By Nnamdi Odumody

Small and medium scale enterprises (SMEs) play a vital role in the socio economic development of any nation. They create jobs and help accelerate wellbeing amongst citizens through entrepreneurial capitalism.

SMEs in developing economies are constrained by a lot of factors which include weak intellectual property rights, access to finance, and multiple taxes. These factors limit their capacities to scale, and becoming successful like their counterparts in developed markets.

The Stanford University Graduate School of Business launched an initiative in 2013, Stanford Institute for Innovation in Developing Economies (Stanford SEED), to end the cycle of poverty in developing countries.

The Seed Transformation Program brings the power of innovation, entrepreneurship, and leadership to established businesses and their leaders — on the ground and in their communities.

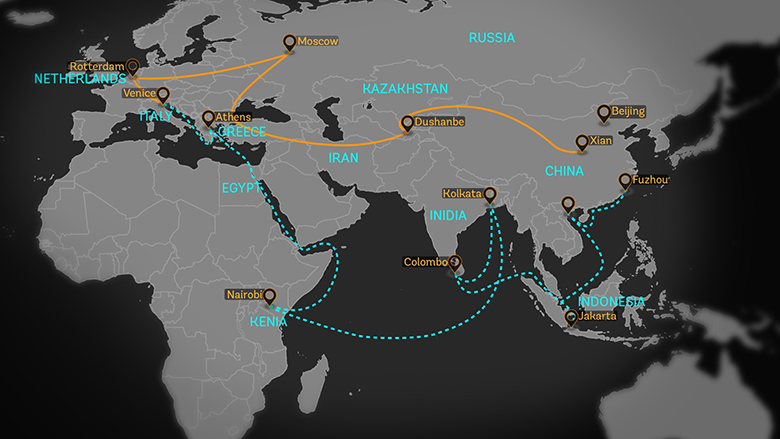

We started in Africa, expanded to India, and our goal is to grow and scale to developing and emerging economies throughout the world. Stanford’s management training, one-on-one support, and networking opportunities empower business owners to lead their regions to greater prosperity.

Conducted largely outside of the classroom, this high touch one-year leadership program challenges leaders to assess their company’s vision, redefine strategies, and make ambitious changes toward exponential growth that will generate new jobs.

Its Business Transformation Programme is focused on SMEs which want to scale in West Africa, Central Africa, East Africa and India. This one year leadership program challenges leaders to access their company’s vision, redefine strategies and make ambitious changes towards exponential growth that will generate jobs. The program consists of intensive sessions taught by Stanford University faculty, and leading industry experts, in each of the countries under their operations, through an experiential learning model.

The Stanford SEED Transformational Programme curriculum is customized to address the challenges of CEOs in developing economies that run fast growing organizations. The attendees undergo trainings in leadership, strategy, entrepreneurial organizations, accounting, marketing, finance, value chain innovation, governance, business ethics, product, and services innovations.

Prospective applicants to this program must demonstrate commitment and potential to grow and scale their companies, by creating jobs, products or services which benefit the bottom of the pyramid and must lead organizations with revenues between $150,000 and $15 million.