A coolest aspect concerning jumpers watches, is that they are among the hardest watches on earth. These profoundly particular games watches are planned with usefulness first on the watchmaker’s need list. This is on the grounds that as a watch is exposed to more noteworthy profundity, the harder it must be to ensure safe activity in a pressurized situation.

How Divers Watches Are Tested

There is a severe worldwide standard that a genuine jumpers watch must fulfill so as to be a guaranteed plunging watch. Watches must breeze through a progression of tests spread out in ISO 6425, to acquire the privilege to print the words “DIVER’S WATCH” working on this issue. Any watch bearing this checking will have fulfilled the ISO 6425 testing technique that is an uncommon sort of certification that the watch will hold up under submarine conditions.

The primary test in the ISO 6425 technique is a buildup test. The test includes warming a plate to around forty to forty five degrees centigrade, the watch is then set on the plate and left for a time of ten to twenty minutes. Over this period the watch will warmth up to this particular temperature. Onto the watch’s precious stone face, a drop of water at room temperature is set and left for one moment and after that cleared off.

In the event that there is any buildup seen to shape underneath the gem face, at that point the watch comes up short the testing. No further testing is directed starting there on.

Another test in the system necessitates that watches be tried at profundities that are 25% beneath their evaluated profundity in still water conditions. Slight climate varieties can make the thickness of seawater vary from somewhere in the range of two and five percent and it is likewise settled by science that seawater is denser than new water.

Warm stun testing is likewise connected to the jump watch as a feature of the testing technique. The testing includes quick temperature changes. For a time of 60 minutes, the watch is first put in forty degree water, at that point when the time lapses, is quickly moved to five degree water. The watch is left for a further hour before being moved back to the forty degree water again for a last hour.

By a wide margin the longest test in the ISO methodology is to test the watch’s protection from the destructiveness of seawater and includes the plunging watch being submersed in thirty centimeter water for a time of more than two days. This is the reason most jumping watches are fabricated from hardened steel, titanium, plastics or earthenware production as these materials don’t rust.

Utilizing A Diver Watch Under Water

Jumping watches are additionally tried for the down to earth use of utilizing a games watch submerged. It is compulsory that all jumping watches have some system for monitoring the aggregate sum of time since the beginning of the plunge.

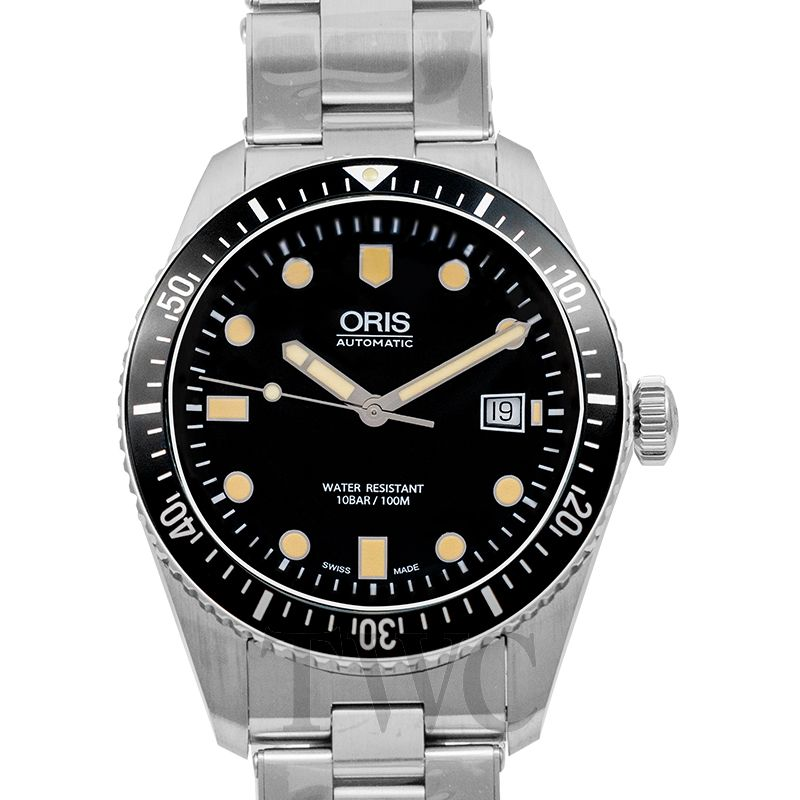

Most simple plunging watches utilize a unidirectional pivoting bezel to track jump length, the bezel must be turned one path and as a feature of the standard is required to have unmistakable markings at five moment interims and a size of an hour. The watch is required to have its 60/0 moment imprint be decipherable at twenty five meters beneath the surface and the perusing of the time intelligible itself. Simple plunging watches accomplish this with luminescent watch hands, while most advanced jumping watches execute this with an illuminated oris divers sixty-five watch screen.

Jumpers watches should likewise demonstrate that they are working, both at 25 meters and in complete murkiness. Simple watches have a running second hand with luminescent tip. At the point when the battery runs out they should introduce an “EOL” (end of life) pointer.

Jumpers watches are among the most thoroughly tried games watches on the planet, which means a decent one will probably last you for a long time and be totally sheltered to use in and around seawater, regardless of whether you are scuba jumper or not.