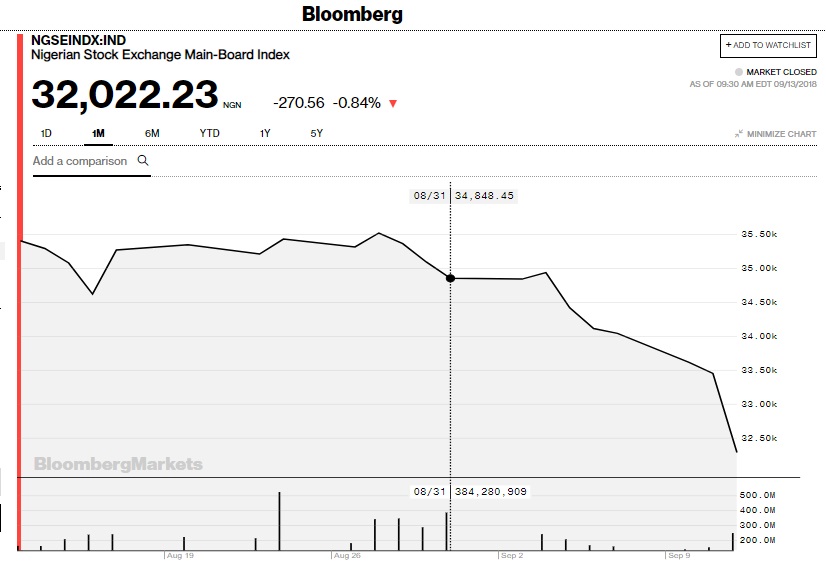

Investors are increasingly losing confidence in the Nigerian Stock Exchange: market lost a total of N423 billion ($1.3B) in one day, the highest in eight months. MTN Nigeria and MultiChoice challenges should not be uncorrelated with this as most foreign investors may be reaching the inflection point.

Following massive sell pressure on the equity market yesterday, the local bourse recorded its biggest loss in eight months, as investors lose whooping N423 billion in one day.

Analysts and operators linked the huge losses incurred by investors to the heightened political risk as the 2019 general elections draw closer on daily basis with the gale of defections without a clear economic plan or agenda to revitalise or boost the economy.

Specifically, at the close of trading on the Nigerian Stock Exchange (NSE) yesterday, All Share Index (NSE-ASI) shed 1,156.38 absolute points, representing a decline of 3.46 per cent to close at 32,292.79 points. Also, the market capitalisation declined by N423 billion to close at N11.789 trillion

I am getting worried now as if this bleeding continues, companies will trigger liquidity buttons, freezing major investments to conserve cash for who knows tomorrow. It could get very ugly that most Nigerian firms will start disengaging workers. If the stock market is battered and investments are muted, one thing happens: everyone withdraws, as pessimism sets in. Most times, workers pay the penalties.

While the fundamentals in the economy remain promising [bank profits are hitting record numbers], the political system is a weak point. That is affecting the sentiments of most investors and driving their asset allocation strategies. Some are moving into fixed income – making treasury bills hot. The implication is that most portfolio allocation decisions do not favor stocks right now in Nigeria.

Politicians have to wake up and help the nation. We are destroying this economy with the mass defection which shows lack of core values and principles in our system in building the nation. Where is the Country-First?