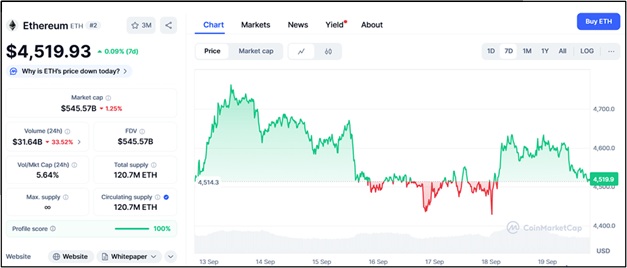

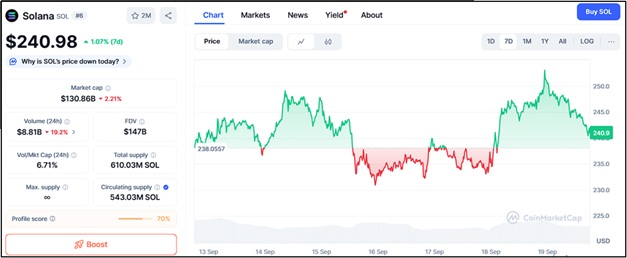

Ethereum is a key player among the world’s top blockchain projects by offering smart contracts for thousands of dApps. In fact, whenever crypto conversations about the adoption are held, Ethereum is almost always mentioned. Some findings indicate that its coin value might have a considerable rise in the next few quarters. The thing is that Ethereum is also struggling to grow.

For example, growing transaction fees, periods with network congestion, and the arrival of other chains like Solana have already caused some worries on how to expand. For the average user of banking, Ethereum is frequently so complicated that it is not considered a complete solution by itself.

This is the point where Digitap becomes the key player. Branded as the world’s first omnibank, DigiTap simply means that one live platform can serve users with both crypto and fiat.

DigiTap Enters as the Omnibank

DigiTap is a fully-fledged financial service for ordinary people. With a customer’s single account, banking operations can be done in any manner. For example, activities like funds deposited in local currency, crypto holding, and sending money anywhere in the world can be done easily.

The platform is not only user-friendly but also automatically converts funds at the best rate through its Smart Exchange Engine. This example of modern but straightforward banking is what allows DigiTap to be recognized beyond the pack when it is compared directly to Ethereum. This is because Ethereum needs third-party apps and many steps to get the same results.

DigiTap is not only about banking on the move. It brings privacy at the highest level for an offshore banking option. In the case of Ethereum, its ETH is used for gas, and it inflates with staking rewards. However, the $TAP is deflationary by default. The fees are generated in every transaction on DigiTap, and 50% of these profits are used to purchase $TAP from the market and burn it very permanently. This leads to a reduction in the amount over time, thus increasing scarcity along with the adoption.

Ethereum vs. DigiTap: Different Paths

While the core of DigiTap is directly tied to its $TAP token, $ETH is designed as a store of value and a base asset in the crypto space. It is often compared to “digital gold” rather than “deflationary gas.” Besides, every transaction fee is distributed among the node validators as an incentive. DigiTap does exactly the opposite. They mint a fee equal to 50% of the base-layer fees, then use half of those tokens to buy DigiTap off the market.

A decentralized network is the backbone of Ethereum for smart contracts, but it is sometimes limited with network congestion, high fees, and slow updates. On the other hand, DigiTap is a fully-audited and compliance-first project with a live app. A regular-use-first model is what sets DigiTap apart and gives the confidence to the investors beyond mere speculation.

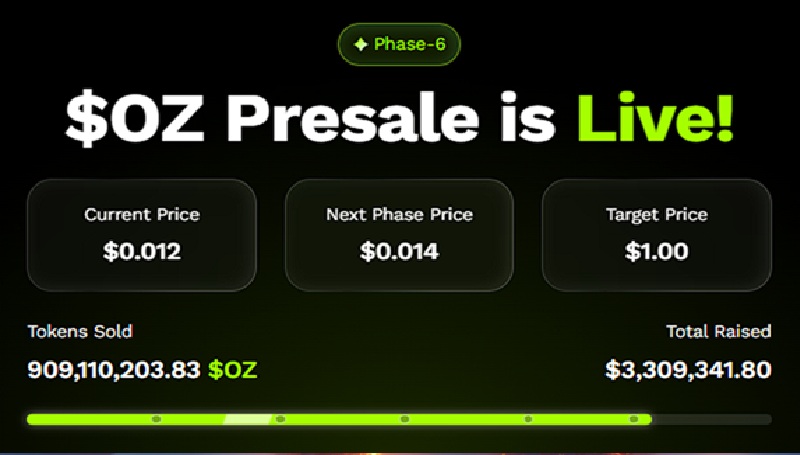

At the moment, the price of $TAP is just $0.0125 which clearly shows a promising entry point for the investors. In fact, the presale has already raised more than $100,000 in a few days. So, the trend is very strong.

Conclusion : Best Cryptocurrency to Invest in 2025?

Ethereum will go on to be a strong hologram among the power players of the world of blockchain tech. The way in which it sets itself up as infrastructural is incomparable and will continue tracking usage in the overall crypto market, making it in the long run more valuable.

But, when it comes to the question of which banking solution is superior, DigiTap is leading thanks to its ability to help customers make easy transitions from crypto to fiat and back in a user-friendly daily manner. DigiTap is the one that finally brings privacy, accessibility, and a deflationary token model in an all-in-one platform.

To those pondering about the next massive venture, Ethereum is still a safe long haul investment, but DigiTap is a genuine, functioning product that is already popular in the mass market. In the banking competition, DigiTap seems to be the one that is better placed to win the race and come out on top first.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale https://presale.Digitap.app

Social: https://linktr.ee/Digitap.app