There are two ways to achieve unicorn (being a billion dollar startup) status in any sane clime.

It’s either you; create enough real value that makes you worth a billion US dollars, or you create perception value, where you look like the next big thing, you push out numbers and branding messages that make it look like you’re about to change the world (in this case Nigeria), and that anyone who doesn’t invest in you early is on the verge of becoming another Gary Vaynerchuck who missed out on an opportunity to be an early investor in Uber Technologies.

Think of a company like WeWork whose founder said WeWork wasn’t a real estate company, but a “State of Consciousness” (whatever that means), that had a fictitious valuation of 47 billion dollars, who stepped into wall street feeling all confident and wanting to cash out big (I imagine Mr Neumann already fantasizing the experience of a new gulf stream airliner), and had the old money boys at wall street look at their S-1 filings and go nah. Valuation crashed from 47 billion to you know where. Story for another day.

Where were we?

Ah yes Nigeria. In Nigeria that doesn’t work. The whole Silicon Valley model of building a startup that bleeds capital even when it’s worth a billion dollars upwards is unlikely to work in Nigeria.

To the best of my knowledge, we don’t have a Japanese guy who raised hundreds of billions of dollars from Saudi investors that gets excited every time he hears AI sitting in a nice air conditioned office in Victoria Island looking for who to sign million dollar investment checks to.

Let me put it this way. If you’re going to build a unicorn in Nigeria, it is unlikely you’ll get there being unprofitable.

To the best of my knowledge, Nigeria has two unicorns; Interswitch, which was founded in 2002 and still considers itself to be a startup 18 years after being founded. If you’re still trying to startup a car 18 years after buying it, it is safe to say you need to get a new car.

The second is Jumia who we call a Nigerian unicorn, but is really more German owned that Nigerian owned, that found its way to wall street, but got thrown back over the wall.

We need more Nigerian unicorns who will build the future of this country, and I believe this piece should be an eye opener for those building startups in various spaces to take advantage of.

Let’s begin.

