As at the time of writing this article, cash has become gold in Nigeria. A quick background – the Central Bank of Nigeria, Nigeria’s apex financial services regulator has instituted a currency redesign, essentially kick-starting the end of old currency notes (specifically the N200, N500 and N1,000 naira denominations). While there is a general predisposition amongst the general public that this action is politically motivated (which is somewhat arguable, considering how close the general elections are), and some have claimed the difference between the old and new naira notes is basically a snapchat filter (an assertion I somewhat share), the problem much to the chagrin of the general populace is how poorly the transition has occurred; the banks do not have access to the new notes (or are seemingly hoarding it), ATMs aren’t dispensing the new notes, POS Agents (who represent the first touch-point for financial services by a good number of Nigerians) don’t have access to it, and while the CBN has pushed its deadline for the loss of legal tender status by the old notes forward, people have deposited old notes at the banks, the banks haven’t disbursed enough new notes, and the crowds at bank who have the new notes are so humongous it’s discouraging to make an attempt.

Scarcity breeds value. Never thought this would be the case for cash, but the scarcity for cash means that POS operators who have access to cash are now charging exploitative withdrawal rates which represent anywhere between 10 – 20% of the value of the withdrawn cash. So while withdrawing 10,000 (US$21.71) would ordinarily be charged at N300 (US$0.65) or less (depending on the POS operator), some operators are now charging as high as N2,000 (US$4.34) due to scarcity of cash.

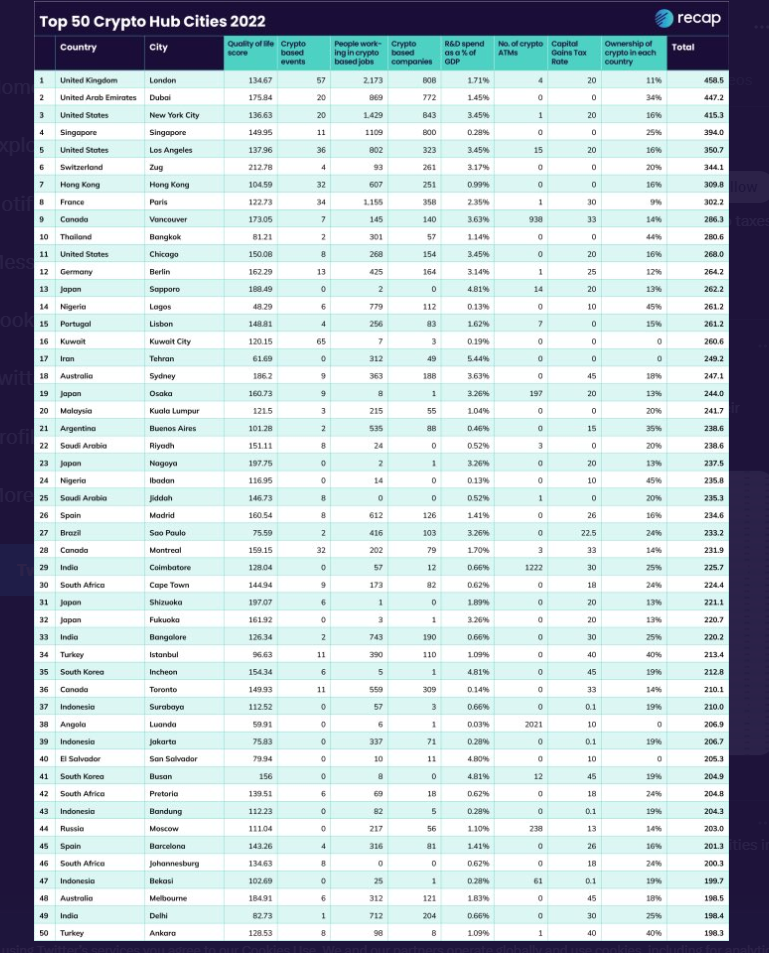

Warren Buffet has a popular saying – “only when the tide goes out do you learn who has been swimming naked”. Nigeria has postured as a digital payments nation for a long time, and to be clear we are. Nigeria is among the few countries globally that has real time payment infrastructure. In fact, Nigeria’s Real time payments rail (NIP), is ranked amongst the top 10 real time payments rails globally by transaction value.

