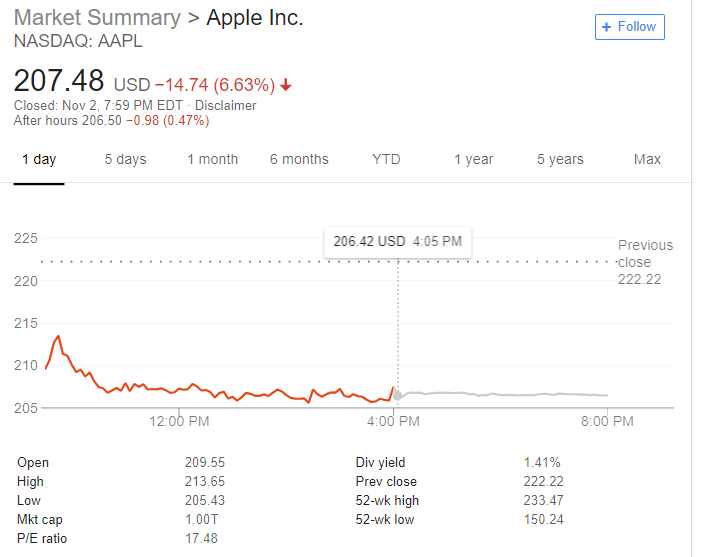

Apple reported a healthy 20% gain in revenue to almost $63 billion. Compared to Q3 in 2017, that was $10 billion growth. It did that growth by deepening cash-generating services and other things (think of Google paying fees to be default search engine in Apple products) while also getting more dollars per hardware (iPhone, iPad, Mac, etc) sold. The great numbers came despite largely no major growth in the number of iPhones sold when compared to last year. Of course, for Apple, that was not really important as the price of iPhone had jumped from $618 to $793 on average.Yes, it makes more money per unit.

Apple’s revenue rose 20% to $62.9 billion while net income came in at $2.91 a share. Both surpassed analyst estimates, which is often good news for investors. This time, however, the focus was put on Apple’s outlook, amid broader concerns that economic growth may slow down in coming quarters.

Largely, the company could continue to make more money even when it is selling lesser number of phones. From what is happening, I can see two things:

- The high cost of Apple hardware is pushing many people to extend the useful lives of their devices. Had it been cheaper, users might have upgraded.

- By Apple continuously jacking up the prices of its devices for better margins, it is making it harder to get new cohorts of buyers into the ecosystem.

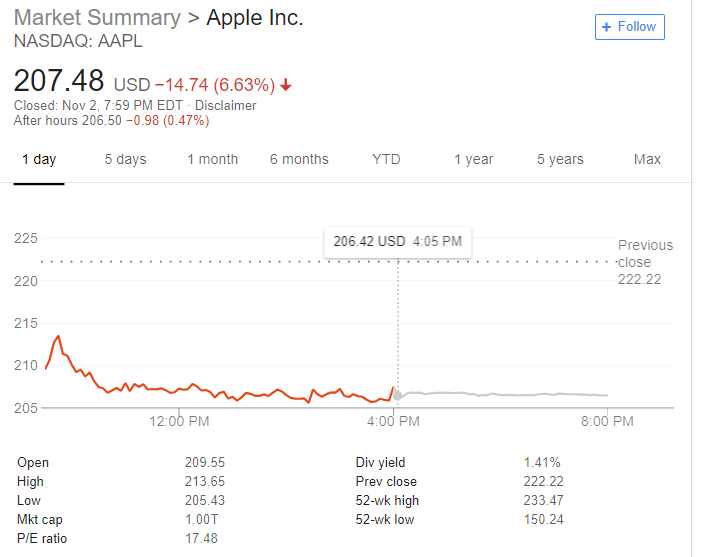

On average, these trends are negative for Apple: anything that declines the absolute number of iPhone sold is bad because even the services which are supporting higher revenue cannot grow without more people using iPhones since Apple services are exclusive to the hardware. Markets did not like the trajectory; Apple stock went down by 6.63%.

Apple stock value

Apple Withdraws

Apple plans to avoid reporting the number of its devices sold per quarter. No company does that when in the position of strength. Yes, Apple knows that it can extract more money per device even when selling lesser number of devices. Yet, not disclosing how many iPhones, iPads, etc it is selling does not make it look better.

[Apple] will stop disclosing how many iPhones, iPads, and Mac computers it sells every quarter. Thus, analysts will no longer be able to see trends in iPhone unit sales, calculate average selling prices, or discern other key trends.

[…]

Looking for more reasons why Apple will stop reporting iPhone sales? Third quarter global smartphone shipments decreased 6%, the fourth quarter in a row of shrinkage, Strategy Analytics reports. “The global smartphone market has now declined for four consecutive quarters and is effectively in a recession,” said Strategy Analytics director Linda Sui. Rival market forecasters at Counterpoint Research predicted yesterday that 2018 will be the first calendar year ever of smartphone sales declines.

(Fortune newsletter)

All Together

Apple will be fine and investors will align. Simply, the company is making it clear that its future is going to include services. So, if you hold Apple stocks because of iPhones and iPads, you may have to reconsider. By dropping the disclosure, Apple wants investors to focus on its revenue bottomline and not the number of devices sold. As far as the company is concerned, if it can grow revenue through payment, apps, licensing, etc, investors should not overly care what is happening on hardware as the company transmutes into making services a key part of its future. Simply, Apple has gone Services.

Apple has officially become a profit making machine: if units sales aren’t increasing, prices can as well go up, and the money keeps coming…

We live in a time where a mere ‘beautiful’ announcement from company’s CEO could add $50 billions to its stock value in one day, and when you misspoke – as high as $100 billion could be wiped off within 24 hours.

Interestingly, Apple is trying to shift the goalpost, something Elon Musk must be happy to hear. Some CEOs have complained about quarterly earnings reporting, on how it does not allow them to pursue long term strategic goals. Of course you hear these ‘complaints’ only when the forecasts are no longer favourable, so smart guys go ahead to change the narrative.

Apple is always smart, now it’s reengineering how it wants both analysts and investors to view its performances, no longer from the lens of hardware units sold; you can call it perception innovation, Apple is king at that…

Like this:

Like Loading...