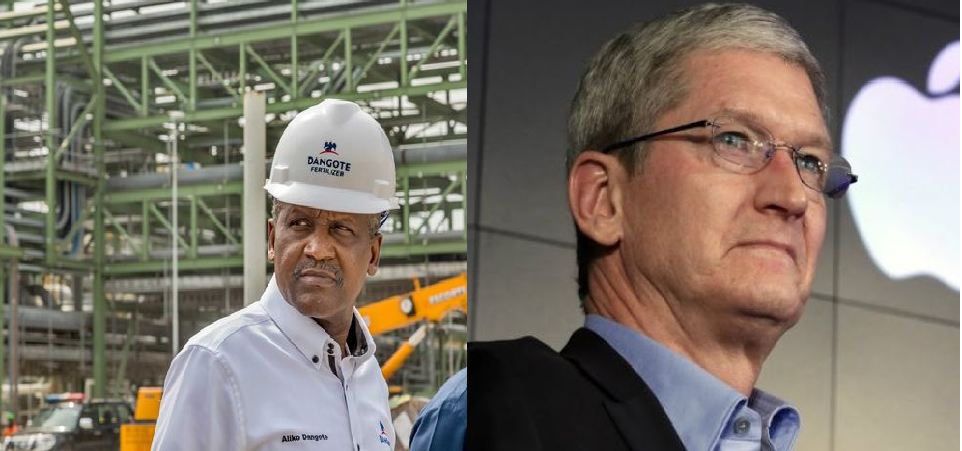

Dangote Group and Apple Corp have one thing in common: both are successful companies in their own domains. Apple is a category-king technology company while Dangote is a preeminent industrial conglomerate in Africa. Apple looks for technology areas with exceedingly huge opportunities. Dangote looks for sectors with untapped opportunities. In most cases, both do not pioneer the sectors, foregoing any first-mover competitive advantage. Rather, Apple and Dangote typically wait for others to move in first, do the initial hard work, and over time, they will plot how to enter, and dislocate the market – and win.

Apple wins most innovation awards because Apple makes great products. But Apple will rarely win any award for bringing new product categories. Before the iPhone, we had Blackberry. Before the iPod, there was the Walkman. Before the Apple Watch, we had Pebble. Indeed, across all domains like payment, music, etc, Apple had always gone to improve what was already in existence. Largely, they watch the incumbents, learn from their mistakes, and then go and build better products. And when the customers see their products, which typically deliver better value, across metrics, the incumbents will begin to experience loss of market share.

Dangote follows the same playbook in Nigeria. Once it discovers a sector that is generating good margins and nice cashflow, it quickly comes in. The playbooks from cement to fertilizer to agro-processing have been consistent on that construct. Dangote will not enter into ecommerce today because there is nothing there. But once there is life therein, expect the conglomerate to pay attention. With thousands of trucks, it can play a double play strategy on nationwide distribution.

For Dangote and Apple, winning markets comes with one clear business construct: unleashing accumulated capabilities with asymmetric resources and execution firepower via technology, financing, distribution, supply chain, human capital, etc that incumbents cannot match. Indeed, by the time pioneers in smartwatch saw Apple’s interest in the category, they gave up because Apple brought in a new basis of competition that is totally orthogonal for them to confront. Dangote does the same thing, and most times wins.

The lesson here is simple: first mover advantage is great, but operating a sustainable business with capacities to build competitive moats to protect castles is even more important.