Building a Unicorn 101

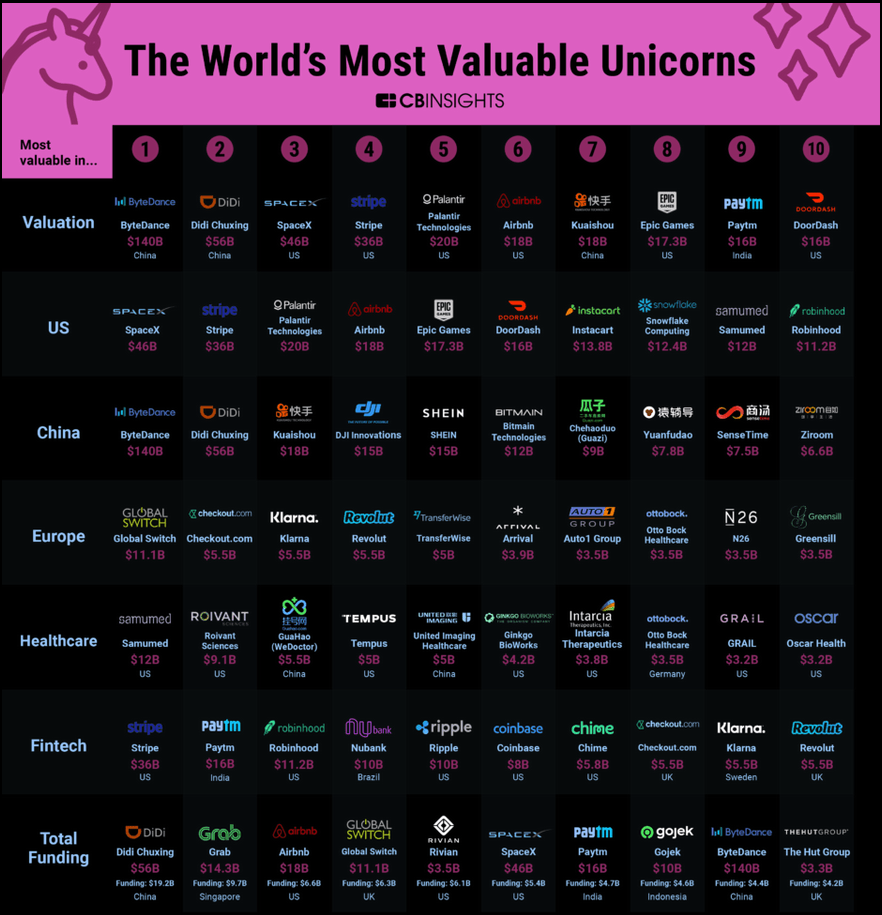

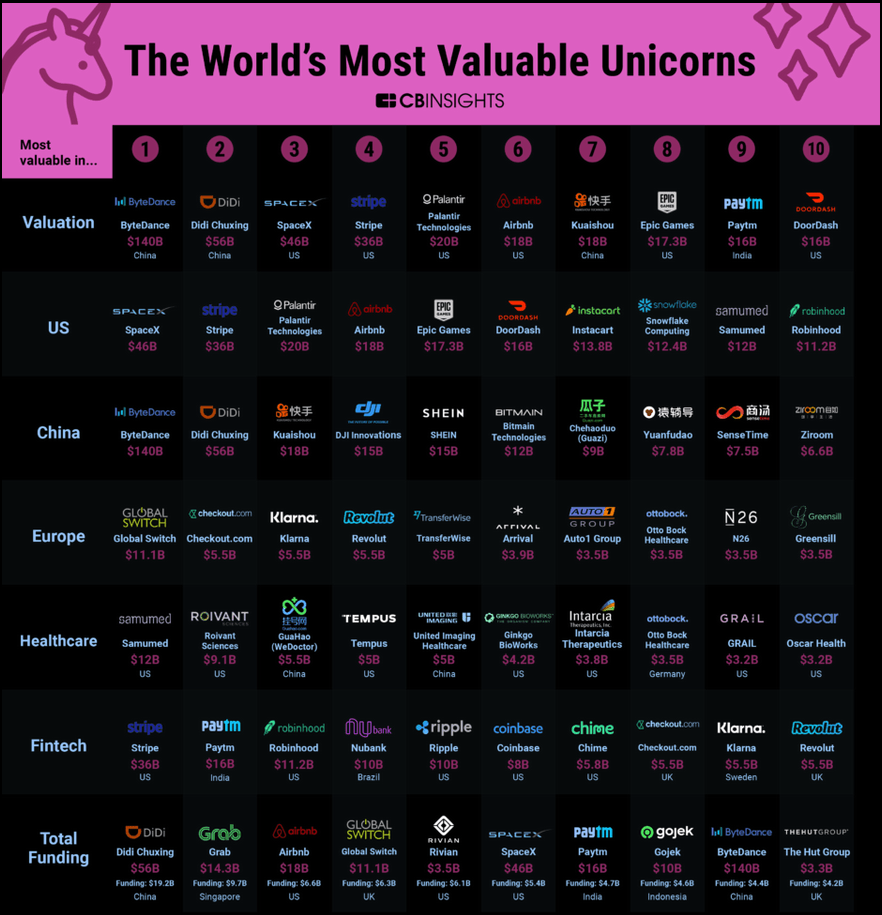

What is a unicorn? I’ve defined this before, but I’m going to do it again. A unicorn is a billion dollar STARTUP, Not just a billion dollar company. So the Dangote group is not a unicorn, even though it is valued at more than a billion dollars. Glo mobile and all the other companies in Adenuga’s portfolio are not unicorns, even though some of them are valued at well over a billion dollars. Our banks; Gtb, Zenith and the likes are not unicorns, even though some are valued at over a billion dollars.

A unicorn is a billion dollar STARTUP, a new company trying to solve a problem, and create value in what could be in most cases a new niche.

How to Build a Unicorn in Nigeria

Step 1: Understand your market

If you’ve read any of my previous works, you’ll know that I always talk about understanding your market.

I do this for two major reasons; one is that it is a key step in succeeding in any clime, having a good understanding of the culture of any environment, and how the people there think is a very important step in building products that scale massively in that environment. Think about how the Lebanese and Indians have held a grip on some industries in Nigeria because they have a better understanding of the market dynamics than the so-called indigenes (omo-niile) of that environment. The second reason I talk about understanding your market is because I am a design strategist, it’s part of our craft, it’s just something we have to do. Don’t ask me why.

If you copy a model that worked elsewhere and try to replicate it in Nigeria, chances are it may not work. When I talk about copying and pasting models, the first thing that comes to mind is usually Silicon Valley, but it isn’t just Silicon Valley, it’s everywhere.

So, someone asked; why haven’t we been able to build our own kind of Mpesa in Nigeria? So, we consulted our modern-day oracle in this day and time. We asked Google.

With the kind of technology we have today, you don’t really need juju to be a witch doctor. The white calabash they shake to show you people in real time could be Skype, those trinkets they shake to use to inquire of their oracles could be Google, and the part where they show you something your great grandfather did many years ago could be YouTube, But I digress.

