This video is for Medcera Partners. It is produced to help them in their business development and marketing efforts. We continue to welcome strategic partners across Africa for Medcera (learn how here).

This video is for Medcera Partners. It is produced to help them in their business development and marketing efforts. We continue to welcome strategic partners across Africa for Medcera (learn how here).

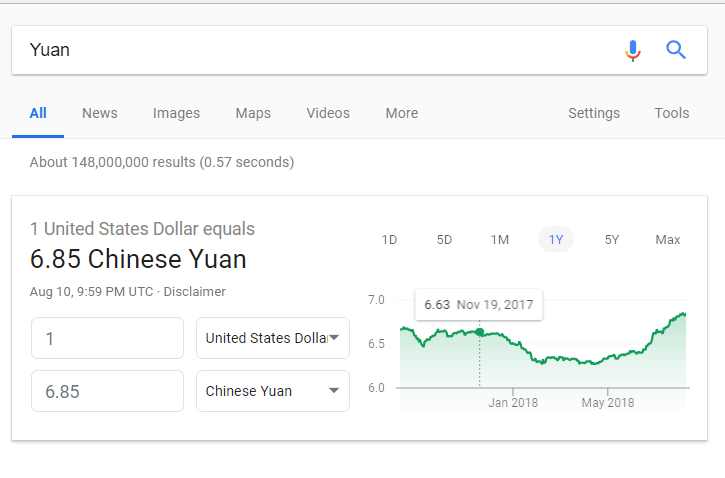

I made the case that the currency swap regime which the Central Bank of Nigeria executed with its Chinese counterpart will help the Naira rise over the US dollar. Largely, if the pressure on the demand on US dollar drops in Nigeria, the price equilibrium point will move under common sense price elasticity of demand (provided there is no backdoor in the implementation).

It seems my post on the currency swap on Chinese Yuan is generating questions. I had noted that US dollar may fall to the Naira if the pressure on US dollar is disintermediated by direct currency swap on Chinese Yuan. In other words, if Nigerians who import things from China do not have to buy US dollar to pay Chinese merchants in China, the demand for US dollar may marginally drop. If that happens, the exchange rate of US dollar to Naira will drop, assuming common demand and supply mechanics plays out.

Yesterday, I made our service available to a US company coming to invest in Nigeria. One of his biggest uncertainties was (Naira) currency instability. As we discussed, I posited that currency loss risk is not going to be wholly coming from Nigeria. In our model here, we expect the U.S. government to win the tariff battle against China (China has more to lose as it exports more to U.S.).

Simply, under the simple balance of trade and balance of payment, China is more exposed than U.S., bilaterally, and that means it has more risks under this escalating tariff battle. But U.S. will also pay a huge penalty with inflation because I expect China after losing this tariff battle to devalue its currency to make its export cheaper thereby neutralizing the impact of President Trump tariff to American consumers. Tariff is tax, and to reduce the burden to customers, you can decide to absorb the tax if you can. One way China can do that would be to devalue the Yuan, making it cheaper to import from China.

If that happens, U.S. will have to “devalue” its own currency to mitigate that impact [that is for academic analysis]. Sure, America can file a case in the WTO for international trade manipulation. But China may appeal dragging the issue for months. Technically, America cannot just wait for judgment from WTO before taking action. The superpower nation can either make U.S. dollar lose value or increase the tariff on Chinese products to counter the impact of the devalued Yuan.

In a case where U.S. devalues its currency to curtail China’s export imbalance through currency “engineering”, Naira will strengthen against the dollar. I smile…lol!

It is very interesting that people still believe that MTN will file paperwork to go public this year in Nigeria. If MTN goes ahead and lists in Nigeria this year, it would be a huge fiduciary irresponsibility as I have noted.

MTN Nigeria was to list on the Nigerian Stock Exchange in 2017. It was later moved to 2018. I have done my research as we wait the prospectus of the initial public offering. But when that did not happen before June 2018, my conclusion is that MTN Nigeria would not list on NSE in 2018.

It is simple – doing so would be carelessness when a presidential election is on the horizon. Elections in Africa typically bring uncertainties, triggering devaluations of equities across markets. So, for MTN Nigeria, I do think the strategists would move this IPO to Q2 2019 to happen after the election.

