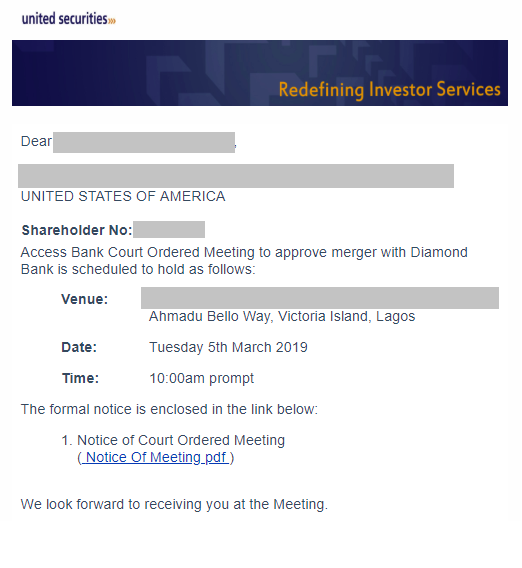

MTN Nigeria will be listed on the Nigerian Stock Exchange but it will not follow the typical process of initial public offer (IPO). MTN Nigeria will go via listing via Introduction, according to statements from its leaders in South Africa. This is how Listing by introduction is explained “It is a way of listing shares already in issue on another exchange. No marketing arrangement is required as the shares for which listing is sought are already widely held. The listing approval procedures for a new listing by introduction are the same as those for initial public offerings (IPO)”. The deal will happen in H1 2019, possibly Q2 since Q1 makes no sense with the election on the way.

MTN Nigeria has said it will list on the Nigerian Stock Exchange by way of introduction in the first half of this year.

The President and Chief Executive Officer of MTN Group, Mr Rob Shuter, disclosed this at the MTN Group’s investor update conference call

[…]

“It means that we will list the company in the initial phases without any public offer or sell-down or initial public offering. I think this will enable us to get the company listed whilst the market still digests the implications of what has happened over the last few months,” Shuter said.

He added, “We will in phase two be doing a project to increase the Nigerian participation in MTN Nigeria, targeting more a free float of around 35 per cent than the free float we have today which is around 20 per cent. So, we aim to conclude at least the listing by introduction in the first half of 2019, pretty much as soon as we can, and then subject to market conditions, appetite and demand we would in phase two do the sell-down.

There is nothing new here: I had expected this to happen in Q2 2019, after the election. The only surprise is the format of using listing by introduction. I had projected the value of MTN Nigeria to be $5.57 billion before the paralyses of fines and penalties which certainly have depressed the valuation before investors.

“So, for MTN Nigeria, I do think the strategists would move this IPO to Q2 2019 to happen after the election. If I am advising them, that would be the first point on slide. Going public in 2018 will cost you 15-20 percent because of the looming presidential election in Nigeria, which could depress international and Nigerian diaspora interests,” he concluded.

This is the value of MTN Nigeria

Yet – do not take this to the bank. MTN put a disclaimer in that statement “… conclude at least the listing by introduction in the first half of 2019, pretty much as soon as we can, and then subject to market conditions, appetite and demand we would in phase two do the sell-down”. Simply, they can claim anything and call it off.

Like this:

Like Loading...