On Oct 12 2009, a Finnish developer Martti Malmi sold 5,050 BTC for $5.02. Since that time, that digital value has returned close to 1,919,430,500%. While I do not do crypto, it is something to think about, on how someone created such a staggering wealth from thin air.

Meanwhile, China continues its digital Yuan vision. Nikkei writes “China will expand trials of its digital yuan Friday evening with a feature letting individuals send money to each other by just touching their smartphones together, broadening use of the new currency beyond physical stores.”

The trial is timed to see whether the platform can handle digital yuan payments without a hitch under heavy stress. Online retailers offer steep discounts on Dec. 12 — a shopping event known as “Double 12” — and usually see a flood of orders right when the day begins at midnight.

Tests are also moving along in other cities. In Chengdu, people invited by employees at major banks are allowed to download a wallet app that can freely convert cash into digital yuan. The electronic currency can be spent at local supermarkets and other stores, and used to pay bills for smartphone service.

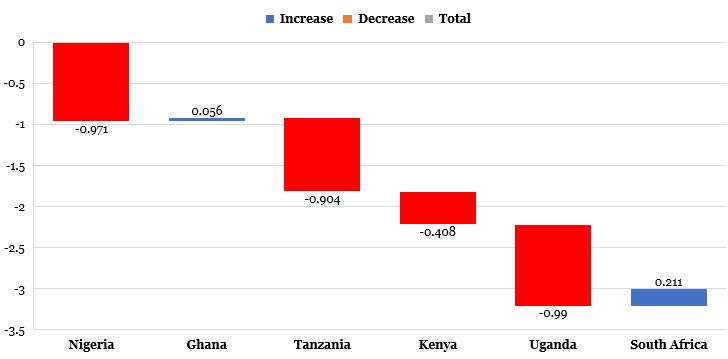

Why can’t we have a digital Naira to reduce corruption through electronic trails? Maybe a good idea or maybe the server will crash and all the money will be lost! You decide. But one thing is evident: nations have BIG roles to drive national growth, anchored on private sectors. Japanese government via Bank of Japan is the largest investor in Japan’s stock exchange! China has funded state-owned-enterprises. America sends stimulus checks despite preaching capitalism, since capitalism works when things are fine, but needs socialism to bail it out at hard times.

The Bank of Japan has taken over as the biggest owner of the nation’s stocks, with the total value of its holdings climbing well above $400 billion.

Massive exchange-traded fund purchases by the BOJ to support the market amid the pandemic this year combined with subsequent valuation gains pushed its Japanese equity portfolio to 45.1 trillion yen ($434 billion) in November, according to estimates by Shingo Ide, chief equity strategist at NLI Research Institute.

Nigeria needs to pick a position and run its own playbook: there is no universal principle on how nations must run their economic policies.