A Fintech startup registered in Delaware and Lagos, Nigeria is looking for investment in StackFX.

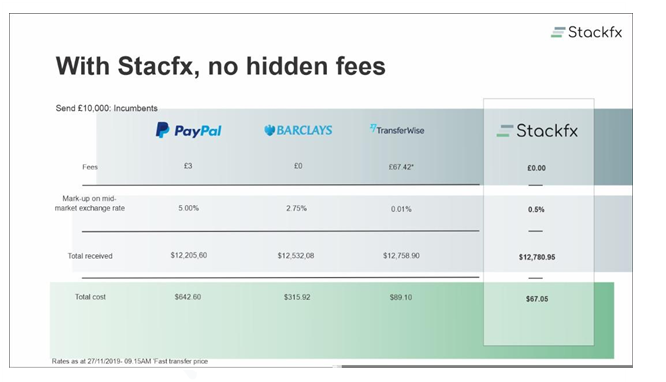

StackFX.io is a P2P FX transaction and remittance product that will facilitate the free flow of funds across the globe and is designed to serve all customer segments. It is owned and managed by Datastarck Inc and other accredited banking stakeholders in countries across the different continents of the world.

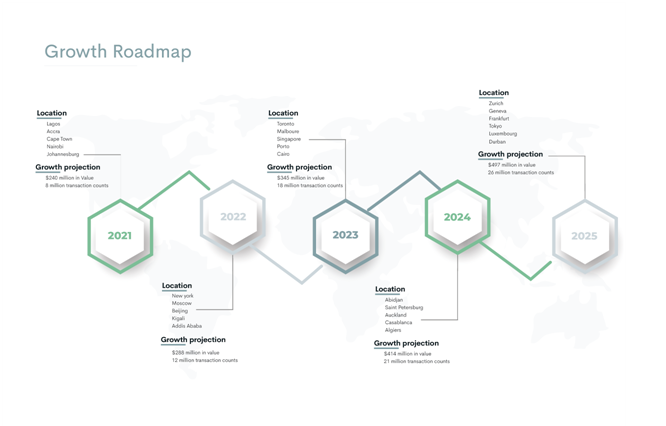

Datastarck Inc, registered in Delaware and Lagos, will use the capital to hire a business development team, acquire technologies & build a top-class team to quickly scale into the African and global markets. The company would also reserve a part of the fund for FX liquidity with its acquirer bank in Europe and the US. The deal is expected to close on February 12 2020.

The idea for StackFx came from the two Founders’ time at Procter & Gamble Nigeria, where the firm regularly ships in a high level of raw materials needed for the production line or plant at intervals.

“Most of the time, we are faced with the heavy task of sourcing for USD to be able to do this exercise, basically to pay foreign suppliers. Although there is year on year plans for same and this is tailored along the Central Bank of Nigeria’s USD buying window that is majorly executed through the commercial banks, most times, there’s always a shortage of exotic currencies to pay foreign suppliers of raw materials, which results in a halt in production & minimum stock level. The firm then struggles or starts sourcing for exotic currencies from the black or grey market.

Sourcing from this black/grey market channels, which is the most unreliable with less liquidity, always comes with double fee/charges, because the firm buys at a rate with a commission from the black market fx traders then take this funds to the bank as a deposit before trading or paying from the corporate domiciliary account. At this end, the bank also charges its own fee at the end before processing the requirements and paying the suppliers abroad.”

In June 2017, the Datastarck team carried out a survey with a research team of 50 persons across the various BDCs, FX black/grey markets and banks FX trade desk, to ask the following:

- What is the average daily retail FX in the grey markets?

- What is the volume or value done over banking FX desk?

- What is the actual FX value/volume in Africa as a whole?

- What is the daily retail FX in Nairobi, Joburg & Lagos by ranking or leading in Africa market?

- What are the problems associated with retail FX sourcing in Africa and Asia?

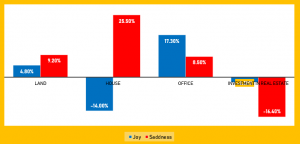

The results of the survey revealed that there is a high level of inconsistency, lack of liquidity, unfavourable rates, multi-layer charges, inability to do instant FX between different countries of the world with ease, difficulty and delayed access FX service and all sorts of proprietary regulatory details and add-on cost.

StackFX was born to address these challenges as well as the existing foreign exchange and payments challenges faced by individuals & businesses. We will provide businesses and individuals with an online platform to exchange currencies with other individuals & businesses and make international payments to their business partners & suppliers abroad.

StackFX will allow customers initiate payments in the local currency of the initiating jurisdiction or US Dollars while the beneficiary receives a direct credit to his account or cash in the local currency or US Dollars (provided send currency is USD, GBP, Euro, SA Rand, Canadian Dollars, New Zealand Dollars, Australian Dollars and beneficiary has a USD account) in line with local procedures.

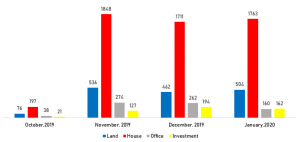

Africa’s Forex within the small and medium businesses alone is estimated at $400billion in transactional volume. StackFX targets 75% and 25% of the Africa market share and globally traded volume respectively, which according to the Bank for International Settlements triennial report of 2016, the foreign exchange market cap averaged $5.1 trillion per day, for 2019 global daily fx volume was 6.6 trillion.

We see a future for Africa that truly fulfils the continents immense potential, but we believe that this can only be done with hard work, passion & dedication, and the road must begin somewhere. We intend to be one of the biggest facilitators of business and trade within Africa and with the rest of the world. We hope to build a strong and long-lasting community based on trust and mutual well-being.

StackFX as a digital FX platform will serve both local and diaspora’s personal, trade advisory and business financial transfer needs, this is made possible through a unified FX platform that is both secure and accessible regardless of region.

We aim to bring positive disruption to the redundant, restrictive and outdated bank’s FX transaction model by using technology to allow real-market participants to dictate their terms and pricing.

Datastarck Inc is calling for seed capital investment for StackFX from Angel Investors and VCs only who meet the following stringent criteria:

- Must be willing to invest for the long term

- Must be willing to allow the company to operate as-is, no change to company culture.

- Won’t try to lock the founders into golden handcuffs or push complex deal terms, renegotiate and grind on terms

- Won’t try to flip the business in 3-5 years

If StackFX sounds like a perfect fit and addition to your investment portfolio, please send your questions and inquiries in an email to investments@datastarck.com.

Upon receiving your email requests, we’ll send you our pitch, demo video and financial model.