Registration has ended for edition 2, register for next edition

Invent, innovate and drive organizational transformation, performance, and growth. Capture emerging opportunities in changing markets while optimizing innovation and profitability. Digitally evolve your business or functional area, turning digital disruption into a competitive capability and advantage. Master the concepts of building category-king companies, and thrive.

After the highly successful first edition of Tekedia Mini-MBA, we have launched the second edition. I invite you to register ($140 or N50,000 naira) . This program is a 4-month weekly program, beginning June 22, 2020 to end Oct 22, 2020. It will comprise videos, flash cases, written materials and webinars delivered online. When we finish, we will issue a certificate from the Tekedia Institute USA.

Register and join us. You will emerge transformed with tools and capabilities that engineer confidence, performance and growth. Accelerate your leadership ascent with us and have access to speak with me on your career and professional development! More so, we have new courses and will be using a new global faculty team to deliver them. Also, we are providing capabilities to grade participants’ Labs besides feedback we provide in the Discussion boards.

Tekedia Institute offers innovation management 4-month programs, optimized for business execution and growth, with digital operational overlay.

How To Register:

- PayPal: follow this link and pay $140 US dollars. It supports most global currencies.

- Bank transfer (Nigerian naira): Pay N50,000 into any of:

- GTBank 0114016493

- UBA 1019195493

- Account owner: First Atlantic Semiconductors & Microelectronics.

- Flutterwave: follow this link (naira) or this one (USD) to use your Verve, Visa, Mastercard, Amex, etc cards across Africa and beyond.

- Automatic Access: Pay via this Tekedia link for self-automatic enrollment with username.

After payment, email tekedia@fasmicro.com with participant’s name and email to complete the registration.

Add extra (optional) $30 or N10,000 if you want us to review and provide feedback on your labs.

Early Bird Registration Benefits Do NOT END (you get the benefits anytime you register)

- Access to any Facyber Certificate program for free. Facyber offers online cybersecurity programs on policy, technology, management, and forensics.

- Get free ebooks & their audio versions: Africa’s Sankofa Innovation and upcoming “The Dangote System: Techniques for Building Conglomerates”

Video presents overview of Tekedia mini-MBA

Theme: Innovation, Growth & Digital Execution – Techniques for Building Category-King Companies

Introduction

Over the last few decades, digital technology has emerged as a very critical element in organizational competitiveness. It has transformed industrial sectors and anchored new business architectures, redesigning markets and facilitating efficiency in the allocation and utilization of factors of production. The impacts have been consequential: nations like Nigeria are moving towards knowledge-based economic structures and information societies, comprising networks of individuals, firms and states that are linked electronically and in interdependent relationships. In this program, we will examine this redesign within the context of fixing market frictions and deploying growth business frameworks in a world of perception demand where meeting needs and expectations of customers are not enough.

Program Time: June 22, 2020 – Oct 22, 2020

Venue & Format: Online via videos, articles, webinars, and flash cases. Program is self-paced which means you consume the materials at your own time and pace.It is completely online. You will have something to complete within 7 days. You decide when you do that within the window. Where you live or your time zone would not be an issue as program is not live-delivered.

Cost: US$140 (N50,000 naira) (20% discount for bulk registration of at least four). We have payment plan, i.e. installment payment plan.

Program Structure: The program structure is presented below; we will add the current faculty in coming days.

| TEKEDIA MINI-MBA CURRICULUM | ||

| Theme: Innovation, Growth & Digital Execution – Techniques for Building Category-King Companies | ||

| Week | Focus | Components |

| 1 | Growth and Innovation of Firms – Prof Ndubuisi Ekekwe | Reading (R), Flash Case (F), Video (V), Challenge (C) |

| 2 | Business Playbook, Manual and Execution – Prof Ndubuisi Ekekwe

Exponential Technologies and Business Opportunities in the Age of Singularity – Transdisciplinary Agora for Future Discussions, Inc (TAFFD), Georgia, USA . TAFFD team developing session: Edward Hudgins, PhD |

