The era of predictive farming is here in Africa. Computational algorithm could use data collected from IoT devices in farms to make location-based recommendations on fertilizer applications across farming zones, and this will be delivered through mobile devices, to stakeholders that subscribe. With this, we can make fertilizer use more effective in Africa. Welcome to the era where regional soil fertility chemistry drives pre-production of fertilizers.

Imagine if fertilizers sold in Ghana have to be different from the ones sold in Gambia because the two countries have different amounts, on averages, of nitrogen, potassium and phosphorus, in their farmlands.We want fertilizers to be packaged with the locations where they will be sold indicated on the bags. Why? The mix in the fertilizer has to be personalized specifically for the region it will be used. The era of dumb fertilizer application has to end in Africa immediately.

Read on why we think the future of farming in Africa is awesome!

Preamble

Low soil fertility, either as a result of soil degradation or inherent low soil fertility, is a major cause of low crop productivity in West Africa. Fertilizers can result in dramatic productivity increases. However, in most countries, commodity fertilizers dominate, which do not address soil and crop-specific nutrient requirements and soil acidity constraints, and thus often give poor returns on fertilizer investments. Much informaton is being generated through various initiatives in many parts of Africa, resulting in different but not necessarily similar or accurate fertilizer recommendations. Recently, the USAID West Africa Fertilizer Program (WAFP) compiled fertilizer recommendations for 10 crops across the agroecological zones (AEZ) of 8 West African countries and summarized them into the Fertilizer Recommendations for West Africa Map (FeRWAM). Approaches that lead to diverse recommendations need to be reviewed, and a more definitive, harmonized approach to delivering better fertilizers to farmers developed.

Roadmap

There is need to design a pathway to deliver fertilizer recommendations that will result in sustaining greater yields and returns on fertilizer investments, particularly for smallholder farmers. Important steps in this process include:

- Soil analysis and nutrient deficiency mapping on a macro scale to determine the extent and variability of nutrient deficiencies and soil acidity constraints

- Developing and validating soil- and crop-specific fertilizer and lime recommendations.

- In collaboration with fertilizer producers, blenders, and distributors, developing the means to deliver improved fertilizer products to farmers

- Addressing regulatory issues and policy constraints that may impede introduction of diverse fertilizer products into the market.

The importance and limitations of soil fertility testing and mapping needs to be understood. And an understanding of the steps in developing and delivering profitable fertilizer recommendations must be built into any roadmap. Then, an awareness of the multiple players involved in the process of developing and delivering improved fertilizer recommendations strengthened.

Strategic Projects

The following projects will help to drive a new dawn in soil testing and fertilizer recommendations in Africa.

- Soil testing and mapping – This covers the benefits and limitations of testing tools, including wet chemistry and spectral approaches, and mapping of soil nutrient deficiencies and acidity constraints as a first step towards developing profitable fertilizer recommendations. Approaches employed by FeRWAM, the ATT project, OFRA, and others must be updated.

- Developing and Validating Fertilizer Formulations – Information derived from soil testing and mapping nutrient and acidity constraints needs to be translated into fertilizer formulations, and those formulations validated before they can be considered as recommendations. Approaches including best-bet evaluations and nutrient omission trials (NOT trials) need to be pursued.

- Scaling up fertilizer recommendations – The fertilizer industry must ultimately manufacture, market, and distribute improved fertilizers and lime. Different fertilizer companies must have different strategies and products to address this. Fertilizer subsidy programs are also a means to getting better fertilizers to farmers, and require coordination with governments in development and evaluation of improved fertilizer products.

- Fertilizer policy and fertilizer regulations – Fertilizer policy and fertilizer regulations have in the past been designed for commodity fertilizers, and often do not facilitate the entry of better fertilizers into competitive markets. The importance of conducive fertilizer policy and regulations, with practical examples of progress, must be examined across Africa.

