About 1.4 billion tonnes of food is lost annually due to lack of cold chain solutions. According to FIIRO, a Nigeria-based food research agency, a farmer loses between 40-50 percent of farm produce. This leads to price hikes in cost of food items, price fluctuations and food scarcity. More than 85 percent of farm owners in Nigeria are without access to cold chain storage solutions. Cooling and refrigeration rely an access to a reliable and affordable source of either electricity or diesel fuel which are often lacking or virtually nonexistent in rural areas.

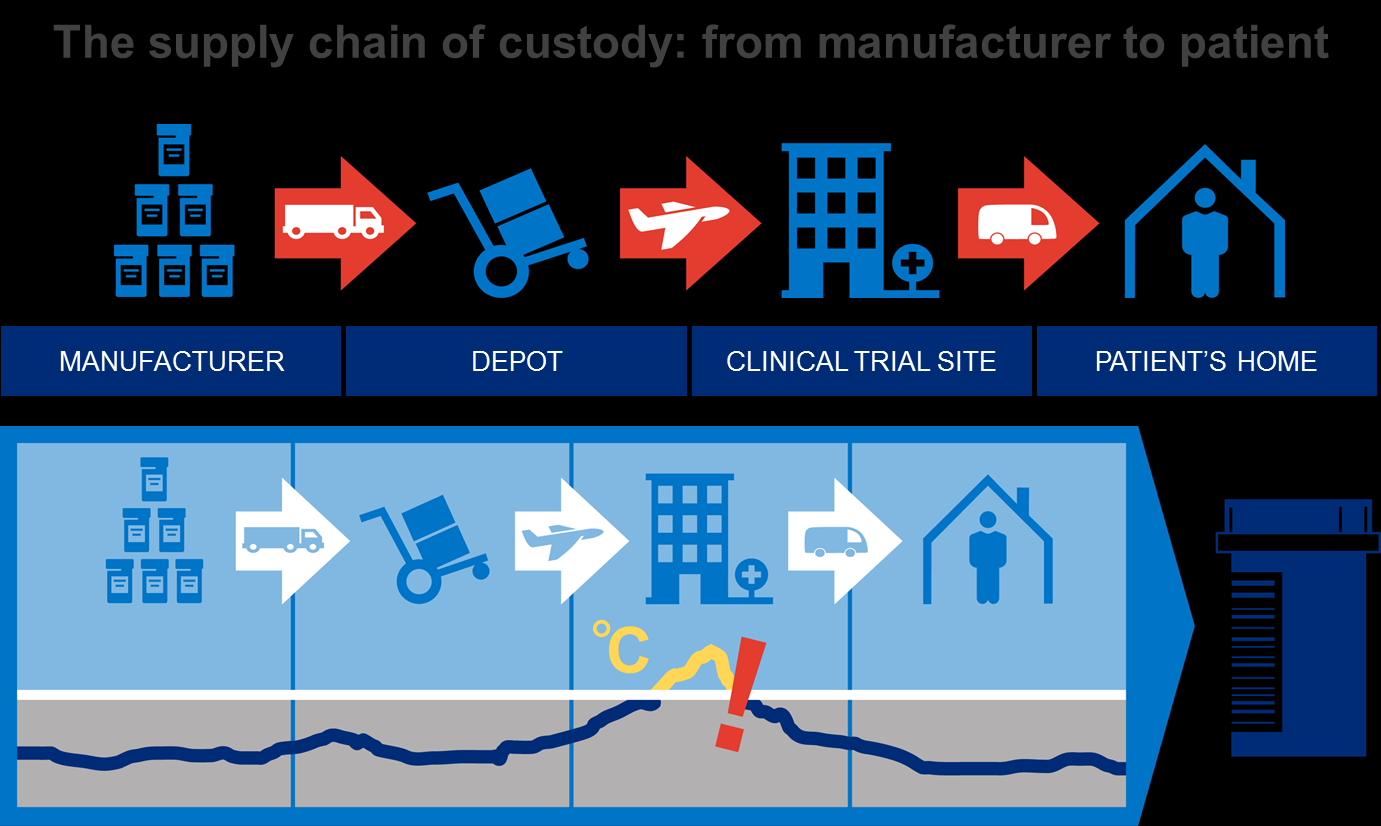

A cold chain or cool chain is a temperature-controlled supply chain. An unbroken cold chain is an uninterrupted series of refrigerated production, storage and distribution activities, along with associated equipment and logistics, which maintain a desired low-temperature range.

In healthcare, cold chain technology is required in the preservation and storage of healthcare products, medications and the dissemination of vaccines. Unfortunately 19.4 million infants do not receive routine immunization due to inadequate cold chain facility during transportation and storage. About 1.5 million annual deaths could have been prevented if there were adequate cold chain storage facilities.

Oghenetega Iortim, a business development expert with expertise spanning different industries which include power, information technology, oil and gas where he built solutions for Nigerian Gas generating revenue of over $1million per annum, and his Cofounder Richard Amiola, a renewable energy expert, who has embarked on projects which harness the potential of renewable energy such as regenerative braking, thermoelectric generation, piezoelectricity and solar energy, decided to come up with a solution to this problem.

The solution is Gricd Frij, a cold chain box for storage and transportation of agricultural and healthcare products, in locations without power infrastructure. This device embedded with real time storage temperature and location monitoring technology has a dedicated battery which lasts up to 48 hours.

Gricd Frij will provide reliable, affordable cold chain solution to preserve crop produce, dairy milk, meat, household food, finding purpose across various sectors, preventing post harvest losses for farmers. It will also preserve vaccines and other healthcare products during transportation to remote, rural areas.

This innovation has been adopted by the Nigerian Institute of Medical Research Lagos for the transportation of laboratory samples, a hospital and some small businesses which rely on cold chain. It gives the user the ability to sustain items at regulated temperatures of up to 20 degrees Celsius during storage and transportation. It is the first of its kind in Sub-Saharan Africa competing with the traditional means of storage which are conventional refrigerators and ice packs in cooler boxes.

The Federal Ministry Of Health, Nigerian Medical Association (the umbrella body of all medical practitioners), and Pharmaceutical Society of Nigeria need to sensitize their members to patronize this innovation which will go a long way in preventing some of the wastages faced by medical centers and pharmacies in drug and other sensitive items during delivery. Also, the Nigerian Agribusiness Support Group, an umbrella body of all organizations involved in agribusiness, Farmers Association, and the Federal Ministry of Agriculture and Rural Development with its Departments and Agencies, should also utilize this product to prevent produce wastages.