R, F, V, C |

| 3 | Modern Business Models and Growth – Prof Ndubuisi Ekekwe

|

Reading, Flash Case, Video, Challenge |

| 4 | New Technologies, Growth, Disruptive Innovation

– Cybersecurity – Adetokunbo Omotosho, CEO, Infoprive – Blockchain – Franklin Peters, CEO, Bitfxt – AI & Cloud – Wale Olokodana, Azure Business Group Lead, Microsoft – Data Management, Big Data & Analytics – Dr Adewole C. Ogunyadeka, esure Group Plc |

Reading, Flash Case, Video, Challenge |

| 5 | Effective Organizational Change Management, Omowunmi Adenuga-Taiwo (most recent role as a Strategy Consulting Manager with Deloitte)

Stimulating New Markets Through Innovation And Perception Demand – Prof Ndubuisi Ekekwe |

Reading, Flash Case, Video, Challenge |

| 6 | Investing and Fundraising – Victor Ndukauba, Deputy Managing Director, Afrinvest West Africa

Personal Finance and Wealth Management – Japheth Jev, CIMA(UK), CGMA, ACA, Japheth Consulting

Sector Innovation and Focus: Case Studies – Logistics – Samuel Akinniyi Ajiboyede, CEO, Zido Logistics – Ecommerce – Olufemi S. Aiki, Co-Founder, Foodlocker – Fintech – Olugbenga GB Agboola, CEO / Co-Founder, Flutterwave – EdTech – ‘Dimeji Falana, CEO, Edves – Agtech – Ndubuisi Ekekwe, Founder, Zenvus – HealthTech – Enoh John, CEO, Lafiya TeleHealth – Supply Chain – Ayodele Adenaike, COO, GIG Logistics |

Reading, Flash Case, Video, Challenge |

| 7 | Sales Management, Marketing and Growth – Moby Onuoha, Queen’s University

Supply Chain Management, Global Partnership & Contracting – Adebayo Adeleke, ex-Chief of Contracting and Deputy Chief, Business Operations Division, US Army Lab #1 – Tekedia Institute |

Reading, Flash Case, Video, Challenge

Instruction { Report Output} |

| 8 | FMCG New Product Launch and Product Strategy – Mohammad Ibrahim, Managing Partner, Stochastic Institute

Effective Supply Chain Management – Execution – Business Objectives and Technologies, Nnamdi Onyebuchi, CEO, Weco Systems Group |

Reading, Flash Case, Video, Challenge |

| 9 | Media, Communications, and PR – Grace Akinosun, CEO, smepeaks

Branding and Advertising – Akachi Ngwu, Executive Director/COO, Luzo Digital Network & Media

Product Design and Packaging – Kemisola Oloriegbe, Manager, Nigerian Breweries Plc |

Reading, Flash Case, Video, Challenge |

| 10 | Business Process and Leadership – Prof. Ayodeji Oyebola, Saint Mary’s University of Minnesota

Process Improvement and Operations Management – Rasheed T. Adebayo, Operations Manager, Schlumberger

Quality and Asset Management –Michael Odigie, Vice President Technical Services, Delek Logistics |

Reading, Flash Case, Video, Challenge |

| 11 | Digital Transformation, Innovation & Strategy – Jude Ayoka, Manager, Access Bank Plc

Leading and Managing Teams, Stakeholder Management with NICER Model – Dr. Chisom Ezeocha, Project Delivery Manager, Shell |

Reading, Flash Case, Video, Challenge

|

| 12 | Accounting, Building Sustainable Enterprises – Ndubuisi Umunna (ACA), Head Finance Accounts & Admin, Royal Exchange