From Google, I realized that the financial infrastructure on ground in Kenya at the time of founding Mpesa played to their advantage, and made Mpesa a no-brainer to adopt. Present day Nigeria has better financial infrastructure than what they had then, so trying to use the approach they used will likely not birth the same results.

Let’s look at Tesla.

So today Tesla is a 400 billion dollar business that was founded in 2003. Americans in general, to a large extent care about climate change, Nigerians? Not so much. An acquaintance was pitching an idea that revolved around biodegradable plastic bags to me this past week, and I told him the whole biodegradable idea isn’t a core selling point, some may, but a good number of people will not care.

If Elon had come to Nigeria in say 2004 to start Tesla, I don’t think I’d be wrong to say he’d probably be a cashier at Zenith bank by now.

The better you understand the Nigerian market, the better your chances of building a unicorn.

A unicorn that isn’t based on a lofty valuation should have at least $100 million in ARR (Annual Recurring Revenue) to be considered as unicorn material. I saw your heartbeat jump there when I wrote $100 million, don’t fear, the people that have done it in the past may have been white, but like Nigerian parents say, they don’t have two heads.

Let’s begin.

How to build a Unicorn

There are two major steps to building a unicorn in Nigeria;

Step 1: Sell Air

If you take a good look at the biggest companies in Nigeria today, most of them have one thing in common; they sell air. Not literally, but theoretically. Their products are essential products that are important to everyday living.

Shelter, food, telecommunications, banking services, and the likes are not nice to haves, they’re essential. Without housing, you live under the bridge, so you need cement. Without food, you could die of hunger, so you need sugar, flour and salt. Without telecommunications, how do you talk to people in faraway places, or even conduct business, so you need MTN, Glo and the likes, without petrol/energy, Nigerian mosquitoes will use you to do brown skin girl, and without banking services, do I really need to say anything?.

Essentialism is the keyword if you intend to unlock any meaningful value in the Nigerian market.

The Nigerian market comprises of 200 million people, what they don’t tell you is that those 200 million people won’t buy your $1000 product because they either can’t afford it, it doesn’t come across to them as being that necessary, or a mixture of both.

Netflix is a nice product, but mama in the market will not spend #4500 every month to pay for subscription when with #200 she can buy the pirated version of the movie with 7 other movies in one CD (I do not in any way support pirated movies, and the likes, but this is a reality on ground that you simply can’t ignore).

With #2100 she can pay for Gotv and watch all the African Magic she wants from the comfort of her couch without having to do any kind of complex setup to get her phone to display on her TV (you know mama isn’t tech savvy), or paying for data to stream movies she can already watch without any other added cost with her Gotv subscription.

But sometimes mama buys gala and coke in the market, if not for herself, but for her grand kids. mama also buys recharge cards to call her children in the city, and she pays for transportation to move her goods from the farm to the city for her to sell. Even though the trailers that carry those goods look so worn out that I am still wondering how the driver can conveniently take it from point A to B without it breaking down and forever refusing to start, mama still pays for it, as long as it gets her farm produce safely to the city. How it moves from A to B, and whether it pumps smoke like it is about to explode is none of her business, But I digress.

Now I can already imagine you saying; mama is not my target market, but that’s the point, if you want to build a billion dollar business in Nigeria, mama (or people like her) have to be in your market.

Your market is the tech savvy millennial who has a smartphone, pays for airtime from his/her bank accounts, uses TikTok and Instagram actively and streams Netflix day in, day out. But that’s the point, if that’s your target market, you’re already operating in a niche market, and you can’t build a billion dollar startup, or really any billion dollar business in Nigeria operating a niche market.

The millennial’s above may be able to afford to pay say #2000 monthly to use your product or service, but the size of your niche may limit that monthly #2000 to less than a million people (that is if you even cross a hundred thousand users).

You need to be realistic. The bigger your addressable market, the better your chances of getting a billion dollar valuation. You need to sell air.

Think about this; The Rolls-Royce is a premium exotic car manufacturer. They sell cars that push their addressable market to those in the top 1%, or even top 0.1%.

A Rolls-Royce may retail for $250,000, and that looks like a lot of money, what they don’t tell you is that they’re not going to sell as many cars as the guys at Toyota selling Corolla’s for $30,000.

In the end Toyota has a larger addressable market, they go home with $206 million per annum, and are valued at $236 billion. Whereas the Rolls-Royce serves a niche market, goes home with less than that per annum, owes $1.7 billion and are valued at $8 billion. When you go to the dealership, it looks like The Rolls-Royce is winning, in reality; Toyota is really the one winning.

