Last month in Harvard Business Review, I shared a small window on how I examine companies. I am proud that more companies and people are using the One Oasis and Double Play Strategies. More than five VCs have reached out and like a happy village boy with blessings, one paid me $$ to explain the constructs deeper. When I look at companies, I examine its momentum (in physics, mass x velocity). A company must have velocity (not just speed) which is speed with direction to become exciting to me.

As I noted when I wrote on Flutterwave, I explained that except Zenith and GTBank in the Nigerian Stock Exchange, that its $1 billion valuation was more than any of the trading banks there, using N480/$ black market rate. A commenter disputed the basis of that call; I responded thus, using Access Bank.

- UBA – N239 billion

- Access – N275.475B

- Stanbic – N444.240B

- First Bank FBH – N260.241B

- As it stands today, at N480/$, Flutterwave is more than all those. Except Zenith and GTBank, FLW is ahead. (Source: Nigerian Stock Exchange)

If NSE investors said Access is worth N275.475B and FLW investors said it is worth $1billion, everything else is irrelevant. That one is public and one is private cannot change the numbers. In short, if FLW goes public now, it would be worth more. If Tesla is not public, people will still argue that it cannot be worth twice of Toyota because it sells less than 10.5 million cars to what Toyota sells.

Those valuation models you quoted are modelling Needs and Expectations; great companies are modelled on Perception. Revenue, income, etc are great but industry trajectory and momentum (mass x velocity) are key. If you have speed instead of velocity, you have no direction as a firm. FLW has velocity and most banks run on speed!

Velocity brings the edges of the smiling curve while speed keeps you at the center. Extra value is captured at the edges. It is the same thing which makes Paypal ( $282.93B) more valuable than Goldman Sachs ($117.59B).

It comes down to this: new basis of competition and the ability to turn your consumers to customers, and those customers to FANS. Yes, velocity makes consumers become Fans, and fandom unlocks Perception during valuation, as huge leverageable factors emerge.

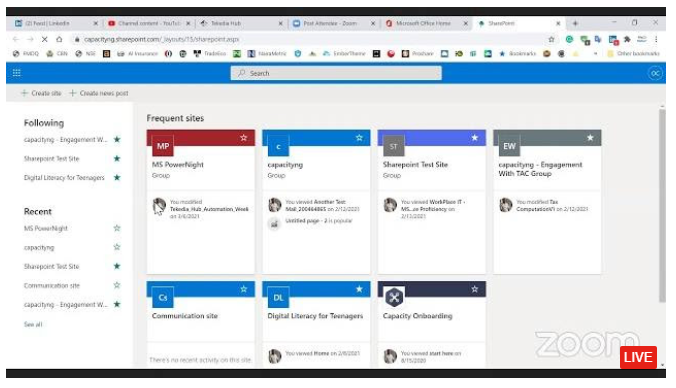

During a Tekedia Live session last week, Akintunde said it brilliantly” “Beatitude of Business – Blessed is the business that converts its customers to fans.” Build at the edges even if you have things at the center.