The importance of technology to modern day commercial activities is indispensable and has occupied a pervasive role not only in commercial transactions but all other spheres of human activities. Indeed so numerous are its forms and the chief among is Financial Technology popularly called Fintech. Innovations brought by technology have brought tremendous and radical changes to the traditional way of conducting commercial activities. Virtually all sectors of the economy of the countries in the world have been disrupted by the innovation brought by technology. Trading and provision of services have now been made easier as physical contact is no longer needed before commercial transactions can take place.

Capital market, a financial market for trading securities of companies, is not left out of this tremendous changes brought about by the technology, as many online platforms now available for buying and selling of company securities quoted on the Nigerian Stock Exchange. Hence, this article tends to bring out the impact of financial technology in the Nigerian Capital market and the needs for effective legal and regulatory framework.

DEMYSTIFICATION OF SOME CERTAIN TERMS

Before delving into the heart of this discussion, it is pertinent to demystify some certain terms like Financial Technology and Capital market for proper and easy understanding.

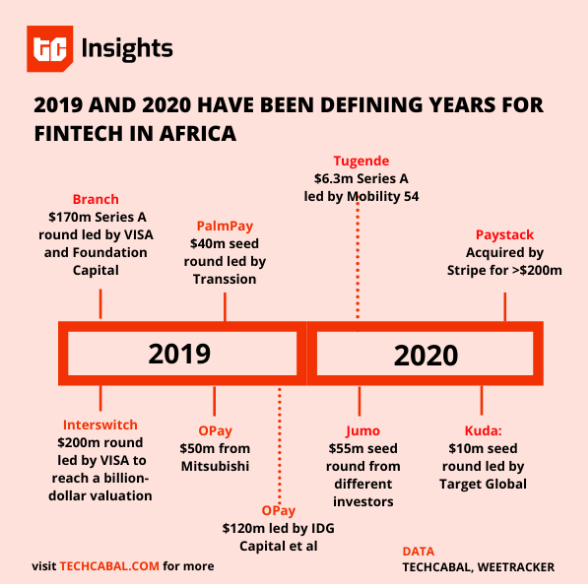

Financial Technology: Fintech, as it is mostly called and the name implies refers to that technology used in delivering financial services as opposed to the traditional banking method of delivering financial services. According to investopedia, Financial technology (Fintech) is used to describe new tech that seeks to improve and automate the delivery and use of financial services. It has also been referred to as the synergy between finance and technology, which is used to enhance business operations and delivery of financial services. Examples of Fintech are Paystack, Paypal, Flutterwave, E-transact, Remittal, etc

Capital Market: Investment and Securities Act, 2007, the chief legislation on Capital Market, makes no provision for definition of capital market. But it has been defined as the financial market where trading of companies’ securities takes place. It has also been described as a financial market for long term financial assets such as government bonds, corporate bonds and equity and unlike money market which functions to provide short term funds : rather, it is a network of financial institutions that in various ways bring together suppliers and users of capital, facilitating the issuance of secondary and long term financial instruments

It is a market where investors and companies engage in trade of financial securities like bonds, stocks, etc

It is a market for buying and selling of shares and other financial securities. The Capital market is divided into primary markets where newly issued stocks are sold to the investors through a process called underwriting and secondary market for financial instruments that already exist.

Companies quoted on Nigerian Stock Exchange raise funds to cater for their financial needs

THE IMPACT OF FINANCIAL TECHNOLOGIES ON THE NIGERIAN CAPITAL MARKET

The elementary but chief function of FinTech is facilitating automated financial services delivery to the consumers. However, Fintech has now expanded beyond this role as many online platforms now exist for savings, crowdfunding, buying and selling of company’s securities, thereby making investment a lot easier for investors and companies to raise capital for their financial needs.

Security and Exchange Commission, the chief regulator of the Nigerian Capital market in its attempt to provide a regulatory framework for operation of Fintech firms and startups in the country launched a FinTech Roadmap Committee at the Q3 meeting of its Capital Market Committee in 2018. This shows that the SEC has come to the reality and impact of Fintech to the Nigerian Capital Market. The Committee came up with a report titled the “Future of FinTech in Nigeria”. It was formerly by the SEC on the 29th October 2019 at the Nigerian Fintech week.

Financial Technology now provides a platform where not only the investment in securities of companies take place but also commodities exchanges where tangible goods like agricultural products are traded. Examples of such platforms are Weath.ng, Chaka, Bamboo, etc. In others words, these platforms can be called online securities and commodity platforms. Also, the Nigerian Stock Exchange has adopted an automated trading system for securities trading on its floor.

