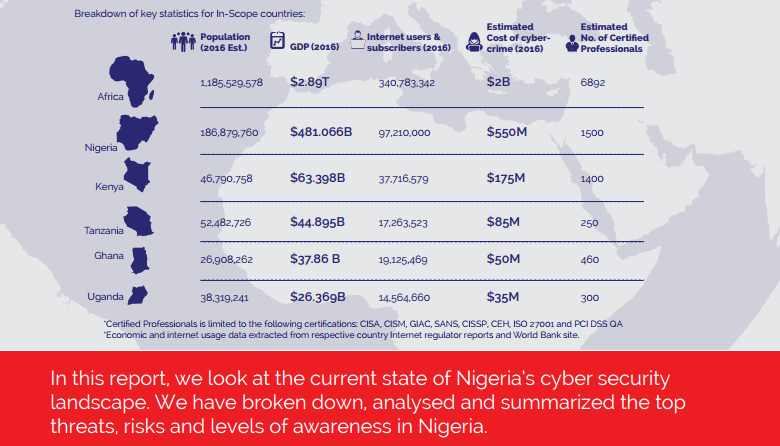

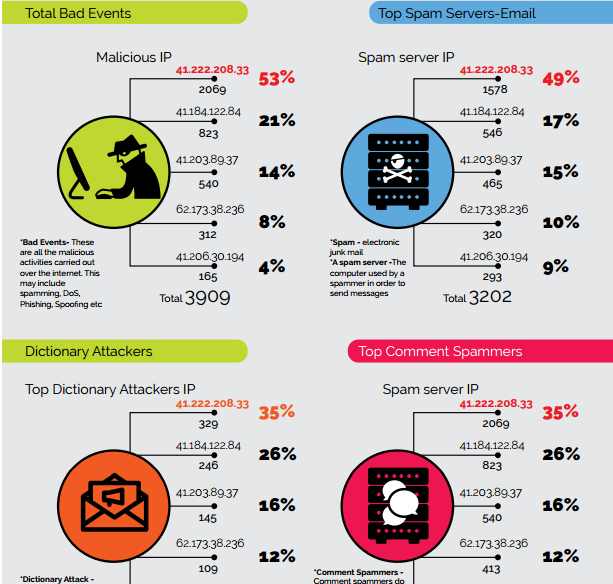

A Nigeria Cyber Security Report has been released. The report has also suggested various ways to mitigate the impacts of cyber-crimes which which cost Nigerian businesses a whopping $550 million in 2016.

The Nigeria Cyber Security Report 2016 was researched, analysed, compiled and published by the Serianu Cyber Threat Intelligence Team in partnership with Demadiur Systems Limited and the USIU’s Centre for Informatics Research and Innovation (CIRI), at the School of Science and Technology.

The estimated cost of cybercrime in Nigeria has soared to $550 million. This cost continues to grow as many organisations automate their processes. This is particularly so for the Ecommerce and financial services sector where the introduction of e-services has introduced new weaknesses that have allowed loss of money through these channels.

The increase in cybercrime in Nigeria can be attributed to the rising poverty levels, greed (on both the perpetrators and sometimes even the victims), easy access to gullible targets by the criminals and lack of adequate legal and regulatory polices to prevent and prosecute the perpetrators when identified.

Way Forward

Based on the research findings, most Nigerian organisations are ill-equipped to respond to information security threats. Although there are different initiatives (regulators, government and private organisations) in place set out to address information security issues in Nigeria, these initiatives cannot adequately address the current information security issues.

Public and private organisations need to rethink their whole approach to information security and establish security practices needed to protect critical IT infrastructure. They also need to train and grow security experts needed to secure this infrastructure. Most organisations now recognize that it is imperative that local organisations take action before the situation worsens and the cost of inaction becomes even greater.

The Roadmap

The challenges faced by Nigeria and in essence African countries, present great business opportunities for entrepreneurs, researchers and vendors. In order for us to stay ahead of the threat curve, we need to continually invest in research, build local cyber threat management infrastructure and enhance our ability to anticipate, detect, respond and contain information security threats.

In our current state, we are unable to build these capabilities. Nigerian entrepreneurs need to step up, work together to build and provide information security services that address these challenges. Nigerian entrepreneurs and researchers should leverage their local presence and understanding of the environment to provide a clear indication of the security problems on the ground.

This local presence combined with partnerships with global players will provide globally tested solutions and approaches to address identified security problems.

Training

The report noted the important of training and awareness. One of the organizations helping in that area is First Atlantic Cybersecurity Institute (Facyber) which offers programs in cybersecurity policy, technology, management and more.