By now, some of my followers will be aware, that the 9ja Cosmos Website is done ( a few tie ups remain on the channels page), and we have also put up a business page on LinkedIn.

This got me to think about some posts I produced in the past for Tekedia – first one I produced in August 2021, where I shared that at that time, 85% of my LinkedIn contacts were in Nigeria, but LinkedIn didn’t seem to be able to capture them as part of my engagement statistics.

I went into some of the data transport arguments that might explain why that was, but nothing seemed conclusive to me.

Why doesn’t Nigeria show in the stats??

Roll on to November of the same year, and another post remarking that a relatively small business like Tiny URL has succeeded where LinkedIn had not. (LinkedIn has been owned by Microsoft since 2016)

Having got past the first 100 followers for the 9ja Cosmos brand page, I decided to have a good look at who had decided to join and where they had been joining from. I was surprised at the level of geo detail.

From a specimen of 140 members, London UK scored the highest for a single location – 9/140, though Nigeria took positions 2-6 of the top 10 locations. and as a nation, the largest presence overall. The city of my birth, Cork in Ireland sneaked into the top 10, with similar showings from Frankfurt, Germany; Randstad, Netherlands; and Washington DC.

In the extended list there were many locations with a single follower, one of which simply said ‘Poplar Bluff’, which is this small town in Missouri, US at the foot of the Ozark Mountains – probably a bit like US version of Ruwa Wuri!

There were also 78 followers LinkedIn couldn’t say where they were. That’s about 55%, so still a lot of potential business intelligence not captured. Still a massive improvement in being able to name Nigerian cities and towns though, as compared to 2021.

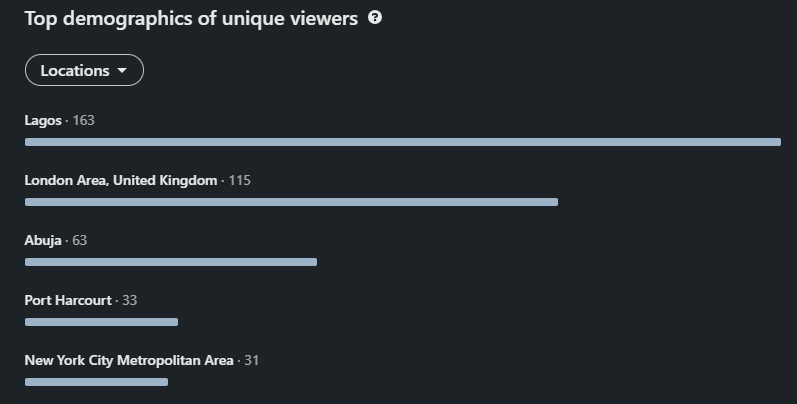

I then decided to look at the stats of my most recent post, to see if this new geo inclusion capability was replicated elsewhere, and not just a feature of the 9ja Cosmos brand page.

This just gave me a top 5, and was unable to give me any details of what it failed to capture – though again, much better than what had been available two years ago. This was the post entitled ‘A SUNDAY MUSING’, a ‘direct to LinkedIn’ post with no Tekedia piece. It didn’t especially have a ‘Nigeria’ focus, so interesting that Lagos blitzed London on it.

Thank you to those who have come out to support the new 9ja Cosmos page

We do however need the strong support of ‘Tekedians’ to move the needle forward, so more followers for the page are urgently needed.

9ja Cosmos is here…

Get your .9jacom and .9javerse Web 3 domains for $2 at:

Visit 9ja Cosmos

Follow us on LinkedIn HERE

All reference sites accessed 20/07/2023

poplarbluff-mo.gov/

linkedin.com/company/98217334/admin/analytics/followers/

linkedin.com/analytics/post-summary/urn:li:activity:7086401079734587392/