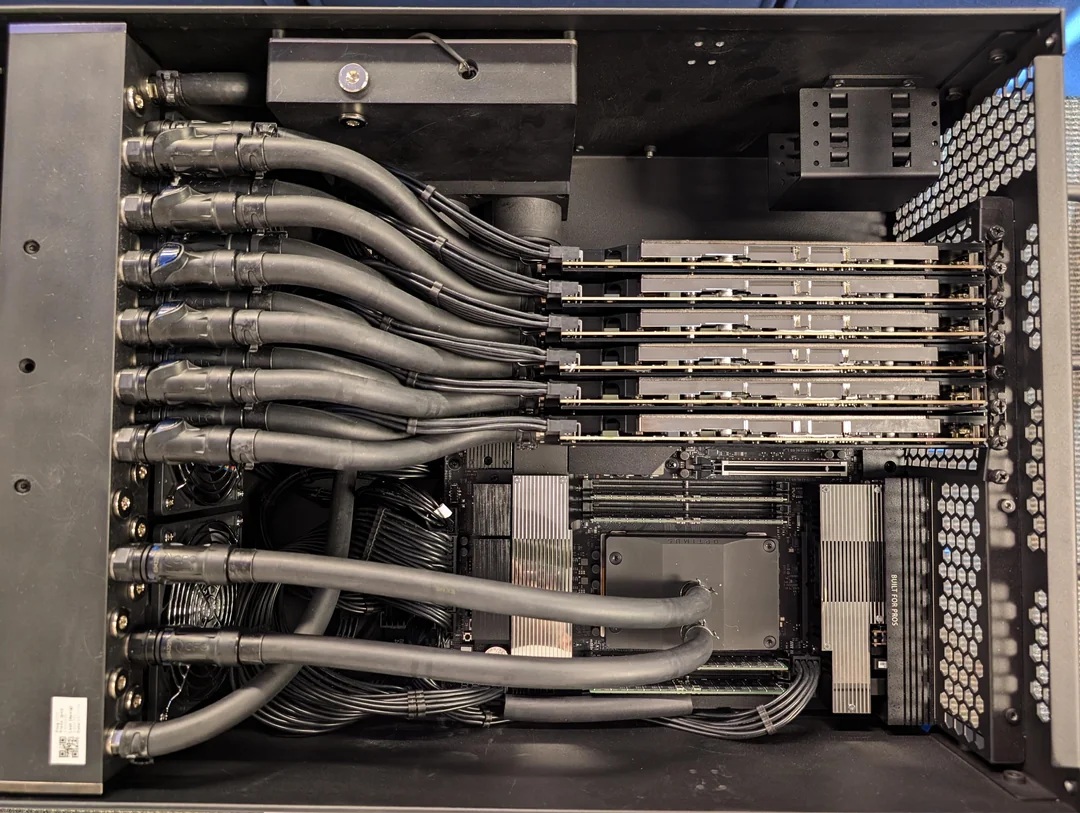

What started as a frenzy over insatiable demand for AI chips think Nvidia’s meteoric rise on the back of GPU shortages has morphed into acute anxiety over whether the power grids can keep up with the data centers gobbling up those chips.

By late 2025, the narrative has flipped: chip supply chains are stabilizing thanks to massive investments from TSMC, Intel, and others, but energy constraints are emerging as the real bottleneck, threatening to cap AI’s explosive growth.

Early 2024-early 2025 worries: Markets were laser-focused on demand outstripping supply for advanced semiconductors, especially Nvidia’s H100 and Blackwell GPUs.

Hyperscalers like Microsoft, Amazon, and Google were queuing up billions in capex, driving Nvidia’s market cap past $3 trillion at its peak. Fears of a “chip famine” dominated earnings calls and analyst reports.

As fabs ramped up like TSMC’s Arizona and Taiwan expansions hitting full stride, supply eased. Global semiconductor capacity grew ~15% YoY, per SEMI data, outpacing even AI-driven demand forecasts. Now, the chatter is about overcapacity risks if AI hype cools—echoing the 2022 crypto bust.

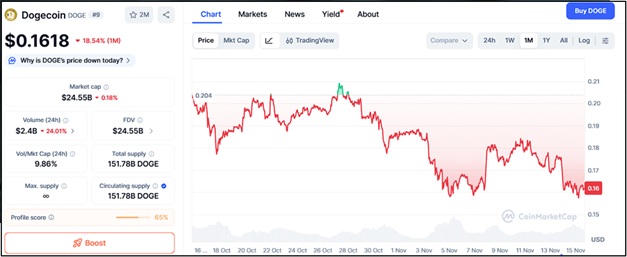

Nvidia itself dipped 10% in Q3 2025 on whispers of softening enterprise orders. The real plot twist is power. AI data centers aren’t just hungry for chips; they’re voracious for electricity—training a single large language model can guzzle as much as a small city’s annual usage. Goldman Sachs now forecasts global data center power demand surging 165% by 2030 from 2023 levels, hitting 92 GW by 2027 alone.

In the US, it’s set to account for nearly half of all electricity demand growth through 2030, outpacing manufacturing sectors like steel and cement combined. This isn’t abstract: utilities filed for $30 billion in rate hikes in H1 2025 to cover grid upgrades, passing costs to households and small businesses.

Data centers consumed 26% of Virginia’s electricity in 2023; by 2025, states like Iowa (11%) and Oregon (11%) are hitting similar walls. In PJM’s market serving 13 states, they drove a $9.3 billion capacity price spike for 2025-26.

Transmission delays—tied to permitting, supply chains, and NIMBYism—mean new capacity lags demand by 3-5 years. An October 2025 Sunrun survey found 80% of Americans fretting over AI-driven bill hikes, with 60% more concerned than excited about the tech.

Water scarcity is another flashpoint: cooling systems in arid spots like Georgia are prompting 33% rate jumps. Big Tech’s 2025 capex hit $370 billion (Microsoft, Alphabet, Meta, Amazon), but ROI is questioned if power shortages delay rollouts.

OpenAI’s 10 GW data center pact with Nvidia? It needs NYC’s summer peak load—good luck securing that amid blackouts. Stocks like Constellation Energy tanked 20% in January on feasibility doubts. AI training/inference boom; hyperscaler capex.

Grid capacity limits; $580B global data center spend in 2025. Double to 100 GW by 2028; 2% of global electricity by 2030. Geopolitical (e.g., Taiwan tensions); overbuild if AI plateaus. Rate hikes, $30B US in H1 2025; fossil fuel reliance worsening emissions.

Markets aren’t panicking yet—data center vacancy rates plunged to 6.6% globally in Q1 2025, signaling demand’s still red-hot—but the energy wildcard could trigger volatility. Expect more M&A in utilities and a nuclear renaissance.

Microsoft and others inked deals to restart plants like Three Mile Island, while small modular reactors (SMRs) could deliver 300 MW per site by 2030. They’re 90% of queued projects, but intermittency means gas/coal bridges the gap, clashing with net-zero goals.

Efficiency gains via Nvidia’s GB200 chips hitting 130 kW/rack densities might shave 20-30% off demand, but not enough to dodge the crunch. In short, chips were the accelerator; energy’s the brake.

If grids don’t scale and policy helps—Trump’s pro-build stance could fast-track permits but tariffs hike costs, we might see AI growth throttled, hitting semis harder than expected.

Bullish on utilities and nuclear plays, cautious on pure chip bets. What’s your take—energy the ultimate AI limiter?