Contracts are by far the most common legal instruments in use and demand, serving as a means of establishing business relationships or individual/corporate interactions across all levels of human endeavour.

Whether as professional retainer agreements, agreements of terms and conditions, supply contracts, SLAs, employment contracts, Joint Venture agreements or syndicated Loan documentations, contracts are the basis of relationships giving rise to causes of action under Nigerian law.

While almost everyone presumably knows what contracts are to the point of making the topic look simplistic, many people still do not know about the factors that make a contract voidable, void or enforceable. Many people also do not understand the conditions under which contractual obligations can no longer become binding, and that constitutes the focus of this article which will be looking deepest into the topics of :-

– What contracts are.

– The conditions for a valid contract.

– The factors that invalidate a contract.

– When contracts can no longer be binding.

What is a contract?

A contract is an agreement that is either written, spoken of or implied between 2 or more parties that is enforceable under the law.

What is the Regulatory Framework governing contracts in Nigeria?

Contracts are governed by the Contracts and Torts laws and Stare High Courts of various component states in Nigeria.

What are the ingredients of a valid and enforceable contract under law?

For a contract to be valid,the following must be present :-

– an offer made by a contracting party;

– an acceptance of this offer made by another contracting party, leading to a consensus ad idem or “meeting of minds”;

– the possession of contracting capability by the parties to a contract;

– the passing of consideration,or each party to a contract doing what they said they will do under the contract terms;

– the agreement not conflicting with law or public policy.

What are the elements or factors that can invalidate a contract?

A contract can be invalidated, or vitiated and rendered unenforceable, by the following factors :-

– Undue Influence :- This is the wrongful use of a position of influence or power to pressure (not just persuasion) an unwilling party into a contract.

– Misrepresentation:- This is a false assertion of fact (which can be fraudulent, negligent or innocent) made by a party which convinces another party into consenting to a contract.

– A Mistake of facts :- Mistakes of this nature can either be common, mutual or unilateral and occur when the subject matter of a contract ceases to exist e.g. entering into an agreement to sell land that has been acquired by a state government.

– Duress :- This is where the consent of a contracting party to a contract as evidenced by their signature for example is obtained through the use of wrongful force nullifying free will, exemplified by the Latin phrase “Non est factum” or “Not my will”.

Duress can only be claimed by an individual and not a corporation or company. It should also be noted that a party who enters into a contract under duress must move quickly to nullifying the contract afterwards by stating that his consent to the agreement was forced.

– Legal Incapacity :- This is where a party is barred by law from entering into a contract by virtue of mental instability, being a minor below the age of 18, or death.

– Conflict with the law :- This is where a contract goes contrary to public policy, law or government regulations e.g. Entering into a contract to supply banned narcotics or documenting a land sale in a manner contrary to the Land Use Act.

The Concept of Mistake under Nigerian Contract Law

There are instances in commercial legal disputes where a party might claim that he will not perform a contractual obligation because the said contract is rendered void by virtue of something called a mistake.

A mistake in contract law is when one or both parties have a false belief about a contract. A mistake might be a misunderstanding about terms, laws, or information relevant to a binding contract. If a party can prove their false belief has legitimate mistake grounds, the contract would become void.

This article will be looking into the concept of mistake under Nigerian Contract Law, with a focus on :

– The definition of a mistake as a contract law concept.

– The types of mistake in contract law.

– The categories of mistake under contract law.

What is a mistake in contract law?

A mistake is a wrong belief or understanding of facts at the point of contracting which a party to a contract relies on because he believes his understanding of the facts before him or the facts themselves to be correct.

What are the types of mistake under contract law?

A mistake can be either :

– Unilateral – where only one party to a contract is mistaken about the fact of terms or contractual subject matters contained in an agreement;

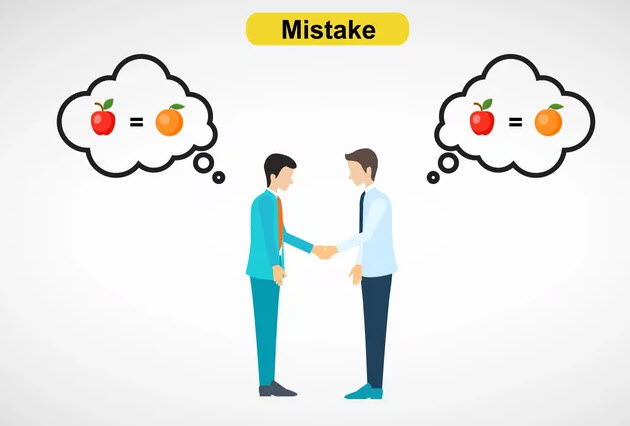

– Mutual – where parties to an agreement are both mistaken about the same material fact in the agreement, which would render them at opposing purposes or mismatched understandings of the offer, accept and consideration aspects of the contract; or

– Common – where both parties to an agreement hold the same wrong beliefs of contractual facts or subject matters.

What are the categories of mistake under contract law?

The categories of contractual mistakes are:-

– Mistakes of Law

– Mistakes of Fact

What are the legal effects of mistakes in contract law?

– Mistakes can be argued as a defense in suits for breaches of contractual obligations which can lead to such obligations deemed voidable(open to being annulled by a party to an agreement) or void(of no legal effect).

– Unilateral mistakes will not render a contract void except if the other party knew of such mistakes or they are deemed unconscionable by a court of law.

– With common mistakes as to subject matter, a contract can be voided in the case of the mistake fundamentally altering the subject matter’s identity, form, description or substance.

– Mutual mistakes can render a contract void where the parties are mistaken about a material subject matter.