Sears, a bankrupt American retail chain, was built on catalog – a fangled technology of its time. It was typical of industrial age business model: send the customers options on what they might need with no certainty on what they actually want. The discovery process was weak, defining the retailer with no sense to get insights at scale, quickly.

On Monday, Sears filed for bankruptcy—a long-expected development in the retailer’s long decline. Sears was once the Amazon of its day: the first “everything store.” Today it’s not worth much more than the real estate its stores sit on.

Like Amazon, Sears started with a single product—watches, in its case—and grew to offer virtually all the goods a growing consumer culture could ever need. In perhaps the one way Amazon hasn’t (yet) caught up, Sears even sold the homes to put those goods in, which have since become quite trendy. (QZ Newsletter)

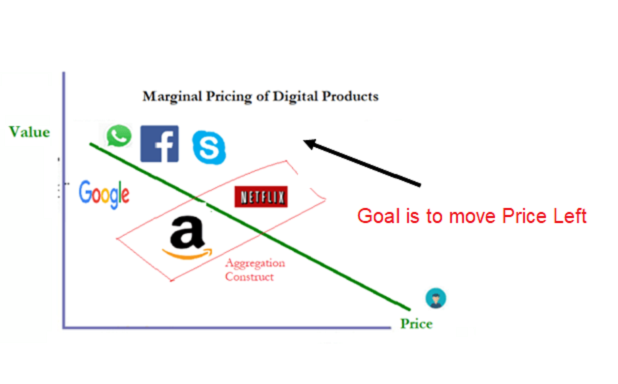

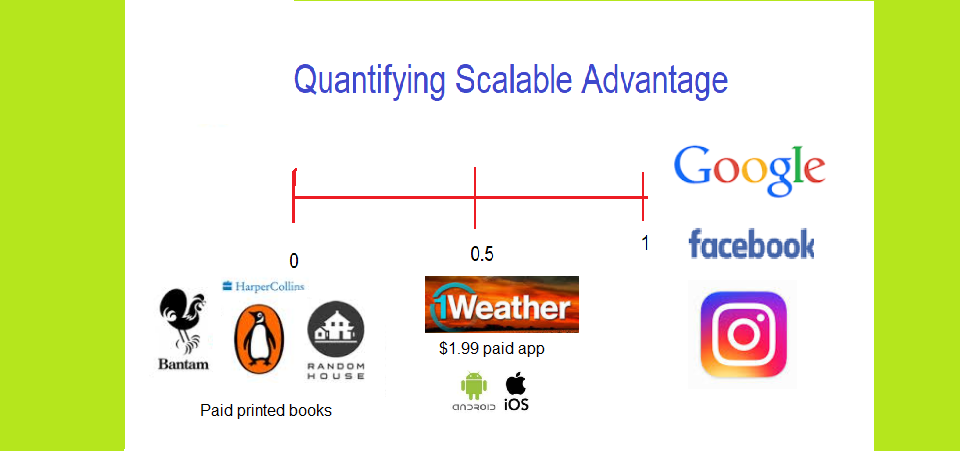

Amazon is built on search – a modern technology which is unconstrained and unbounded, only limited by the imaginations of the consumers. Search provides a window into possibilities, making it even possible that Amazon can see patterns on things it does not have in stock, and quickly respond to add them.

Search has velocity, catalog has only speed; no antenna for direction. Search enables Perception Demand which enables the acceleration of consumerism by rewiring the mindsets of users to a new domain which they might have never imagined. As customer tastes move, your business must adapt. You need the antenna to move in the right direction to make that happen. Yes, in the 21st century, you win with Perception Demand.

Yes, no matter what you do, you cannot catalog your customers. You need to find a way to help them discover the future in your ecosystem, and you must respond to WIN with them.