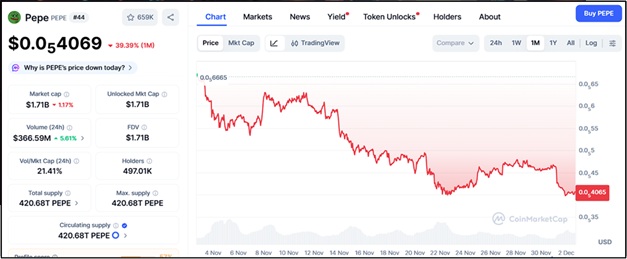

This week, Bitcoin accomplished a significant rally, essentially surpassing the $105,000 mark, and the whole crypto market got kind of lit because of that. Little Pepe, a Layer 2 blockchain combining fast transactions with meme culture, is benefiting from this trend. Large investors entering the market are driving prices higher, prompting interest in similar altcoins and early-stage opportunities. For investors seeking to spread their risk away from BTC, here might be the next turn in the journey of tokens like Little Pepe, TRX, and SUI.

Frogs with Power: Little Pepe’s Meme Kingdom

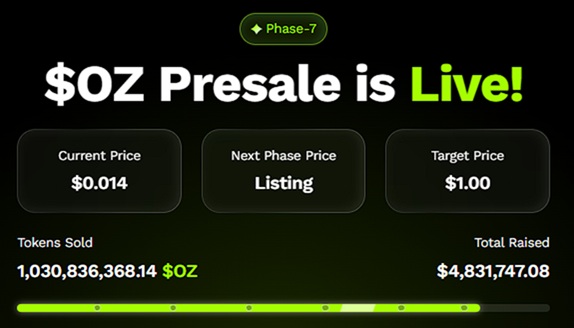

Little Pepe is making waves with its Layer 2 network designed for speed and ultra-low fees. Currently in Stage 13 of its presale, 1 LILPEPE trades at $0.0022, with nearly $27.6 million raised out of the $28.7 million goal. The presale has sold over 16.7 billion tokens, leaving only a fraction for new buyers. With whales now showing interest, Little Pepe could see accelerated demand as early backers secure positions before the next price jump. The ecosystem is built on security, with a CertiK audit scoring 95.49%. This gives investors confidence that $LILPEPE smart contracts are robust and safe. Besides being secure, Little Pepe has been giving back to its buyers through a series of giveaways, in which more than 15 ETH in prizes were included. Additionally, the coin has no trading tax, allowing users to benefit from staking rewards and from marketing efforts that will attract many social media users through memes, videos, and influencer collaborations.

TRX Gains Quiet Strength While Market Dips

TRON(TRX) has shown impressive resilience amid BTC’s rally. Currently around $0.29, TRX has maintained relative stability while other major coins struggle. Its liquidity heatmap suggests upside clusters above $0.30, pointing to a potential sweep higher. Analysts note that the market is quietly absorbing dips, making this a possible accumulation opportunity for whales. Technical setups on TRX hint at bullish momentum. An inverse head and shoulders pattern is forming, supported by a long-term ascending trendline near $0.28 to $0.30. The pattern indicates that continuation is favored if buyers hold this support zone. Even amid volatility, TRX remains green while the broader market turns red, suggesting strong rotation into defensive assets that could reward patient investors.

SUI Navigates Critical Levels

SUI is trading near $1.75, approaching key support zones after a period of consolidation. The token’s descending triangle pattern has tested traders’ patience, but the ecosystem shows signs of strength with active transaction volume and utility integration. This makes SUI a candidate for strategic accumulation while waiting for confirmation of a breakout above resistance levels. According to the charts, SUI seems to have been operating within a specified channel, decreasing its highs slowly. Early oversold conditions are indicated by RSI and MACD figures, suggesting a potential turning point. Traders consider $1.75 as the turning point, with short-term goals of $1.80 and $1.88.Whales could use this compression phase to position themselves ahead of a wider market recovery.

Layered Momentum in a Bullish Crypto Week

Altcoins, such as Little Pepe, TRX, and SUI, are benefiting from the recent BTC rally that surpassed $105,000. These three tokens have different stories unfolding: Little Pepe is a rapidly popularizing meme token, TRX is strengthening its position by defensively providing liquidity, and SUI is a token whose price is showing signs of consolidation and a possible breakout. Investors looking to diversify their portfolios with high-risk assets might consider these tokens as their next step, provided they also manage their entry timing properly. The market is expected to behave like a combination of FOMO, whale accumulation, and cautious optimism this week. The rise of Bitcoin is a reason for market optimism. Altcoins remain highly volatile, rewarding only well-positioned investors. Monitoring liquidity zones, structural supports, and presale progress is key to managing risk and capturing early opportunities.

Conclusion: Your Next Steps

If you liked those memes and if you are a Little Pepe fan, the Little Pepe presale is still going on for $0.0022 per token, which is a chance to get in early before the last rounds shut. Buyers willing to invest can also be active in daily community discussions, receive updates, and enter giveaways by joining the Little Pepe Telegram group. This is an ideal time for investors to position themselves strategically across promising tokens as whales push Bitcoin to new highs. At the same time, the altcoin market responds with opportunities for early adopters.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

$777k Giveaway: https://littlepepe.com/777k-giveaway/