Locked down and boxed in, the tale of foreign investors.

Lockdown has created an opportunity where we least expected. As you are aware, Banks are one of the few active essential services allowed to operate, but none is working full time, they are mostly running skeletal activities including the CBN.

Talking about the CBN, they have gone skeletal for some time now and have stopped supplying dollars to BDCs since late March. Aside BDCs, they have muted their activities in the I & E FX market too.

The I & E FX window is for Investors and Exporters, it provides liquidity for investors who have invested in Nigeria and wish to repatriate their capital home in dollars.

Now that the CBN has muted its activities in I & E, and all other sources of dollar inflow into the country are also weak or locked – inflows from Foreign Portfolios are weak, oil money inflows from NNPC and IOCs are handicapped by declining oil prices and the inability of NNPC to find buyers for Nigeria’s crude oil even at ridiculously cheap prices.

As a result of the tight flow of dollars created by the challenges above, it’s almost a tale of nowhere to run for foreign investors, their funds are boxed-in. So, it is a case of I have sold my shares but can’t find dollars to take my money back home, rather than leave my cash idle, let me make a re-entry into the market, after all, most stocks are cheap. Local Investors aren’t taking a back seat either, they are riding on the back of low prices to take positions in the market too. Add the tale of foreign investors and the bargain-hunting appetite of local investors, what you have is a bullish market on a bullish run.

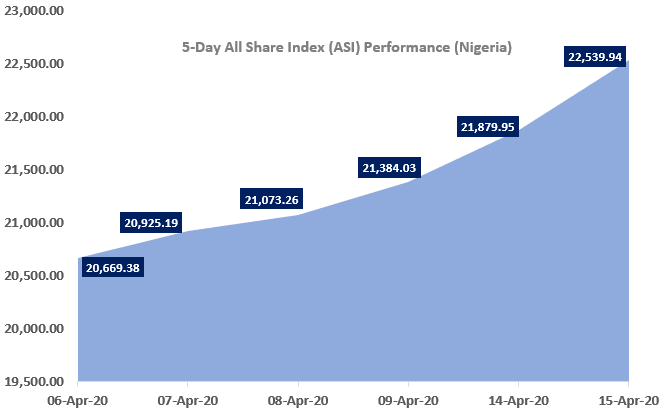

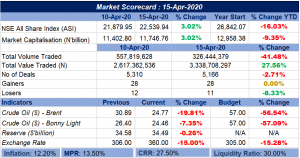

Today, the ASI appreciated by 3.02% to extend its bullish run to 5 consecutive trade days, and abate the year-to-date loss of the Market to 16.03%. For the records, this is the second-largest single-day gain of the Market this year. Today’s gain also marks the second-longest run the Bulls have had this year.

See the image below for a complete snapshot of market performance.

Click on the link https://bit.ly/2XrvIf9 to open a stockbroking/share purchase account and trade within 24 hours.

Talking about the CBN, they have gone skeletal for some time now and have stopped supplying dollars to BDCs since late March. Aside BDCs, they have muted their activities in the I & E FX market too.

The I & E FX window is for Investors and Exporters, it provides liquidity for investors who have invested in Nigeria and wish to repatriate their capital home in dollars.

Now that the CBN has muted its activities in I & E, and all other sources of dollar inflow into the country are also weak or locked – inflows from Foreign Portfolios are weak, oil money inflows from NNPC and IOCs are handicapped by declining oil prices and the inability of NNPC to find buyers for Nigeria’s crude oil even at ridiculously cheap prices.

As a result of the tight flow of dollars created by the challenges above, it’s almost a tale of nowhere to run for foreign investors, their funds are boxed-in. So, it is a case of I have sold my shares but can’t find dollars to take my money back home, rather than leave my cash idle, let me make a re-entry into the market, after all, most stocks are cheap. Local Investors aren’t taking a back seat either, they are riding on the back of low prices to take positions in the market too. Add the tale of foreign investors and the bargain-hunting appetite of local investors, what you have is a bullish market on a bullish run.

Today, the ASI appreciated by 3.02% to extend its bullish run to 5 consecutive trade days, and abate the year-to-date loss of the Market to 16.03%. For the records, this is the second-largest single-day gain of the Market this year. Today’s gain also marks the second-longest run the Bulls have had this year.

See the image below for a complete snapshot of market performance.

Click on the link https://bit.ly/2XrvIf9 to open a stockbroking/share purchase account and trade within 24 hours.

Market Breadth: The breadth of the market remained strong today as the Bulls maintained their hold on the market for the sixth day running, 28 stocks appreciated as against 11 that depreciated. ZENITH and NEIMETH led the gainers’ chart, while ARBICO and WEMABANK led the losers chart. See the list of top gainers or losers below:

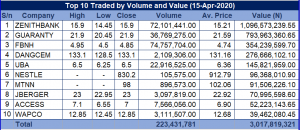

Market Turnover: ZENITH and GTB led the most traded stocks chart in volume and value. See top 10 traded stocks below:

Have a great evening.