Zenvus Fusion

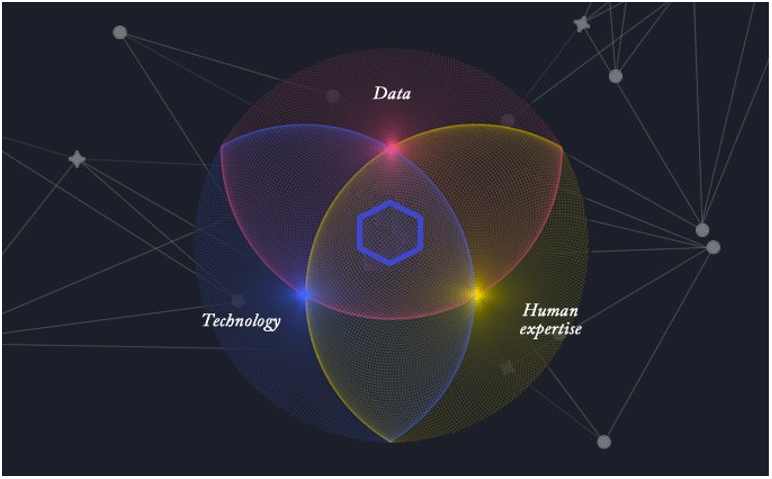

Zenvus Fusion is a service for governments and development organizations which is designed to help build Soil Fertility Geography in constituencies. It could be a state Soil Fertility Geography or even a National Soil Fertility Geography. We also support local governments.

Our product provides the data that makes it possible for farmers to understand the natures of the farmlands before they begin planting their crops. We do this by collecting many data samples to appropriately represent the soil fertility equivalence of that region or area.

The aggregated soil fertility data is made accessible for all stakeholders. The data is also GIS-tagged so that the exact locations of the soil are known.

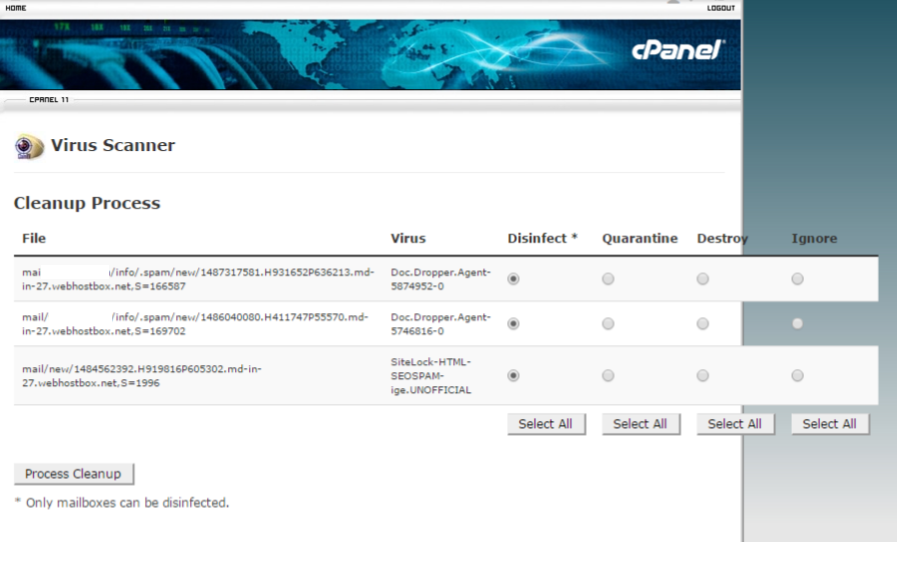

Computational algorithm will use this data to make location-based recommendations on fertilizer applications across farming zones, and this will be delivered through mobile devices, to stakeholders that subscribe.

Also, farmers can get predictive recommendations on the most economically viable crop to grow by feeding present crop prices, fertilizer cost, and population into the algorithm.

With this soil fertilizer geography, fertilizer production will become personalized

and specifically engineered to mitigate deficiencies with deployment regions known pre-production.

We welcome inquiries from governments, development organizations etc.