to buy cryptos with regulatory clarity.

Overall, these factors present substantial bullish potential for Bitcoin Cash. Therefore, our Bitcoin Cash price prediction estimates a maximum price of $450, a minimum price of $200 and an average price of $325 by the end of 2024.

>>>Buy Bitcoin Cash Now<<<

Cryptoassets are a highly volatile unregulated investment product. No EU and UK investor protection. Your capital is at risk.

Bitcoin Cash Price Prediction 2025

Crypto bull markets generally last between 12-18 months, so providing it starts in 2024, we expect the end of 2025 to signify the peak.

However, Bitcoin Cash’s advantages over Bitcoin, such as scalability and speed, come at a tradeoff. As mentioned, the hardware requirements to process 32 MB blocks can become very expensive, meaning only mining farms and institutions can afford to mine Bitcoin Cash.

Moreover, the lower transaction fees for Bitcoin Cash make the coin significantly less profitable to mine. In other words, miners are willing to expend less computational energy to mine blocks, leading to a lower hash rate and weaker network security.

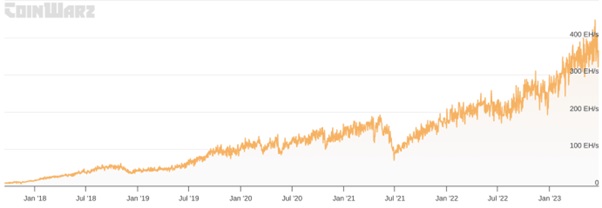

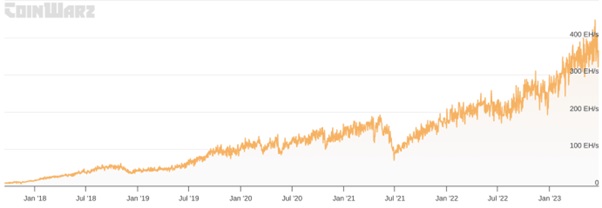

According to CoinWarz, the average Bitcoin hash rate is 377.70 EH/s. In comparison, the Bitcoin Cash hash rate is currently just 4.04 EH/s, and before the recent BCH price increase, it was below 2 EH/s throughout the last year.

As seen on the Bitcoin Cash chart below, the hash rate has remained below 5 EH/s since 2017.

However, during the same period, the Bitcoin hash rate has climbed steadily, showing a much healthier progression in network security, as seen below.

Bitcoin Cash has sacrificed security and centralization to provide faster and cheaper transactions. Moreover, Bitcoin has a layer two solution, the Bitcoin Lightning Network, which facilitates secure, decentralized, fast and cheap transactions.

With this in mind, Bitcoin Cash may struggle to break its previous bull market high, but the recent institutional interest means there is still growth potential.

Based on our considerations above, and historical price points, our Bitcoin Cash price prediction 2025 estimates a possible high of $807, a low of $450 and an average price of $628.5.

Bitcoin Cash Price Prediction 2030

Long-term price predictions are often challenging to make, particularly for a cryptocurrency like Bitcoin Cash which is currently undergoing a significant change.

As we have seen with the recent pump, a higher BCH price leads to a higher hash rate, making the network more secure. Considering the institutional interest and its capped supply of 21,000,000 coins, we could see increased demand and low supply – particularly if it becomes commonly accepted for payments. If this occurs, the hash rate could finally climb higher, making the network secure and giving it long-term potential.

Nevertheless, the price of Bitcoin Cash has been unable to keep up with Bitcoin since its inception. The chart below shows the Bitcoin Cash price against the Bitcoin price since 2017.

BCH has continually lost value against BTC. While there is still potential for it to make a reversal, the probability is very low if we consider its past performance.

While this does not mean Bitcoin Cash cannot grow long-term, it limits its potential. With this in mind, our Bitcoin Cash price prediction 2030 estimates a possible high of $1,200, a low of $500 and an average price of $850.

Although it has the potential to climb higher than this, it seems highly unlikely, considering its lack of decentralization, security and past performance against Bitcoin.

>>>Buy Bitcoin Cash Now<<<

Cryptoassets are a highly volatile unregulated investment product. No EU and UK investor protection. Your capital is at risk.

Possible Highs and Lows of Bitcoin Cash Price

Despite its difficulties, Bitcoin Cash still has potential and could become one of the best bull market cryptos. The table below shows our Bitcoin Cash price forecasts between 2023 and 2030.

| Year |

Minimum Price |

Maximum Price |

| 2023 |

$135 |

$345 |

| 2024 |

$200 |

$450 |

| 2025 |

$450 |

$807 |

| 2030 |

$500 |

$1,200 |

What Analysts Predict for Bitcoin Cash?

The recent influx of institutional interest makes Bitcoin Cash a high risk to high reward crypto. With that in mind, we have summarized the Bitcoin Cash forecasts from several analysts below to gain a clearer understanding.

- The Trading Educatio Bitcoin Cash price forecast predicts possible lows of $173.04, highs of $196.13 and an average price of $178.75 by the end of 2023.

