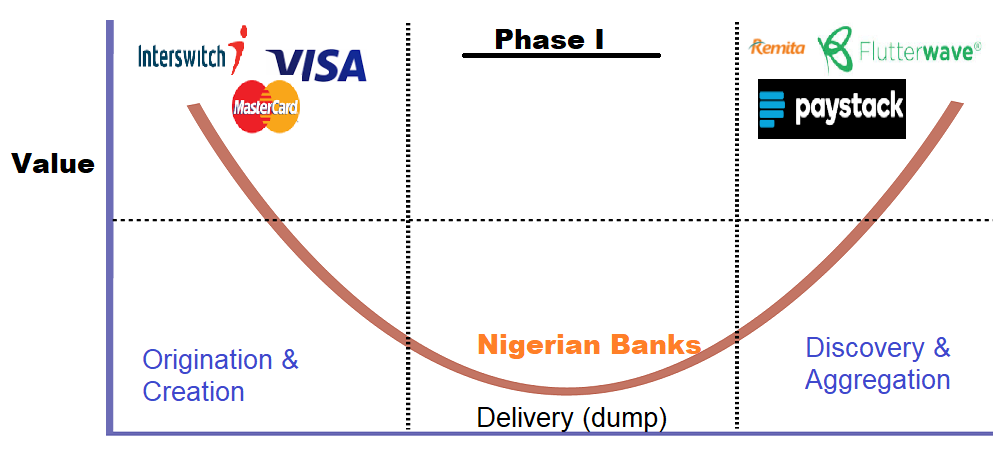

OneFi, the parent company of Paylater, a digital lending startup in Nigeria, has acquired Amplify, a fintech company in Lagos. OneFi recently raised $5 million (debt) from Nairobi-based Lendable to transition into a full-fledged digital banking institution. As expected, OneFi is dropping Paylater, going with OneFi at the interim. (I had written few days ago: “So, the name of a digital bank cannot be Paylater!“.) So, the name change is the way to go.

Of course, OneFi does not need to be a “bank” to offer banking services. With this acquisition, the company will deepen its consumer and social finance using Amplify technologies which it acquired. So, the parent of Paylater is no more just an online lending startup but a digital financial institution.

This consolidation is expected in the African fintech sector which is getting more competitive with likes of WhatsApp and Alipay on the way.

Lagos based online lending startup OneFi is buying Nigerian payment solutions company Amplify for an undisclosed amount.

OneFi will take over Amplify’s IP, team, and client network of over 1000 merchants to which Amplify provides payment processing services, OneFi CEO Chijioke Dozie told TechCrunch.

Nigeria’s Paylater Raises $5 Million as It Transitions into a Full-Service Digital Bank

The Full Press release

Amplified Payments Ltd [Amplify], a fintech company that builds and facilitates payment solutions and digital financial transactions in Nigeria, has today announced its acquisition by One Finance Limited [OneFi]. The deal, completed for an undisclosed fee, took effect as of March 1st, 2019, and sees OneFi boost its financial services offering, as the company adds Amplify’s assets, tradements and flagship products, AmplifyPay and mTransfers, to its growing portfolio.

Conceived in 2015 by co-founders Segun Adeyemi and Maxwell Obi, who first met as Entrepreneurs-in-Training at MEST Africa’s Entrepreneurial Training Program in Accra, Ghana, Amplify has scaled quickly to become one of Nigeria’s leading online recurring payment processors, supporting over 1,000 merchants and facilitating digital transactions for four of the country’s largest banks.

The company’s core products, AmplifyPay – a payment gateway specialising in recurring transactions – and mTransfers – a keyboard banking solution that enables consumers to conduct bill and P2P payments in any chat app – have propelled the three-year-old start-up to a market-leader in Nigeria’s financial processing space.

As a result of the acquisition, Amplify co-founder and CTO, Maxwell Obi, will join the OneFi team to oversee the payments direction of the company, whilst co-founder and CEO, Segun Adeyemi, will depart as he pursues new ventures. Commenting on the acquisition and his new role, Maxwell says, “The key factor which stood out in our decision to work with OneFi was that we saw them as an extension of our vision. We stepped into this industry to use our payment solutions to facilitate a growing economy, and OneFi’s focus on financial inclusion feeds well into this. It’s a real example of a collaborative effort, and I’m excited to see the next chapter of our development.”

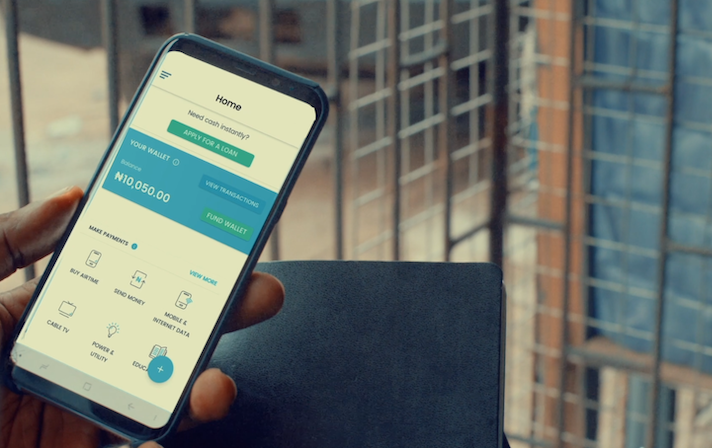

Paylater, OneFi’s consumer-facing lending platform, was launched in 2016 by Nigerian finance entrepreneurs Chijioke and Ngozi Dozie, and provides hassle-free loans without the need for human intervention or bias in decision making. Through its app, which has been downloaded over one million times, Paylater has deployed over $50M across 750,000 loans, approving over 1,500 loans a day at an average of $80 per loan. In late 2018, the company became the first African fintech platform to secure a credit rating. The acquisition of Amplify is the next step in the company’s journey, seeing the platform pivot to a one-stop-shop offering additional products such as savings, bill payments and credit reporting.

Chijioke Dozie, OneFi Founder and CEO, adds, “Today’s announcement signals OneFi’s first acquisition; a strategic decision that kicks off our transformation from a digital lender to a diverse digital financial services platform focused on transactions, payments and loans and will ensure we meet our ambitious goal of doubling our size in Nigeria this year. We have long respected the Amplify team for their ability to provide innovative solutions under adverse conditions, and we look forward to blending our expertise to power the future of fintech infrastructure and digital payments in Africa.”

Amplify also secured their first investment from MEST Africa, the Pan-African incubator, training program and seed fund, in 2016, when Adeyemi and Obi graduated from the program and the company officially launched. Amplify is the 5th MEST Africa company to be acquired and the first in the fintech space.

MEST Managing Director, Aaron Fu, concludes, “Seeing Amplify exit to such an established and well-known player in Nigeria’s fintech sector is a really significant moment in MEST Africa’s 11-year history. Watching Segun and Maxwell develop Amplify into a market leader in just three years has been thrilling to see, and we expect to see many more African tech start-ups take this route to market. Our hope is that the Amplify journey will be an inspiration to thousands of entrepreneurs in the making.