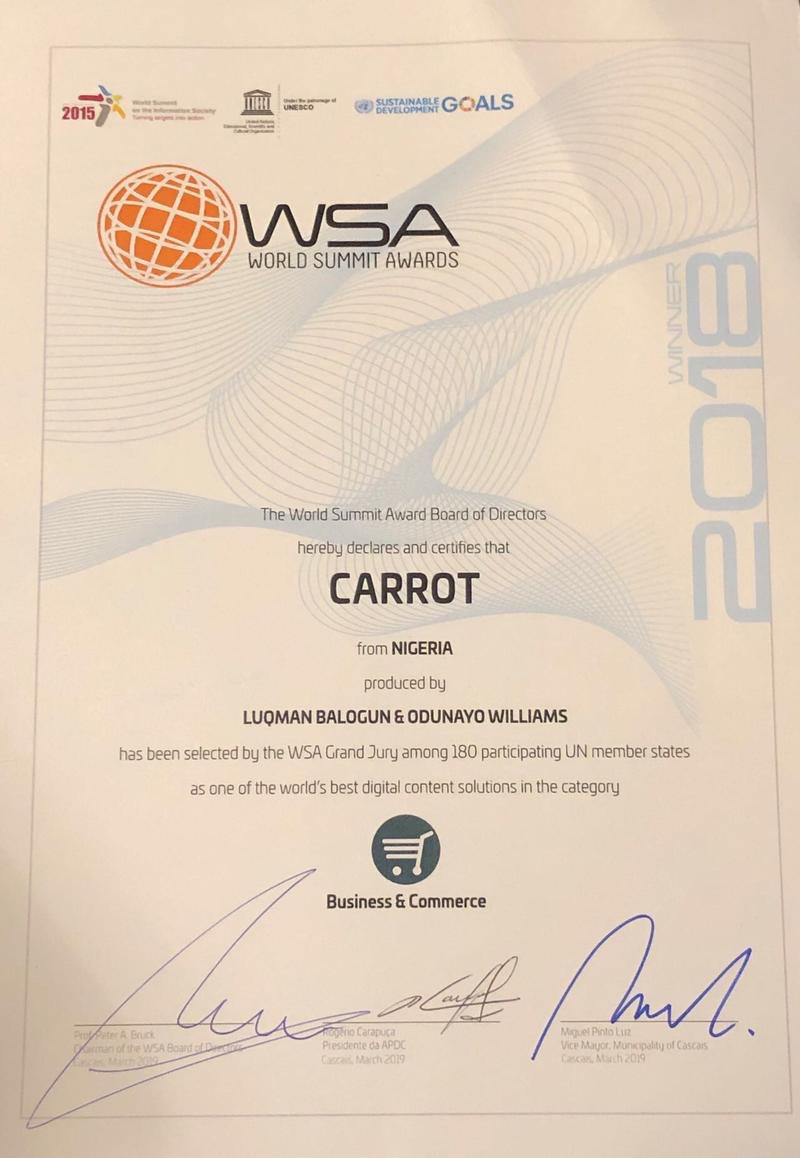

They have won the World Summit Awards for Nigeria as the best digital content solution in business and commerce. They are using digital technologies to solve centuries-old problem in Nigeria by deploying software to “eat” the world of Will making. Carrot is an online service that helps people to plan their estates. In other words, Carrot provides tools which help users to create their wills, organize assets, and secure their financial future. Through the platforms, the rights of widows and broad family members of a deceased person are protected.

Carrot Advisory Limited, is a fintech company with special focus on helping families with innovative and affordable financial planning services. […]

Carrot.ng is our delivery platform and it is enjoyable, convenient and secure. Our Carrot app will be available soon and can be downloaded in google playstore and iOS App Store.

Our partners include Leadway Insurance, Royal Exchange Assurance Group and SendBox.

Nigeria has a low penetration of wills making. It is estimated that only about 5% of Nigerians write their wills. Simply, there is a huge market opportunity in this market if software can reduce the frictions and make more people prepare their Wills. That will reduce assets value-destructions which happen when descendants fight over assets. No wonder, UNESCO honored Carrot as an innovator for providing a platform to fix that friction.

“One of the challenges faced by Nigerians today is that of inheritance and estate planning. It is generally believed that the making of wills is an exclusive preserve of the rich but this is a false assumption. A recent study carried out by our team revealed that more men are writing wills than women.

It also showed that people 60 years and above or people working with organisations that insist on staff wills making are those writing their wills in Nigeria. We are trying to remove all barriers that prevent most families from getting the kind of legal and financial protection they need and deserve.”

According to the company, the platform enables testators to appoint guardians for their beneficiaries – spouse, siblings, children, aged parents or others. The testator can also appoint trustees, witnesses and executors. The goal of the whole thing is to eliminate the falsification of wills and the paralyses that come for a deceased person’s estate especially by family members.

“Carrot.ng helps families break through the perceived challenges of securing and protecting their families’ financial future. It overcomes the difficulty, costs, and isolation that most people experience while trying to complete essential legal and financial tasks.

Carrot.ng enables you to make a legal and valid will, purchase a health, life, travel and unemployment benefits insurance and organize your inventory of assets – in minutes and with just a click.”

How It Works

The company has provided a simple process for users to create wills in their platforms.

- We will ask you a few questions to determine your eligibility and help you create your Will. Our in-house legal experts are on hand to assist you through live chat and phone support.

- Our legal experts will check it and ensure it complies with applicable laws. We will be in contact with you through this process. You may be required to make changes to your Will.

- We will print, package securely and deliver 2 hard copies of your Will via DHL. Also, your witnesses will need to be there to sign your Will in your presence.

- Tell us where to save a copy of your Will. We can also help you keep a copy of your Will in our vault.

All Together

This is a brilliant product as explained by the Founder/CEO of Carrot Technologies Limited, Luqman Balogun.

“The unique social experience on Carrot.ng also makes it easy for users to invite family and friends to serve important future roles, encouraging transparent dialogue about hopes and expectations. Carrot guides users through these decisions, and makes them easy to change at any time, with just a click on their phones. It combines many of the tools used by the wealthy and makes them accessible and affordable to all families.

“Carrot is removing all barriers that prevents most families from getting the kind of legal and financial protection they need and deserve. We have made it enjoyable, convenient and secure for everyone to create a financial security plan and organize their assets easily by visiting our website ‘www.carrot.ng’.

“Families can finally take this off their perpetual ‘to do’ list – in a way that is social, and even enjoyable, right from the comfort of their homes, offices or on the road.”

Carrot.ng is powered by Carrot Technologies Limited, a financial technology firm with special focus on inheritance and estate planning. The Company has very distinguished and accomplished professionals on the Board and chaired by Prof M. T AbdulRazaq. Other directors are; Henry Laraiyetan, Odunayo Williams – Co-Founder/COO, Markie Idowu, Lawal Olarinoye, and Segun Afolahan.