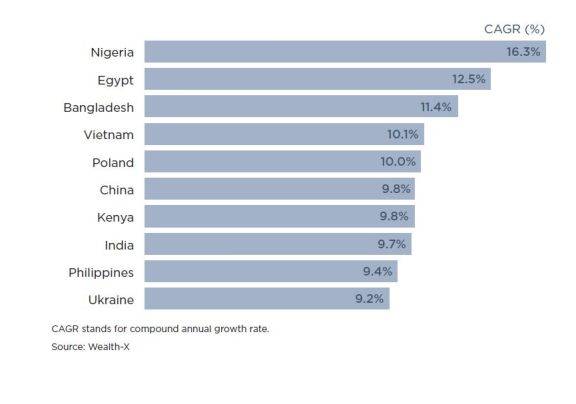

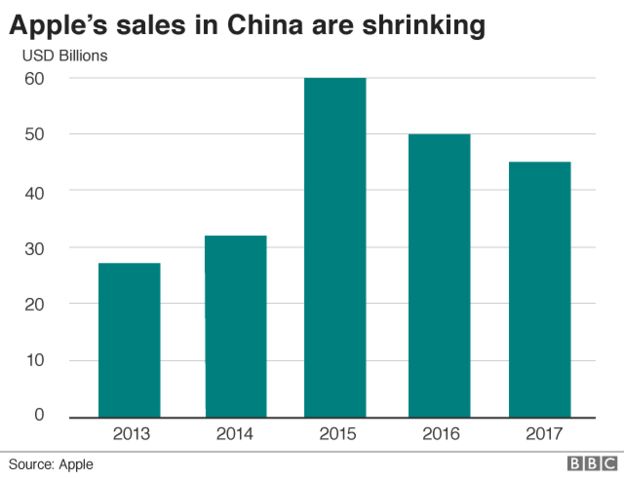

Tecno, the leading smartphone brand in Africa, controlled by Transsion Holdings will face a real test as Xiaomi arrives Africa. Xiaomi has done well in China and India but needs further growth. That growth cannot come from North America and key parts of Europe since the brand is largely banned in those regions over IP related issues. So, when all the permutations are done, the core critical market to explore is Africa. Hence, the maker of Mi phone brands is arriving.

Xiaomi says it’s launching a department in Africa, which will be headed by its current vice president. While the company has been selling phones in the continent since 2015 through local partnerships, the new department marks its official venture into the area.

{…]

Xiaomi is famous for making cheap handsets even though, recently, it’s been trying to move to the higher-end segment and sell more expensive, fancier phones. That doesn’t mean it’s given up on cheap phones. The company spun off a separate brand named Redmi, which focuses on making lower-priced phones. The first Redmi phone launched in early January features a 48MP rear camera and a midrange Snapdragon 660 chipset for just US$145.

There is still a huge opportunity ahead as Africa remains a growth market and despite the strong competitive position Transsion occupies with its brands, anything can happen in the smartphone sector. We used to have Nokia controlling more than 90% of the feature phone market. Then, Blackberry ruled and dominated a nascent smartphone market. Samsung later took over, but then lost its top position to Tecno. Simply, Xiaomi should take its chances.

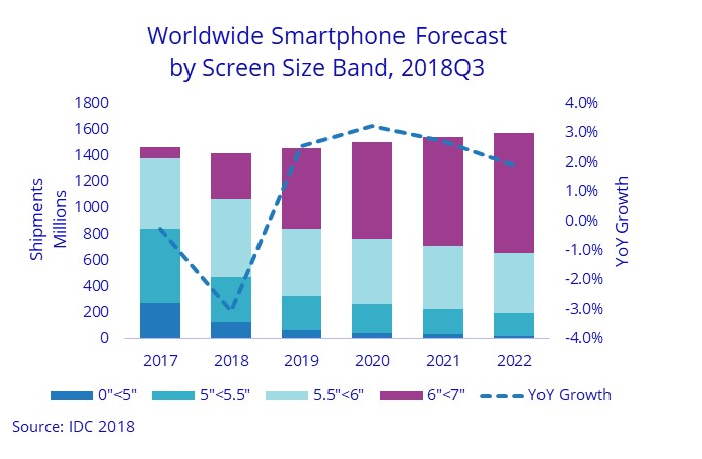

As these phone brands make Africa home, the immersive connectivity convergence will happen, as predicted, in 2022. Across board, Africa will win when there is competition. Yet, I am hoping that we can have local players in the continent as part of this rivalry.