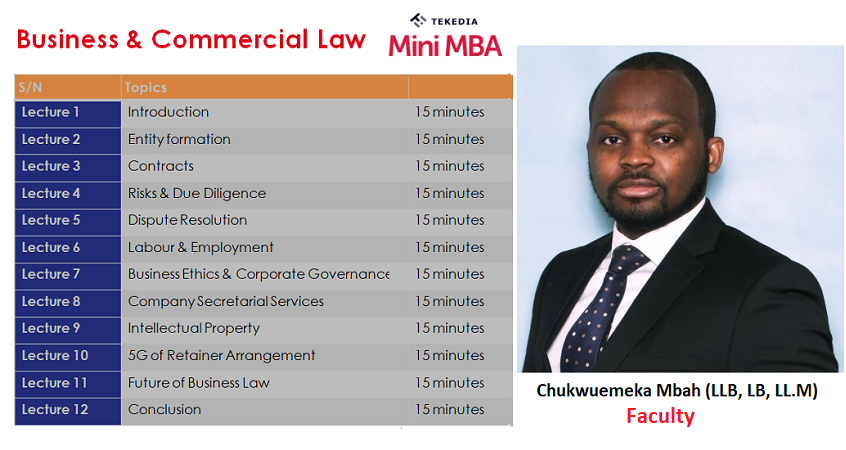

Risk Management – Akeem Rasaq, Head Of Risk Management, Chapel Hill Denham Business & Commercial Law – Chukwuemeka Mbah (LLB, BL, LLM) Law, Manager, Sherwin Williams |

Reading, Flash Case, Video, Challenge |

| 13 | Lab #2- Tekedia Institute

Special Series on Winning in Business (all videos) – Prof Ndubuisi Ekekwe • Session 1 – Readiness for The Frictions of Nations • Session 2 – The Six to Unlock Values in Markets • Session 3 – The Two Critical Playbooks • Session 4 – Mechanics of growth & Investment Options • Session 5 – Finding the Edges and Market Opportunities • Deep Conversations – Answers to Big Questions

Sustainability Strategy and Social Innovation – Temitayo Ade-Peters, CEO, We For Good |

Instruction {Report Output}

Video |

| 14 | LIVE SESSION: Building Your Business Financial Models (templates included) – Michael Olafusi, Financial Analyst Fellow, Brightmore Capital; Lead Consultant, UrBizEdge

Human Resources Management .- Adora Ikwuemesi, Director Kendor Consulting |

R, F, V, C

R, F, V, C |

| 15 | Auditing, Forensics, Policies and Controls – Yusuf O. Sanni (ACA), Chief Internal Auditor, BUA Cement Plc

Contracting, Negotiation and IP – Jeff Chineme Maduka (LLB, BL, LLM), Snr Legal Manager, American Tower |

R, F, V, C |

| 16 | Driving Profitable Growth, Marginal Cost, Scaling – Prof. Ndubuisi Ekekwe

Effective Financial Planning and Management – Okpaise Kenneth, Financial Advisory Manager, AIICO Insurance Plc

Capital Market Operations – Azeez Lawal, CFO, TrustBanc Group |

R, F, V, C |

| 17 | Lab #3 – Tekedia Institute

Innovation Lessons: 5in5 (5 Firms in 5 Sectors) – Africa/Global – Aderinola Oloruntoye, Dean, Workforce Group

Disruptive Sustainability Innovation for Long Term Business Growth – Eustace Onuegbu, President, incsr.org |

Instruction {Report Output}

R, F, V, C |

| 18 | Effective Project Management – Taiwo Abraham, Project Manager, Horizant

The Call to Execution (Summary) – Prof Ndubuisi Ekekwe |

R, F, V, C

Reading , Video |

| Report , Closure | ||

| Lead Facilitator: Prof. Ndubuisi Ekekwe | ||

*(All Saturdays have Discussion Webinars of one hour; the contents would be recorded for replay). **In some names (law, accounting, etc), we have to put the professional titles due to the regulatory nature of the fields.

