The Goats in the game of Finance

On April 14, 2022, it was announced that Tesla and SpaceX CEO Elon Musk will start to acquire Twitter. This acquisition is a game-changer for the world of WEB3 and memecoins. Let’s take a closer look at what this means for the community. CZ Binance made a hefty investment in the Twitter deal banking $500,000,000, wow this is huge for all of you web3 crypto lovers out there. So What is all the fuss about over Sam Bankman-Fried and did CZ Binance cause his demise?

The Tweet What caused Toon Finance to go viral?

CZ Binance was a friend of Sam Bankman Fried, both gentlemen are owners of Cryptocurrency exchange sites that bank millions and billions of dollars in per year. These two gentlemen are very wealthy and well known in the crypto industry. This is one of the most prominent and iconic moments for crypto and the future of centralized exchanges.

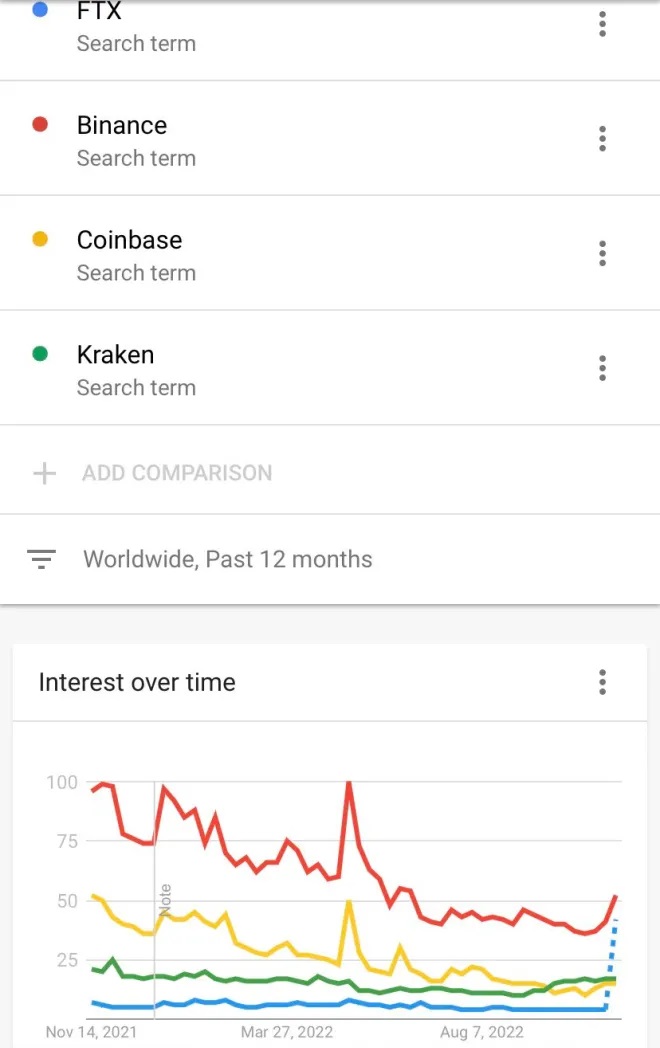

CZ Binance founded and owns what is known as the Binance Exchange, the world’s leading crypto exchange by volume and users. CZ Binance heard that Bankman-Fried’s FTX exchange was having some issues with their LP which is basically the nuts and bolts of the entire business.

Without the liquidity to back it there would be no actual funds for its users to cash out and technically those are the user funds for the most part. It is similar to running a bank, in reality the bank borrows its clients money and pays it back to them when they wish to withdraw it and if the bank does not have the money then insurance pays the customer.

This is very rare and only happens when a bank goes completely bankrupt. Is this the case for Sam Bankman-Fried? Is he and his FTX exchange going bankrupt? That seems to be the word on the street as he scrambles to find over 2 Billion in user funds. This caused the exchange to crash and users are now flocking to decentralized exchanges like Toon Finance.

What is WEB3?

WEB3 is the third generation of the World Wide Web. It is a decentralized network that allows users to interact directly with each other without the need for intermediaries. This new generation of the internet is powered by blockchain technology and decentralization. With WEB3, users have more control over their data and are able to interact with each other in a more secure environment.