It has increased participation of people investing in the securities of both local and foreign companies, thereby making it easier for both the investors and the companies to interact without physical contact.

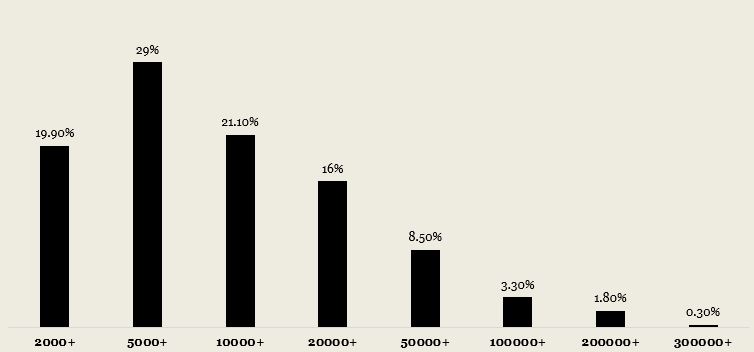

Convenience: as reported by Mckinsey & Company on their website customer adoption of fintech is primarily driven by access and convenience. This in turn, reduces the time and stress in going through the traditional way of investing in securities of a company. Toeing this pathway, this has increased participation of low and middle income earners in the Nigerian Capital Market. It has promoted and still promotes easy access to the Nigerian Capital Market.

Accountability and Transparency are one of the driving forces of any financial investment as Fintech tends to portray these traits in their provision of financial services to the both the key players in the Nigerian Capital Market, even at a reduced level of documentation. Payment of taxes and other charges are done automated thereby promoting accountability and transparency. One can actually conclude here on this, that there has been a tremendous increase in government as there is no need for cash to exchange hands.

Integration and facilitation of payment for shares bought by investors is another chief role Fintechs play, as payment cannot be made possible without their services. This is made possible through card payment whether debit or credit, payment with account or bank transfer without visiting the traditional Banking institutions.

Finally, FinTech is invaluable to the development of the Nigerian Capital Market and its overwhelming role cannot be overlooked, hence the need for a proactive and effective legal and regulatory framework.

THE NEEDS FOR EFFECTIVE LEGAL AND REGULATORY FRAMEWORK FOR FINTECHS IN THE NIGERIAN CAPITAL MARKET.

Provision of clarity and effectiveness of legal and regulatory framework of any legal system works magic. This cannot be over emphasized as this we result in the development of that country especially its economy. Lack of effective legal and regulatory framework on fintechs providing online securities and commodities exchanges trading has stifled the innovations and creativity of the fintech firms thereby limit their participation in the Nigerian Capital Market. This can be seen in the recent case between Chaka, an online platform for trading of securities and SEC, whereby the latter secured an interim order from the Investments and Securities Tribunal restraining the former and its promoters from advertising or offering for sales securities. This has led to the confusion on whether fintech firms dealing with securities as a stock broker or not.

It has been aptly argued that existing capital market regulations are inadequate in providing clarity as to the status and compliance requirements of Fintech companies.

As society keeps changing, legal frameworks must also be in motion in order to meet up the dynamic nature of the society. Our laws and regulations must keep to time and not remain static. This can be achieved by having proactive regulatory bodies saddled with the responsibility of making regulations for the Market through their enabling laws. The Capital Market of every country plays crucial roles in their economies, hence the needs for innovations.

Effectiveness and Clarity of legal and regulatory framework for FinTech in the Nigerian Capital Market would pave a pathway for development of the market which would enhance and equip it to compete globally.

CONCLUSION

In conclusion, Fintechs have come to stay and play a crucial role in the Nigerian Capital Market. The needs for an effective legal and regulatory framework cannot be faulted as this would lead to more innovations being brought by the fintechs to the development of the market.

References.

See http//: corporatefinancialinstitute.com

See the paper titled “An Introduction to the Capital Market”, delivered at a seminar in Abuja on 12th October 2000 by Dr (Mrs) Ndi Okereke Onyiuke, DG and the CEO of the Nigerian Stock Exchange. Quoted at pp 361 of Com pany Law and Practice in Nigeria by Hon. Dr J Olakunle Orojo.

https://www.mckinsey.com/featured-insights-midle-east-and-africa/harnessing-nigerians-fintech-potentials

Tayo F. ‘SEC VS Chaka: Key Lessons for Regulators and Securities FinTech Companies’ https://www.busnessday /opinion/article/sec–v- chaka-keylessons-for-regulators-and-securities-companies/amp/ .