Career Week: To Transform Workers into Leaders and Innovators

Our Career Week (Nov 2-6 2020) is not designed for finding jobs. Rather, it is structured to TRANSFORM workers, founders & entrepreneurs into business leaders and champions of innovation in their companies. The sub-theme is Nurturing Innovators: Career Planning & Resilience During Disruption. It will be packaged under the Tekedia Mini-MBA theme of Innovation, Execution & Growth. Our knowledge experts for the Week include human resources experts and leaders from MNCs and startups, across industries and global regions:

- Dupe Akinsiun – Head, Leadership & Capabilities Center, Coca Cola HBC

- Nnenna Jacob-Ogogo – Head, Alpher, Union Bank

- Precious Ajoonu – Manager, Jobberman

- Bukola Kogbe, Regional HR Director – Africa, Barry Callebaut

- John Wesey – CEO, Psyntech

- Dr Akanimo Odon – CEO, Envirofly Consulting UK

- Antonia Adeyemi, CIPD – Managing Director, StatsXperts Consulting

- Dapo akinloye – COO, Emerald Zone, ex-HR Head, Lafarge CBG

- Dr. Fatai Olajobi – Partner, Neo-Neurons Concept

- Dotun Jegede, Senior Partner, Dee Bee Consulting

- Elizabeth (Ayeni) Nyah, Human Resources Business Partner, VDT Communications

- Ezra Anajonu – CEO, Save’N’Fflex

- Capt. Ola Olubowale – Manager, Viva Energy Australia

- Abraham Owoseni.com – Principal Consultant, MindMould

Video presents overview of weekly session

Target Audience: This program is designed for professionals across functional areas like sales, marketing, technology, administration, legal, strategy, finance, etc across all business sectors and domains.

Learning Objectives: To innovate is to set a new basis of competition in an economy, business sector or market. Most times, it results to disruption. This program is designed for private (large, SMEs, startups) and public institutions. Participants will:

- Master the mechanics of digital growth – the reward of innovation – through frameworks, cases and evolving strategies.

- Understand how to undergo digitization journey that is fully aligned with corporate objectives through measurable and realizable benchmarks.

- Acquire business capability tools that do not just RUN their firms but can TRANSFORM them.

- Design corporate growth experiments in Lab sessions based on One Oasis Strategy, Aggregation Construct, Double Play Strategy, Accumulation of Capability Construct, and more.

Facilitator: Prof Ndubuisi Ekekwe invented and patented a robotic system which the United States Government acquired assignee rights. Dr Ekekwe holds two doctoral and four master’s degrees including a PhD in engineering from the Johns Hopkins University, USA. He earned undergraduate degree from FUT Owerri where he graduated as his class best student. While in Analog Devices Corp, he co-designed an accelerometer for the iPhone. A recipient of IGI Global “Book of the Year” award, a TED Fellow, IBM Global Entrepreneur and World Economic Forum Young Global Leader, Prof. Ekekwe has held professorships in Carnegie Mellon University and Babcock University, and served in the United States National Science Foundation Committee. The South African press called him “a doctor of innovation” for helping organizations on the mechanics of business innovation, strategy and growth. Since 2009, the Chairman of Fasmicro Group which controls many startups and entities has been writing in the Harvard Business Review.

Reliance Infosystems Sending 40 Staff To Tekedia Mini-MBA, Enjoys Group Benefits

Support of Tekedia Non-Resident Fellows

The Founders’ Question – And Unveiling of Tekedia Non-Resident Fellows

Our sample certificate which will be awarded to participants

Tekedia Mini-MBA Corporate

Tekedia Mini-MBA Corporate is a customized version of the general Tekedia Mini-MBA. It is designed for private and public institutions by sector, phase of growth and organizational structure. It focuses on the same theme of innovation, growth and digital execution. But unlike the 4-month general Mini-MBA, the Corporate vision goes for 6, 8,10 or 12 weeks. Email for a quote.

More Features of Edition 2

Besides the core features of our program, we have the following for the Tekedia Mini-MBA.