What are Memecoins?

Memecoins are digital tokens that can be used to purchase goods and services on the WEB3 platform. They are similar to traditional cryptocurrencies but have additional features that make them more suitable for use on the WEB3 platform. For example, memecoins can be used to reward content creators on WEB3 platforms. This incentivizes content creation and helps to grow the WEB3 community.

What Does This Mean for the Community?

The acquisition of Twitter by Elon Musk is a huge win for the community of WEB3 and memecoins. With Twitter, Musk now has access to a large audience that he can use to promote WEB3 and memecoins.

This will help to increase awareness of these technologies and grow the community even further. Additionally, Twitter is already integrated with many popular blockchain projects, which will make it easier for Musk to promote WEB3 and memecoins on this platform.

Elon Musk’s acquisition of Twitter is a big deal for the community of WEB3 and memecoins. With Twitter, Musk now has access to a large audience that he can use to promote these technologies.

This will help to increase awareness of WEB3 and memecoins and grow the community even further. Additionally, Twitter is already integrated with many popular blockchain projects, which will make it easier for Musk to promote WEB3 and memecoins on this platform.

Top 3 Memecoins to Invest in this Year

Dogecoin: The Classic & Original

Dogecoin is a cryptocurrency that was introduced in 2013. It was inspired by the “doge” meme that was popular at the time. Dogecoin quickly gained popularity due to its low price and friendly community. However, Dogecoin may be in trouble due to its old blockchain technology.

What is Dogecoin?

Dogecoin is a cryptocurrency that was created as a joke in 2013. It was inspired by the “Doge” meme, which featured a Shiba Inu dog. Dogecoin quickly gained popularity due to its low price and friendly community. However, Dogecoin may be in trouble due to its old blockchain technology.

Dogecoin’s Popularity

Dogecoin was created as a joke in 2013 but it quickly gained popularity. As of January 2021, Dogecoin has a market capitalization of $1.2 billion and is the 35th largest cryptocurrency. Dogecoin’s popularity is due to its low price and friendly community.

The Problem with Dogecoin

However, Dogecoin may be in trouble due to its old blockchain technology. The Dogecoin blockchain is based on Litecoin, which itself is based on Bitcoin. This means that Dogecoin is behind both Bitcoin and Liteoin when it comes to adopting new technologies.

For example, Bitcoin has already adopted Segwit, while Liteoin is currently testing Segwit. This puts Dogeoin at a disadvantage because it will take longer for new technologies to be adopted by the currency.

Dogeoin is a popular cryptocurrency that may be in trouble due to its old blockchain technology. The currency is based on Litecoin, which itself is based on Bitcoin. This means that new technologies will take longer to be adopted by Dogeoin. Although the currency has a friendly community and low price, this may not be enough to keep it afloat in the long term unless it can modernize its technology.

Shiba Inu: The “Sister” Project of DOGE

Shiba Inu is a cryptocurrency that was created in August 2020. It is a fork of the popular Dogecoin and itself is based on the Ethereum blockchain. The token was created with the intention of being used as a meme coin but has since gained popularity among investors and traders. However, Shiba Inu may face challenges in the future due to its reliance on old blockchain technology.

What is Shiba Inu?

Shiba Inu is a cryptocurrency that was created in August 2020. It is a fork of the popular Dogecoin and itself is based on the Ethereum blockchain. The token was created with the intention of being used as a meme coin but has since gained popularity among investors and traders. However, Shiba Inu may face challenges in the future due to its reliance on old blockchain technology.

The name “Shiba Inu” comes from the Japanese breed of dog of the same name. The face of the Shiba Inu dog is featured on the coin’s logo. As of May 2021, there are over 10 billion SHIB tokens in circulation with a total market capitalization of over $6 billion.

How Does Shiba Inu Work?

Shiba Inu works similarly to other cryptocurrencies like Bitcoin or Ethereum. Transactions are recorded on a public ledger called a blockchain. blockchains use cryptography to secure transactions and prevent fraud. Each transaction is verified by nodes on the network before it is approved and added to the blockchain.