- According to AMBCrypto, the price of BCH will reach lows of $147.58, highs of $169.80 and an average price of $158.69 by the end of 2023.

- Based on CryptoNewZ’s BCH price prediction, the price could reach a minimum of $112.56 and a maximum of $273.46 by the end of 2023.

- Bitnation predicts that the price of Bitcoin cash could reach lows of $229.60, highs of $344.40 and an average price of $287 by the end of 2023.

- DigitalCoinPrice forecasts that Bitcoin Cash could reach a possible low of $171.36, a high of $418.54 and an average price of $410.49 by the end of 2023.

>>>Buy Bitcoin Cash Now<<<

Cryptoassets are a highly volatile unregulated investment product. No EU and UK investor protection. Your capital is at risk.

What’s The Point Of Bitcoin Cash?

Since Bitcoin’s launch in 2009, many people have worried about its scalability. Particularly as much of the supply is already in circulation. Although Bitcoin halvenings occur every four years to slow the circulation of new Bitcoin tokens, the crypto is expected to max out around the year 2140. Though it might be over 100 years away, realistically, we don’t know how the supply and demand will change as the rewards for mining new blocks are slashed.

Another factor that capped the popularity of Bitcoin is the fact it isn’t necessarily suitable for everyday transactions. Mining new blocks requires a huge amount of energy, and the Bitcoin network is only able to process 1MB of transactions every 10 minutes. (By contrast, Visa can process approximately 1,667 transactions every second!)

Some of Bitcoin Cash’s benefits include:

- 8MB blocks.

- Lower transaction costs.

- Faster transactions.

- The above points have made BCH easier to use for merchants.

Who Is Behind Bitcoin Cash?

Unlike Bitcoin, BCH has much lower transaction fees, can process more transactions per minute, and was designed to make everyday crypto payments easy. BCH uses its own network, separate from the Bitcoin network, which has increased the block size to 8MB — eight times larger than Bitcoin’s. This makes BCH much faster because it means more transactions can be validated per block.

Although this has raised concerns that the security of Bitcoin Cash isn’t as rigorous as Bitcoin, many investors believe the benefits outweigh any drawbacks. BCH has a lot of vocal supporters, including Roger Ver, an early Bitcoin investor who now champions Bitcoin Cash instead. In December 2018, he told The Independent that BCH “simply works better” than the original BTC.

Bitcoin Cash development is highly decentralised, and it is worked on by many different groups around the world. There is no central authority. It’s also worth noting that the community splintered when Bitcoin SV (BSV) was created.

>>>Buy Bitcoin Cash Now<<<

Cryptoassets are a highly volatile unregulated investment product. No EU and UK investor protection. Your capital is at risk.

What Is Bitcoin Cash Used For And How Does Bitcoin Cash Work?

Bitcoin Cash’s aims are pretty simple and go back to the initial idea of what Bitcoin was intended to do — cut out the middleman and provide peer-to-peer transactions, which it has done since its creation.

Bitcoin Cash also uses a proof-of-work consensus mechanism that means that it can be mined. Many mining pools that mine Bitcoin also mine Bitcoin Cash because they are quite similar.

A little-known fact — Bitcoin Cash does have smart contracts. Smart contracts can be made on the Smart Bitcoin Cash sidechain which is compatible with Ethereum’s virtual machine and Web3 API. This means that DeFi projects can work on top of Bitcoin Cash too.

What Influences the Price of Bitcoin Cash?

Since Bitcoin Cash is focused mainly on payments, one of its key price drivers is the demand to send and receive payments with it. This means that the number of vendors who accept Bitcoin Cash can play a significant role in increasing its price.

Another price driver is speculation. As seen following the EDX exchange listing, speculation of further adoption leads investors to buy the coin to try and make a profit later, pushing up the price.

The broader market’s performance also influences the Bitcoin Cash price. Bitcoin Cash generally moves in unison with the rest of the market; however, it has also displayed higher levels of volatility in recent years.

Is Bitcoin Cash a Buy Now?

It is likely that Bitcoin Cash will prove to be one of the best long-term crypto investments. This is mainly due to its security and decentralization flaws and is evident in its inability to create a new ATH in the last bull market.

Clearly the recent interest from institutions and relative regulatory certainty give it an upper hand in the short term compared to some Proof-of-Stake cryptos.

>>>Buy Bitcoin Cash Now<<<

Cryptoassets are a highly volatile unregulated investment product. No EU and UK investor protection. Your capital is at risk.

Conclusion – Bitcoin Cash Price Prediction

Overall, while Bitcoin Cash has room for growth, it faces several issues that are challenging to fix and present significant downside risk for the coin.

With this in mind, we have compiled a list of the best cryptos to buy today. Check it out by clicking the button below.

>>>Buy Bitcoin Cash Now<<<

Cryptoassets are a highly volatile unregulated investment product. No EU and UK investor protection. Your capital is at risk.

Like this:

Like Loading...