If I am advising them, that would be the first point on slide. Going public in 2018 will cost you 15%-20% because of the looming presidential election in Nigeria which will depress international & Nigerian diaspora interests.

There is something structurally deficient in Nigeria right now. We have lost any element of core principles at senior political leaderships, at both national and local levels. When such happens in a nation, especially at a developmental phase where humans are largely the institutions, investors are rattled. Now, not listing in 2018 seems to be official as Securities and Exchange Commission (SEC) has confirmed that it is yet to receive any document from MTN. Even if MTN files the paperwork next month, it may be late as by the end of November, markets will begin to slow down for Christmas break. Simply, three months will not do it, and that means expect this IPO next year. And the wait continues since 2017.

Acting Director-General of the Securities and Exchange Commission (SEC), Mary Uduk has tasked MTN Group on official filing of the Initial Public Offering (IPO) prospectus to the commission.

Uduk, while reacting further over recent media reports that MTN Nigeria is good to go with the Nigeria Listing, stated categorically that neither MTN Nigeria Limited nor any of its advisers or representatives has filed any application on the IPO with the commission.

Mines, a fintech startup re-inventing credit in emerging markets, has closed a Series A round of $13M led by The Rise Fund, a global fund managed by TPG Growth. Nigeria’s Bank of Industry also participated. Mines plans to use its investment for talent acquisition, continued growth in Africa, and expansion, to South America and South-East Asia. This is a huge warchest and Mines will use it to battle Paylater which recently crossed 1 million app downloads.

There are other players like Wema Bank’s ALAT and Piggybank.ng. These are competitors and also coopetitors and together these entities can pioneer a new sector that will make banking a sports for many Nigerians: something to cheer.

It is going to be a huge one – credit is credit no matter the form it came. Piggybank and Paylater are apps-driven while Mines runs on partnership- operating systems. You may not necessarily know Mines but some of the credits offered by some Nigerian telcos are powered by Mines.

This is a huge competition because if Mines meets the needs of customers (especially the not-so-affluent), those customers will not have anything to do with banks. Yet, the company works with banks. It has to as if it wants to make progress at scale where bigger credits can be extended to more affluent customers.

Mines provides a Credit-as-a-Service digital platform that enables institutions in emerging markets to offer credit products to their customers; no smartphone is required. Leveraging their own data sets, domestic institutions are able to serve loans to customers ignored by available credit systems and open up entirely new revenue opportunities.

“There are more than 3 billion adults globally without access to credit. Our vision is that every one of them will have instant access to credit in the next 10 years.” explains Ekechi Nwokah, Mines CEO. “We believe the best way to realize this vision is to partner with banks, retailers and mobile operators and power digital credit products tailored to their markets so they can create the customers of tomorrow, today.”

By mining high-volume data like phone records, bank records, and payment transactions in real-time, Mines can instantly assess credit risk in markets that lack robust credit bureau infrastructure. It then integrates its risk models with identity, origination, payments, loan lifecycle management, and customer service to form a holistic platform. The net result is a seamless user experience where partners’ customers can apply for and receive a loan in less than 60 seconds or make instant purchases with virtual or physical credit cards.

The company has hardened its proprietary technology in Nigeria where it has been used by over 1 million customers since launching in 2017. It is now the leading provider of consumer credit in the country, counting mobile operators 9mobile and Airtel, payment processors Interswitch and NIBSS, along with several banks amongst its partners. “What we have done differently is take Silicon Valley technology and built it into a product that is robust enough for emerging markets like Nigeria, Brazil, or Indonesia”, says Chief Scientist Kunle Olukotun. “We can extend credit to all types of customers, including customers without smartphones or even bank accounts as these are the people who need credit the most.”

As part of the financing, Yemi Lalude from TPG Growth and Willem Willemstein from Velocity Capital have joined Mines’ Board of Directors. Lalude says, “Mines combines world-class artificial intelligence and extensive use of data with a strong focus on local partnerships to build financial inclusion. We are excited to partner with them to drive financial access across the world.”

Mines started out as a research project on high performance artificial intelligence led by Olukotun, a professor of computer engineering at Stanford University. It came to life after a chance meeting with Nwokah, a computer scientist working on big data projects at Amazon Web Services, after which they teamed up to direct the technology towards solving the grand challenge of financial access. Both founders grew up in Africa and understand the challenges facing technology companies trying to solve problems in emerging markets without a deep respect for the complexities of local culture, knowing they need to take a different approach.

