You have that legendary and iconic artist on DVD but technological trajectories have caught up with you: the DVD is there but you cannot play the artist because your present tech gadgets are not compatible with that DVD format. It is a big friction we all go through, missing precious pasts as dislocations engineered by innovations distort moments we have saved and archived in DVDs. I had the same issue – and overcame it. A brilliant software called WinX DVD Ripper Platinum, a DVD Ripper/Rip DVD, made the difference.

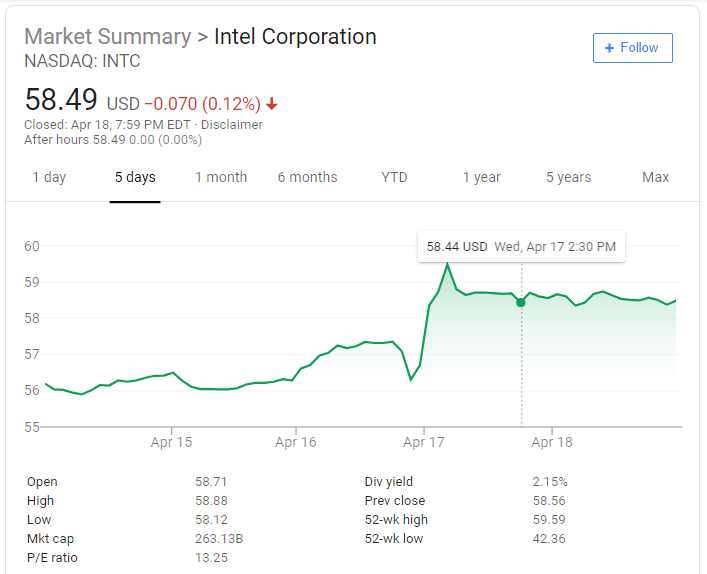

WinX DVD Ripper Platinum is a Windows-based software capable of ripping any DVDs/ISO images to hard drive. It can rip DVD to MP4, MPEG and more. More so, using the software, one can convert DVDs for playback on Apple products like iPhone, iPad, Apple TV, and iTunes. For the non believers of Apple world, who use broad Android devices, you are also covered as products from Huawei, Samsung, Tecno and even Amazon Kindle are supported.

I have Microsoft Xbox and Sony phone and was able to copy my DVD library to Plex Media Server, and NAS drive. Simply, WinX DVD Ripper Platinum allow people to solve DVD playback challenges as it can decode DVDs of any types from any countries.It supports the following versions of Windows – Windows 10, Windows 8/8.1, Windows 7, Vista, XP, 2003, and 2000.

The capability to work in any nation means WinX DVD Ripper Platinum. overcomes DVD playback errors which can include things like failed to read DVD, DVD won’t play on Windows 10, etc. These are errors related to region encoding and encryption restrictions. By rippling the DVD to video with WinX DVD Ripper Platinum, these issues are managed.

Core Features and Advantages

There are many great features and inherent advantages in this largely free DVD Ripper software. Some include:

- The solution is fast – the whole ripping process of DVD to video can happen in 5 minutes. This is possible with the patented in-built Level-3 hardware acceleration technology.

- It has deep features making it versatile. This means the outputs are available in many formats to enable playbacks in any device like Android, iPhone, etc

- No matter your DVDs – made by yourself, or purchased from stores (from other countries), you can make perfect backup by using the powerful DVD ripper. Even if your DVDs are scratched, damaged or unplayable, the software is here to offer a solution.

- High Quality Engine helps deliver highest possible image quality. On top of this, you can balance and master the video quality and file size according to your own need.

- This DVD ripping software is preloaded with a video editor to polish your DVD movies. You can crop video to remove the unwanted borders and area, trim video to set the start/end time to cut video clips out and merge to combine several titles. You can also select subtitle track (incl. forced subtitle) and even add the downloaded SRT subtitle files in any languages.

How to rip DVD to Video

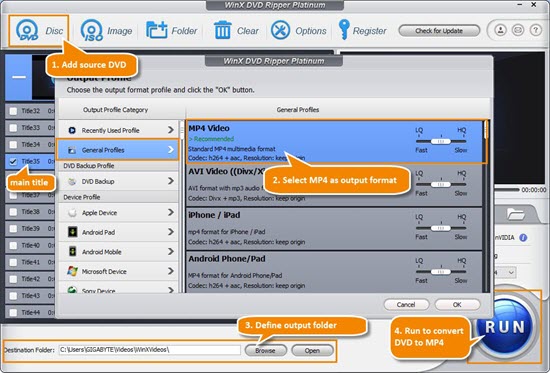

To rip DVD to video (MP4/MKV/AVI) with WinX DVD Ripper Platinum, there are simple steps. First, install and launch WinX DVD Ripper Platinum on your PC. Then follow the tutorial below to rip DVD to MP4 on Windows (10) easily and quickly. You should insert the DVD Disc into the DVD drive in advance.

Step 1. Add the source DVD disc/folder.

Open WinX DVD Ripper, click DVD Disc icon. A dialogue box appears asking you to select source disc. Do it and click OK.

Step 2. Select MP4 as the output format.

A couple of seconds later, all DVD titles will be listed and the main title will be automatically checked. Meanwhile, Output Profile window pops up.

Find General Profiles category and select MP4 Video (codec: h264+aac) as output format. Click OK. Additionally, you can choose MP4 output profile from other categories, such as YouTube Video, to iPhone Video, to Android Video according to your needs.

Step 3. Define output folder to save MP4 video.

At the Output Setting area, click Browse button to select a destination folder in the dialog box that opens, and click OK.

Step 4. Start to convert DVD to MP4 without quality loss.

This DVD to MP4 ripper will automatically enable hardware acceleration according to your GPUs. you just need to click RUN button on the bottom right and It takes roughly 5 minutes to rip a feature-length DVD movie to MP4. Certainly, a process bar can tell you how the conversion goes.

Step 5: End

All Together

I know you are excited to go straight and use this software. Yes, you want to get DVD Decoder for Free. I refer you to this WinX DVD Ripper Platinum giveaway campaign for a start.