Editor’s Note: This company has actually collapsed; the title of this piece has been updated.

Thomas Cook’s issues went beyond Brexit. But Britain’s complicated departure from the European Union, and its impact on the pound, may have been the final nail in the troubled company’s coffin.

The travel operator’s dramatic collapse follows years of mismanagement and a failure to keep pace with online rivals, writes Hanna Ziady from CNN Business. And Brexit didn’t help.

Analysts say it was one of several factors that led to the 178-year old travel company’s demise, which has left 150,000 UK holidaymakers stranded abroad and cost thousands of employees their jobs

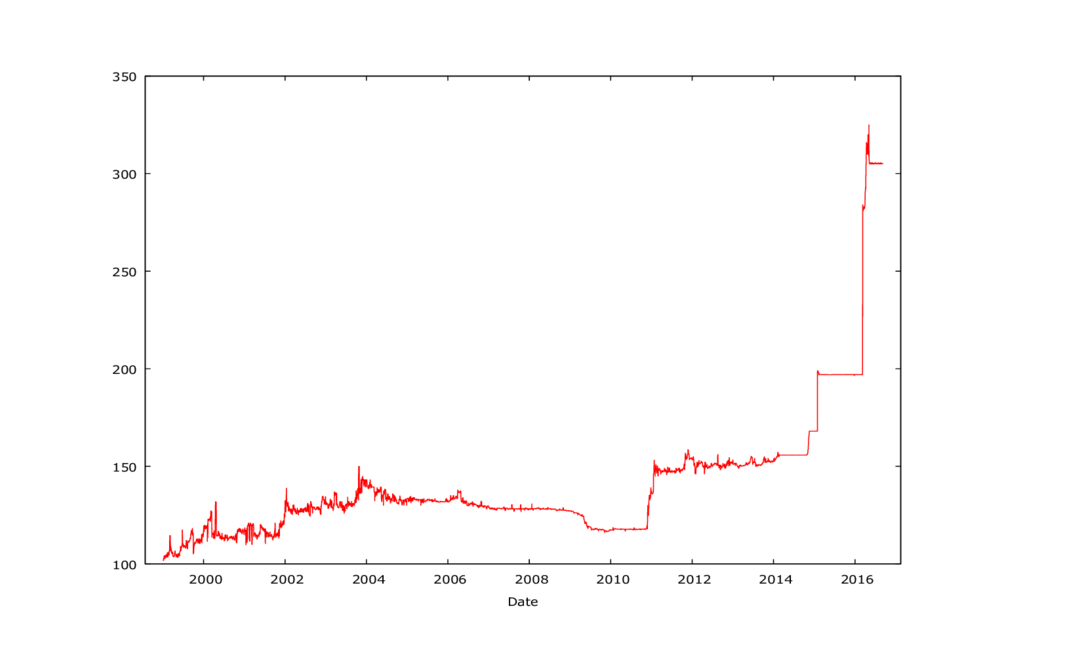

The 178 years existence of Thomas Cook is under serious threat with the British traveling company failing to secure £1.1 billion bailout fund to stay in business.

Thomas Cook Group have been struggling with a burden of £1.7 billion debt that has pushed it into administration. The Civil Aviation Authority announced the tour operator’s bankruptcy early Monday morning.

“Thomas Cook Group, including the UK tour operator and airline, has ceased trading with immediate effect. All Thomas Cook bookings, including flights and holidays, have now been canceled.” The aviation regulator announced in a statement.

In a statement issued on their defunct website, the company acknowledged the announcement of the Civil Aviation Authority.

“We are sorry to inform you that all holidays and flights provided by these companies have been cancelled and are no longer operating. All Thomas Cook’s retail shops have also closed.”

The Guardian reported that apart from the 9, 000 UK jobs at risk, about 150, 000 travelers, who use Thomas Cook services are stranded around the world. The unprecedented turn of events has prompted a backup plan by the UK government to evacuate her stranding nationals.

The UK Prime Minister, Boris Johnson, who has ruled out the possibility of £150 million bailout from the government said the only plan of action is to bring the Holidaymakers home.

“It is a very difficult situation, and obviously our thoughts are very much with the customers of Thomas Cook, holidaymakers, who may now face difficulties getting home. We will do our best to bring them home.” He said.

The contingency plan was also reiterated by the Foreign Secretary, Dominic Raab, who told the BBC that it’s all the government has on the table for now.

“We would wait to see and hope that Thomas Cook can continue but in any event, as you would expect, we’ve got the contingency planning in place to make sure that in any worst case scenario we can support all those who might otherwise be stranded.” He said.

The tour company has been making desperate moves to savage a dire situation that holds the fate of 21, 000 employees and about 600, 000 travelers around the world.

Before now, the company has accepted a £900 million bailout but was told to get £200 million more, which is proving difficult. Meeting with stakeholders, among them, Chinese conglomerate Fosun, has proved futile, instigating the kind of disappointment that the chief executive, Peter Fankhauser doesn’t want to talk about.

The guardian reported an indication that the company made a lot of proposals, which includes asking lenders to reduce a £200 million demand for extra funding and for credit card companies to release about £50 million of cash they hold as collateral against Thomas Cook bookings.

The whole situation has thrown the holidaymakers into panicky, especially those who are on a trip right now. However, Thomas Cook has reassured them that there is nothing to be scared of, since their interest is protected by the Atol scheme, a (sort of) insurance scheme that guarantees the welfare of holidaymakers. A staggering £600 million to bank on in case things go south.

But the twist in the hope is that not all the customers of Thomas Cook have the Atol coverage, and the company noted that repatriation flights are only available for passengers whose journey originated in the UK. Therefore, the cancellation means that many are going to get thrown out of hotels or planes.

Holidays companies usually don’t pay the bills until after 90 days, but in the case of cancellation and obvious liquidation, hotels try to get their money from holidaymakers.