Photos/ MINES Executives l-r Adia Sowho, Ekechi Nwokah, Kunle Olukotun

By next year, Zenvus will begin supporting individual farmers. We made the first leap on that when we released the Zenvus Boundary which helps farmers in mapping the boundaries of their farms. At the moment, our focus has been governments and cooperatives largely because we need scale to serve customers.

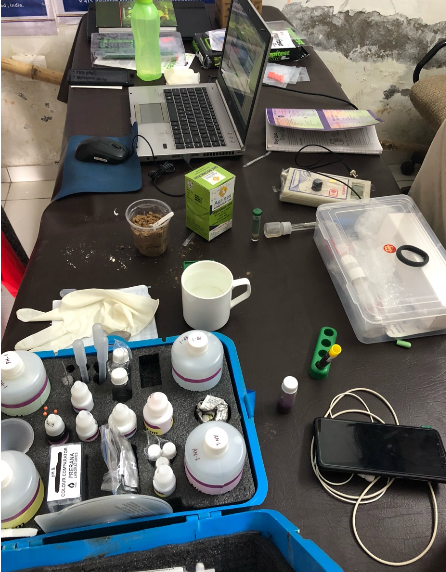

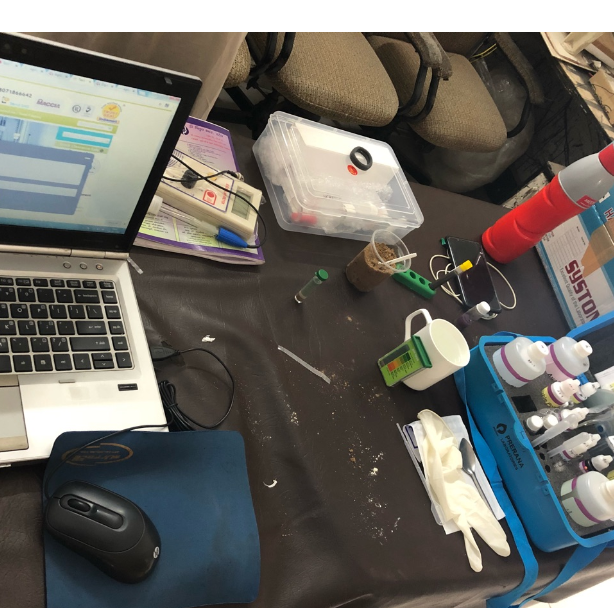

Enjoy photos from Zenvus Soil Nutrition Lab where we are researching and building models on soil chemistry, computational algorithms and crop growths.

I am asking African governments to commission my firm to map all the farmlands in respective countries, archive the nutritional values, tag them to maps (via Zenvus Boundary) and make the data FREELY available. Yes, with that, farmers using their phones will have clarity on the state of the farmlands. It is a unfortunate that government sells the same fertilizer in Sokoto, Owerri and Ibadan (all in Nigeria) when the soils have different nutritional needs. Why waste nitrogen (in a fertilizer) in a farm with lots of urea if that saving can help support more lands?

I think we can fix African agriculture. We just need resources to scale this thing really fast! If you have linkage to a state government, we have Zenvus Fusion to improve agriculture.

Zenvus Fusion is a service for governments and development organizations which is designed to help build Soil Fertility Geography in constituencies. It could be a state Soil Fertility Geography or even a National Soil Fertility Geography. We also support local governments.

Our product provides the data that makes it possible for farmers to understand the natures of the farmlands before they begin planting their crops. We do this by collecting many data samples to appropriately represent the soil fertility equivalence of that region or area.

The aggregated soil fertility data is made accessible to all stakeholders. The data is also GIS-tagged so that the exact locations of the soil are known. The Computational algorithm will use this data to make location-based recommendations on fertilizer applications across farming zones, and this will be delivered through mobile devices, to stakeholders that subscribe. Also, farmers can get predictive recommendations on the most economically viable crop to grow by feeding present crop prices, fertilizer cost, and population into the algorithm.

With this soil fertilizer geography, fertilizer production will become personalized and specifically engineered to mitigate deficiencies with deployment regions known pre-production. We welcome inquiries from governments, development organizations etc.