NIP (NIBSS Instant Payments) continues to record double digit growth in transaction value and volume on a year on year basis signifying how much growth is occurring in the Nigerian payments space. The rise of payment gateways focused on the online acquiring space like Paystack, Remita, Flutterwave, Interswitch etc. has also played a role in pushing online transaction and also empowering eCommerce, a market expected to record Annual CAGR of 11.74% according to Statista.

So while Nigeria has made (and is making) massive strides in the online acquiring space, we have not made a corresponding dent in the offline acquiring space (digital transactions occurring at physical merchant locations). The cash scarcity problem shows that the tides have eventually gone out and it seems like most of us were swimming naked (excluding me, I was wearing boxer shorts lol)

WHAT REALLY IS AGENCY BANKING

When we think of financial inclusion in Nigeria, the majority of people like to point out agency banking as the Nigerian version of “Banking the Unbanked”, but is that really true? Let’s look at the data; according to data from NIBSS, about 1.14billion transactions occurred at POS terminals nationwide in 2022, representing a 17% YoY increase in POS Transactions.

This is one of the most accurate data points for a single payment segment in Nigeria, because while NIP data published on the NIBSS Portal represents what is the majority of digital payments in Nigeria, NIP does not represent the entirety of digital payments in the country. Local transactions between banks that happen on a bank’s core banking and involve what is essentially an internal ledger update are not represented on the NIBSS portal because they do not have visibility into that, even transactions processed by other account to account payment rails like those owned by fintechs like Remita, UPSL and the likes are not captured in this dataset. However, since almost all (if not all) POS terminals in Nigeria are certified by NIBSS and have a NIBSS integration, NIBSS has visibility.

While POS transactions have shown growth over the years, sources tell me that a good part of this growth is coming from super agents. In other words, while POS transaction data may get people thinking that more Nigerians are making digital payments at merchant locations, it actually means that more Nigerians are withdrawing CASH at Agent locations.

Agency banking was supposed to be a way to increase access to financial services by the “financially excluded”. Agency banking today is basically an extension of banking services via agent touch points to more users. However, while banking involves a plethora of services and solutions, more than 60% of all agent network transactions in Nigeria today are cash in, cash out (fintech lingua for deposits and withdrawals).

Agency Banking is not digitizing cash. It’s recycling it.

The Micropayment Problem: Why do people still need cash?

The major reason people still need cash is because no one has really solved the micropayment problem in Nigeria. I’ve written about this in an earlier piece, so I won’t go into that here, however, the crux of the matter is that while you can pay for things at a supermarket with your card or via a bank transfer, the minute you begin to descend the economic ladder of products and services, cash begins to morph from one of the payment options accepted (as it is in the supermarkets) to being the only payment option accepted (as it is at the Aboki’s Kiosk or the yellow Lagos Danfo Bus), and considering that more Nigerians earn less than US$1,000 a year than those who earn above it, the majority of the market functions in this category.

The Metamorphosis of Offline Acquiring

Offline acquiring till now has been majorly card driven – customer uses a debit card to pay for goods at a merchant location via a POS terminal. Today, pay with bank transfer on payment terminals is gradually making in-roads (same way it made in-roads in online acquiring). Solutions from fintech companies allow merchants generate a static or dynamic virtual account from a payment terminal for customers to transfer to. And unlike in the past when merchants would have to wait to receive credit notifications at the back office before releasing goods to customers, POS terminals are set-up to identify the exact moment money hits the issued virtual account and notify merchants, thereby reducing the need for customers to “wait for confirmation”.

The offline acquiring space clearly needs to morph deeper to accommodate the offline digital payment needs of the majority of Nigerians.

“A crisis is a terrible thing to waste” – Paul Romer, Stanford Economist

Micro Payment Plays

Solving the micropayments problem involves a multi-faceted approach that involves various stakeholders and a concerted effort. One dimension to come at it from would be the transportation angle. According to 2019 data from the National Bureau of Statistics, after Food (56.65%), transportation (6.44%) represents the second largest consumption group for Nigerian households.