- Tekedia Innovation Summit: An annual physical summit at no extra cost to participants of Mini-MBA in the specific year, in Lagos. The summit will also be webcasted.

- Co-Innovation Idea Circle: Offers the ability for members to share product and service ideas, and get feedback from the Mini-MBA community.

- Funding Club:We have a partnership to help participants from start-ups and established companies connect with investors, rewarding market innovations.

- Partner Marketplace: Opportunities for member-firms to offer free products and services to the community as a way of getting some of their products before users and potential customers. These services could include web hosting, product samples, books, business legal services, etc.

- Innovation Book:During the planned 2020 Summit, we will unveil a book – Innovation for Growth: Techniques for Building Category-King Companies.

Email: tekedia@fasmicro.com

Selected Testimonials

- A participant received a promotion after implementing a playbook in our session.

“Sir, I am overjoyed. I just received a promotion. On Thursday, I sent to my CEO a Covid-19 Continuity Plan, using the template you made available in Tekedia mini-MBA class. Early today, management asked me to present it via video. Ten minutes ago, I received an email from Head Admin that management wants me to execute that template, and they also promoted me. I am also getting a refund for my personal investment on this training. I want to say thank you to all the faculty for this service.”

- A participant received funding after using ideas from our session on fundraising.

“I discarded my business plan and used the Week 1 business canvas on the Challenge Assignment. Today, I am happy to share that less is indeed better: we received $25,000 from an investor. I want to thank all the faculty especially Mr. Azeez Lawal. His course on Fundraising with African sense is the best ever. I also thank you for a statement in one of the class videos, “Your customer can be your investor. Believe this… the best investors are customers”. This investor is a customer and we will begin by serving his company even though we are a separate company.”

We continue to profile our Faculty and Courses on Tekedia homepage

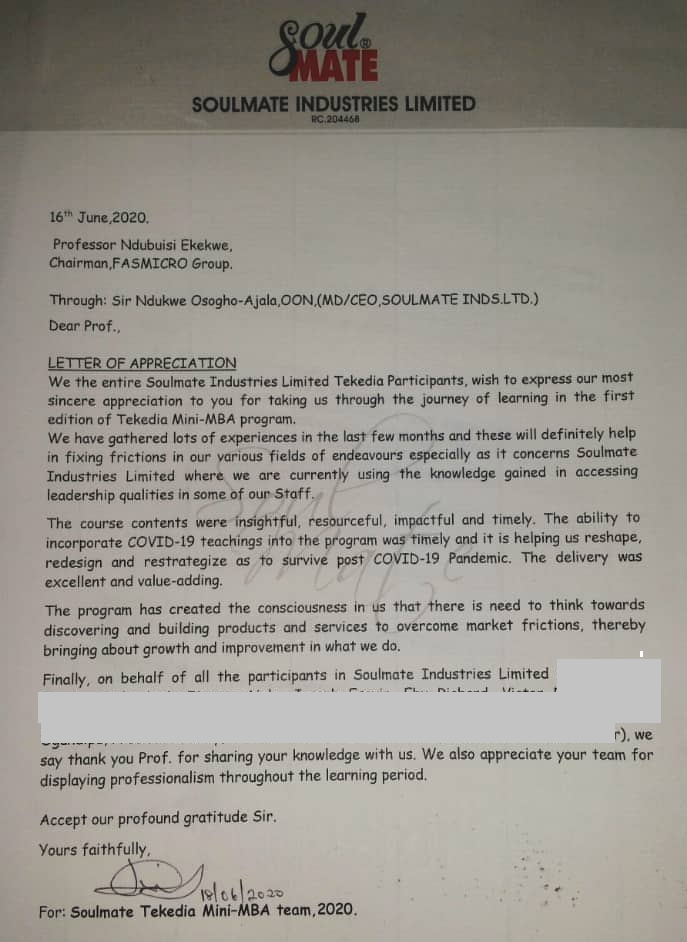

Testimonial from Soulmate Industries Ltd