However, unlike Bitcoin or Ethereum, which use proof-of-work (PoW) consensus algorithms, Shiba Inu uses a proof-of-stake (PoS) algorithm. This means that users can earn rewards for holding SHIB tokens in their wallets instead of mining them like PoW coins.

SHIB tokens can be used to purchase goods and services online or traded on cryptocurrency exchanges like Binance or Huobi Global for other digital assets like Bitcoin or Ethereum.

What’s Next for Shiba Inu?

While Shiba Inu has been successful so far, it faces some challenges in the future. One obstacle it will need to overcome is its reliance on an old blockchain platform like Ethereum. While this gives SHIB some existing infrastructure and developer support, it also exposes it to potential problems down the line if Ethereum experiences any issues or decides to change its roadmap in a way that doesn’t mesh with Shiba Inu’s goals.

Another thing to keep an eye on is transaction fees; because SHIB transactions are processed on Ethereum’s network, they are subject to Ethereum’s high gas fees which could make using SHIB impractical for small purchases down the road.

Overall, I think Shiba Inu has some potential despite its challenges. I like that it has low transaction fees and that it can be used to buy goods and services online. I think its reliance on Ethereum could be problematic though so I’ll be keeping an eye on how that develops. Are you holding any SHIB? Let me know your thoughts in the comments!

Toon Finance Cooks up a new DEX swap for it’s users

Toon Finance, a relatively new player in the DeFi space, has already shown great promise with the successful conclusion of their stage 1 presale. Now that they are entering stage 2, the team’s main focus is on marketing and getting the word out there with an aggressive plan to put up 70 billboards. But they are not neglecting their product development side, making sure that their goal is to create the best protocol in all of WEB3.

Toon Finance’s Road to Stage 2

Toon Finance’s journey to stage 2 started with a very successful stage 1 presale, which showed that there is definitely demand for their product. Now that they are entering stage 2, the team’s main focus is on marketing and getting the word out there with an aggressive plan to put up 70 billboards.

Additionally, they are also continuing to work hard on the product development side to make sure that their protocol is the best in all of WEB3. By doing this, they hope to achieve mainstream adoption and become the go-to protocol for dapps and DeFi projects.

Toon Finance also announced that they will be purchasing the Billboard that lies directly across the street from $50 Billion Dollar Twitter Headquarters. That is right, you heard it correctly, they will be getting one of the most iconic billboards in the world.

This is huge progress for the new ICO that is still in pre sale phase 2 shooting for a whopping 25 million USD.

DeFi dominance

With so many projects gunning for a slice of the DeFi pie, it is becoming increasingly difficult for any one project to stand out from the rest. This is where marketing comes in. Toon Finance recognizes that in order for them to become the dominant player in WEB3, they need to get exposure for their project and let people know about what they are creating.

That is why their main focus right now is on putting up 70 billboards across key cities around the world. Additionally, they are also active on social media and are working on building strategic partnerships with other projects in the space.

Toon Finance is definitely a project to watch out for in the coming months. With a strong focus on marketing and product development, they are well positioned to become one of the top protocols in WEB3. Be sure to follow them closely as they continue their journey towards DeFi dominance!

Investors are understandably bullish on meme coins due to their recent success. For example, Dogecoin has seen its price increase by 800% since January 2021. And Shiba Inu’s price has increased by 3,700% since January 2021. Given the current investing environment, it’s not surprising that investors are flocking to meme coins in droves.

If you’re looking for an investment with high potential upside, you may want to consider investing in meme coins like Dogecoin, Shiba Inu, or Toon Finance. While there’s no guarantee that these coins will continue to outperform other investments in the future, they have shown remarkable growth so far and could continue to do so for years to come.

To participate in Toon Finance’s presale, here are the links below:

Website: https://toon.finance/

Presale: https://buy.toon.finance/

Twitter: https://twitter.com/ToonSwapFinance

Telegram: https://t.me/ToonSwapFinance

CoinMarketCap: https://coinmarketcap.com/currencies/toon-finance/

DEX SWAP : https://swap.toon.finance