“Controlling advanced chip manufacturing in the 21st century may well prove to be like controlling the oil supply in the 20th. The country that controls this manufacturing can throttle the military and economic power of others.” The War on the Rocks.

This is going to become the most important battle of the 21st century. The U.S. has an asymmetric advantage over China via manufacturing tools and advanced CAD tools like Cadence. But China understands that the future of its ascension goes through silicon and bytes and would fight.

The United States recently did this to China by limiting Huawei’s ability to outsource its in-house chip designs for manufacture by Taiwan Semiconductor Manufacturing Company (TSMC), a Taiwanese chip foundry. China may respond and escalate via one of its many agile strategic options short of war, perhaps succeeding in coercing the foundry to stop making chips for American companies. If negotiations fail, China might take drastic measures, turning the tables on the United States. On the more modest end of the spectrum, China might start some type of trade war with Taiwan to ensure access, following the playbook Beijing used to coerce Korea over Terminal High Altitude Area Defense (THAAD) or Australia over its recent decision to lead a call for investigating the origins of the novel coronavirus. On the more extreme end, these Taiwanese chip foundries might be subject to an aggressive campaign of sabotage. And even though observers of the region might downplay the risk, it is not impossible that this could be used as a part of a casus belli for China’s long-held desire to reunify by force. Such is the importance of chips in this era.

As a chip designer, this is the only way the U.S. can win whatever battle it sets to win. Why? The oxygen of the 21st century market is microprocessor and if you do not make great ones, you have no chance to dominate global trade and commerce. Today, the U.S. controls more than 80% of the best manufacturing tools even though China holds some of the most important rare earth metals. It is like Nigeria’s Niger Delta with crude oil (here China) and Mobil coming to extract it from the land (US with the equipment). The stakes are high for Joe Biden after Trump did not really change the trajectory despite his efforts: China ramped up more trade surpluses in the last four years than in the last four years of Obama. The war of chips and how they are used will shape this decade, and possibly this century.

In this piece, I explained how the U.S. could fight to remain the dominant global leader. And interestingly, the US had pushed its fight against Huawei by restricting the access of manufacturing tools used in advanced semiconductor production from Huawei and other selected companies. Unlike all the playbooks it has run in the past, the equipment ban is having severe impacts on Huawei as the company has reported lower operating numbers since the ban began.

But there are two things Huawei cannot do and cannot find solutions at the moment: semiconductors machinery, and advanced CAD tools for analog chip design. Cadence and Synopsys control the global market for the latter at more than 99%, especially for high end chip designs. While Mentor, Magma and others register on the chart, Cadence is the leader. Interestingly, the top five players are Americans.

Then on chip manufacturing, while we hail TSMC, Globalfoundries and Samsung Electronics, all of them depend on semiconductor tools supplied by American companies. Without those companies, these companies cannot operate.

So, to cripple Huawei, the U.S. recently said that no American semiconductor machinery can be used by any semiconductor foundry that does business with Huawei. Magically, nearly all foundries in the world became affected; TSMC is rumored to have dropped Huawei. If Huawei cannot get a foundry to help on its chip fabrication, it has a big challenge. At the moment, it does not have the capacity to build these factories without relying on American machinery and equipment. This is Huawei’s biggest test! With this ban, it is now an asymmetric warfare and I expect a surrender even as the UK plans to wean itself off of Huawei by 2023, on 5G.

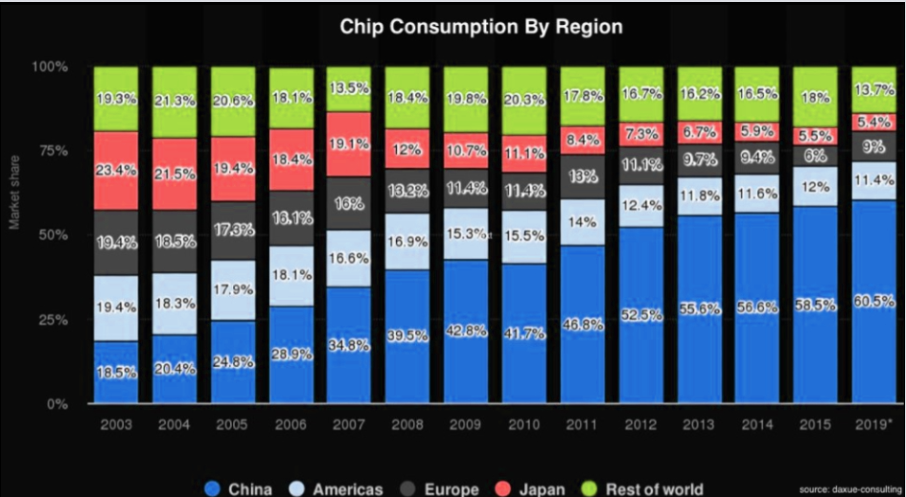

But this table shows something: China is really the new world. Do you see that 60.5% for China and every other person to share the balance? Good luck isolating what seems like the future.