The Nigerian market is an essential market. If you want to build a billion dollar business, stop selling niche products, learn to sell air.

Step 2: Sell to the Big Boys

The average Nigerian can’t afford many things. Most people you see using iPhones bought them second hand, most cars you see on the road are second hand, and most people build their houses themselves (not by literally putting the blocks together). If you really want to make money in the Nigerian market, You need to sell to the big boys, you need to sell B2B.

B2B is an Acronym that means business to business. In other words, B2B is a model where a business’ product is sold to other businesses. In this model, enterprise is the game, the product you sell is used primarily by businesses, rather than everyday Jack’s on the street.

If Innoson Motors wasn’t in the B2B space, I have strong reasons to believe they would have shut down by now. You may have a product of immense value in the Nigerian space, but the fact that people can’t afford it, not because it’s overpriced, but because you really can’t sell it any lesser if you intend to make a profit is the Achilles heel of many businesses today and the reason Nigerian markets are filled with substandard goods.

If the everyday user can’t afford it, design a product that can be used by corporations.

There are two major reasons selling to corporations is ideal; first is they can afford to pay for your service, and two is that churn rates are usually lower with corporations.

Let me put it this way; if I get tired of an app on my phone, all I need to do is hold down on the app, click uninstall, and I’m done. If a corporation is tired of your product or service, off boarding you may be difficult; going through the stress of looking for a new provider and migrating their data to a new provider may not be worth it, especially if you’re not making too many mistakes (this isn’t a license to misbehave, but I trust your good judgment).

Corporations and governments can afford to pay you millions for your product and/or service, whereas the everyday user is limited to maybe a couple of thousands.

If you really want to build a billion dollar startup in Nigeria, you need to learn to sell to the big boys.

The Sweet Spot

In high school math, I was taught how to draw Venn diagrams. There’s a big circle at one end, another big circle at another end, and there’s an intersection point where the two circles meet.

At one end is selling air, at the other end is selling to the big boys, the sweet spot is when you begin to sell air to the big boys. This is what the biggest businesses in Nigeria do.

If you run a bakery, your air is flour, and since selling to a bakery is B2B, when Dangote flour sells to you, they’re essentially selling air to the big boys, and since you’re a bakery (depending on your production capacity), chances are, you’re buying around 200 bags of flour or even more in a month. Not many individuals are buying even 3 bags of flour in a month, talk less of 200 bags. That’s selling air to the big boys.

Axa Mansard is an insurance company. Not many individuals have comprehensive health insurance in Nigeria, but since most big companies make it mandatory for their employees to have health insurance of some kind, companies sign up with Mansard to get their employees comprehensive health insurance. The company needs it, and Mansard gets to sell that service in bulk rather than on a person to person basis. What Mansard is really doing is selling air to the big boys.

Be like Mansard, sell air to the big boys.

Someone may point out Transsion Holdings (parent company of Tecno, Infinix and Itel) isn’t doing any of these, and I would like to say that first of all, Nigeria isn’t Transsion’s only market, but that being said, telecommunications plays a massive role in a normal Nigerians life today. Even the old mama’s In the villages today have mobile phones.

Connectivity is important to both the old mama in the village, and the AirPod wearing youth on the street, albeit at different levels.

You may not know, but Transsion does have a large share of the feature phone market (aka torch light phone market) at 54%, so they’re also selling air. They may not be selling to the big boys, but I never said you must do all three, just pick one and execute on it as best as you can.

Conclusion

Building a unicorn is fantasized as the dream of a majority of startup founders, especially in Nigeria, but dreaming alone isn’t enough to get that unicorn off the ground, you need to be strategic, especially if you operate in the Nigerian market to be able to sell air, sell to the big boys, and if you’re strategic enough, sell air to the big boys.

PS1: If you’re selling air through a digital product, make sure your product can be accessed through USSD codes. Not everyone has access to a smartphone, and not everyone wants to download a new app. I think we’re already having app fatigue.

PS2: If I mentioned your organizations name in this post and you feel offended, I apologize, it is majorly just for humor sake, I’m a funny guy, and that’s just the way I write.

PS3: Honestly, I believe that Nigerian entrepreneurs shouldn’t necessarily focus on building unicorns, but building products that add immense value to the life of Nigerians, and Africa as a whole. Think of companies like Andela, Flutterwave and even Utiva, they’ve added a lot of value to the lives of Nigerians and Africans as a whole, and they’re not even unicorns.

Like this:

Like Loading...