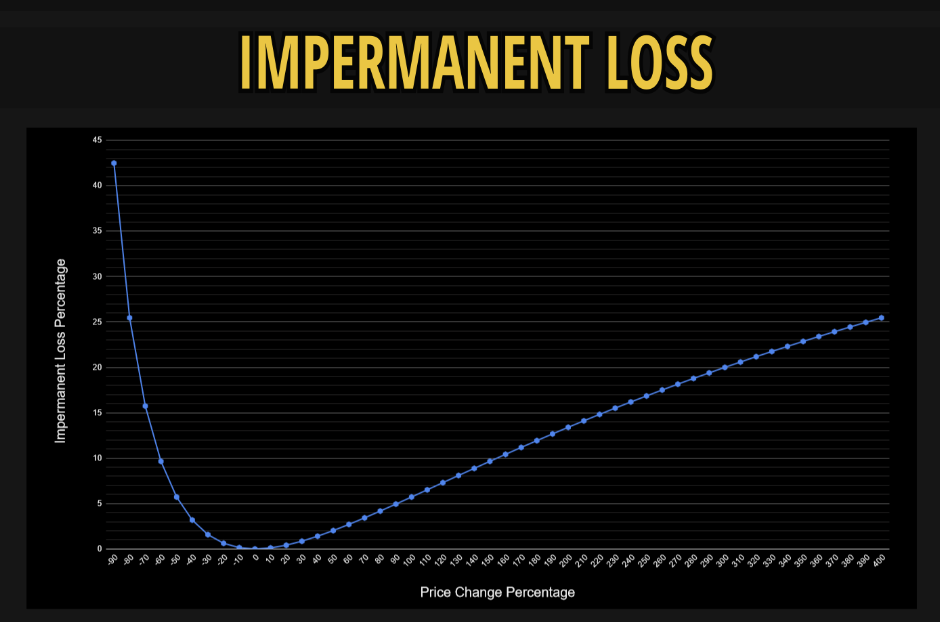

Impermanent Loss (IL) is the main pain point for passive liquidity providers in constant-function AMMs like Uniswap v2, most classic DEX pools, and even many Curve pools when prices move a lot.

Impermanent loss is the unrealized loss in value when providing liquidity to a decentralized finance (DeFi) liquidity pool compared to simply holding the assets. It occurs because market price changes rebalance the ratio of tokens in the pool, and the loss is only “impermanent” until you withdraw your liquidity, at which point it becomes permanent. You can mitigate this risk by providing liquidity to pools with stablecoin pairs or correlated assets, or by choosing pools with high trading volumes to earn more in fees.

It occurs because the AMM rebalances the pool automatically, forcing LPs to sell the appreciating asset and buy the depreciating one ? when the price reverts or keeps moving, the LP ends up with less dollar value than if they had simply held the tokens.

Michael Egorov— Curve’s founder has been working on several ideas over the years to reduce or eliminate IL. LLAMMA lending-liquidating AMM algorithm, powers Curve’s native stablecoin crvUSD and its associated “Lending” markets.

A user deposits Bitcoin into a 2x-leveraged BTC/crvUSD Curve pool. The protocol borrows crvUSD to maintain the target leverage while managing exposure so LPs behave economically like spot BTC holders. The user doesn’t need to provide any crvUSD. Instead, the protocol borrows crvUSD against the liquidity position itself, for the other side.

Then, when price moves up or down, the protocol will grow or shrink the position so that the LP position moves in line with BTC prices. It gets larger when BTC goes up (increasing leverage), and gets smaller when BTC goes down (reducing leverage).

This is often what people mean when they talk about “Yield Basis” or Michael’s solution to impermanent loss, even if the branding has evolved. LLAMMA basically eliminates impermanent loss. Traditional AMM like those present on Uniswap v2/v3, classic Curve pools, your deposit is always 50/50 or fixed-ratio.

Any price move forces you to sell the winner and buy the loser ? IL. LLAMMA used in crvUSD markets and Curve “Lending” pools, instead of providing passive liquidity in a normal AMM, your collateral like ETH, BTC, is placed into a special “banded” AMM that continuously converts your collateral into crvUSD as the price moves against you, and converts back when price moves in your favor.

The conversion happens in the exact same direction and magnitude as a liquidator would do in a lending protocol like Aave or Compound. So the P&L of the position is almost identical to just holding the asset outright, minus small fees.

Result is near-zero impermanent loss actually slightly positive in many cases because of the soft-liquidation mechanics and the way bands are priced. When you deposit WBTC into the WBTC/crvUSD lending market, you’re not really suffering classic IL.

Your position slowly converts to crvUSD as WBTC price drops protecting you from further downside, and converts back to WBTC as price rises letting you capture upside again. WBTC/crvUSD and cbETH/ETH/crvUSD LPs have had effectively zero or slightly positive “IL” compared to holding, even through massive volatility.

Current products that use this mechanism as of Dec 2025 crvUSD lending markets (WBTC, WETH, cbETH, tBTC, etc.) – the original LLAMMA pools. Curve Crypto V2 pools with LLAMMA mode – some newer pools (e.g., ethenaUSDe/crvUSD, various LST pools) are being deployed with the same engine.

LlamaLend – one-click isolated lending markets basically private LLAMMA pools that Michael has been pushing more recently. Remaining limitationsIt only works well when one side is a stable asset crvUSD or similar. You still get classic IL in volatile/volatile pools.

Liquidity is still lower than the biggest Uniswap or classic Curve pools, so trading fees can be lower. Slightly more complexity. Michael’s LLAMMA mechanism (crvUSD + Lending markets) is currently the closest thing DeFi has to a real solution to impermanent loss for LPs who are happy to pair volatile assets with stables.

In many cases it doesn’t just reduce IL — it essentially removes it and even gives LPs very close to hold returns + yield.If you’re providing liquidity today and care about IL, the highest conviction places are usually: crvUSD lending markets (WBTC/crvUSD, WETH/crvUSD, etc.)

Some of the new LLAMMA-based crypto pools are the practical embodiment of what was once talked about under the “Yield Basis” name.