While fintech companies like Touch and Pay Technologies, the firm behind the Lagos BRT Cowry Cards have done a great job so far, more work needs to be done in making it possible for Nigerians to make digital payments in yellow buses. Three key problems that would need to be solved are:

One – reliable payment – Touch and Pay Technologies runs a closed wallet scheme that transfers via NFC, which is good considering bus conductors cannot be waiting for 5 minutes to see your alert. Another way to solve this would be via a local transfer that doesn’t run on an interbank payment rail. When you transfer money to someone who has an account with your bank, that transaction is basically an internal ledger update and doesn’t run on any interbank payment rail, that’s why those transactions are fast and free. Expecting everyone to use the same bank is impractical. The closest to a cross bank local transfer in Nigeria today is eNaira.

The eNaira is hosted on CBN’s treasury system and as such regardless of who your sponsoring bank for an eNaira transaction is, eNaira to eNaira transactions are basically internal ledger updates at the CBN – in other words, those transactions can be free and fast (a key determinant for digital transactions).

The second problem to be solved is split payments. Local buses in Nigeria do not just load people and go, there is a whole ecosystem of “players” taking bus fees via Agbero’s for this economy to exist. Split payment capabilities allow monies collected within buses to be split into various accounts at point of collection (bus driver, Agbero, Agbero’s oga, and Agbero’s Oga’s Oga – you get the drift).

While there are concerns that the oga’s at the top of this ecosystem will prefer things remain in the dark and push for cash, they also have no visibility into what happens in these their “empires” so this could be a great way to give them that visibility.

The third problem is payment touch-points; an Agbero with N1,000 (US$2.17) in his account cannot buy Kai-kai (Nigerian slang for a type of alcohol) from the local woman selling it because she clearly doesn’t take transfer. Creating Incentives for her to take digital payments may include opening her up to credit via that medium so that the Agbero doesn’t need to off-ramp into cash before spending his money.

I know it seems like I’m making an undue emphasis on Agbero’s, but if you live in Lagos, you know that Agbero’s are a key stakeholder in the local transportation ecosystem.

Non-Card Systems

In my personal opinion, offline acquiring cannot be built on POS Terminals, considering terminals are too card focused (which I don’t think is the way to go), and aren’t enough.

In Nigeria today, there are presently 1.6 million terminals in a market of more than 41 million MSME’s. Ignoring the process MSMEs go through to acquire terminals, this may be a deterrent to adopting POS Terminals, but since there are more than 150 million mobile phones in Nigeria, every mobile phone can and should be turned into a payment collection point.

Mobile Money by MPesa made this happen and is why more than 50 million people process transactions via MPesa across the seven African markets they operate in.

Bus drivers can be incentivized to adopt via multiple propositions, including access to vehicle financing to “expand their businesses”

This model can also be expanded to other verticals including local corner shops and Aboki Kiosks that can also be incentivized via access to credit. In-fact, the scarcity of MSME credit in Nigeria means that almost any MSME behavior can be incentivized via access to credit. MSME’s are also very good people to lend to (primarily because they tend to have higher repayment rates, and they stimulate the economy). I’ve written extensively on SME lending in case you want some more background on that.

Essentially, a hub and spoke approach where each player’s payment touch-point is mapped and enabled for micropayments is the way to go. It is hard work, requires a lot of stakeholder engagement and a rethink of the payment business model (as take rates may not apply for this market segment), but the value that can be created and extracted by anyone who gets this right is huge.

CONCLUSION

Unlike online acquiring today which is somewhat a red ocean market in Nigeria, the opportunities for the hundreds of millions of people today in Nigeria to be serviced via well though out offline acquiring solutions that meet these customers and merchants where they are is still a huge green field opportunity for anyone willing to do the hard work of cracking this market. I personally think that this is the next goldmine opportunity in African payments today.

Inspired By The Holy Spirit

Like this:

Like Loading...