By Chuma Akana

Recently, the financial inclusion programme of the Central Bank of Nigeria experienced a boost with the release of the guidelines for licensing and regulation of payment service banks in Nigeria. Some have cited this as a refreshing development, with potential to yield the desired financial inclusion results. Ostensibly, the guidelines intend that only entities with the right capabilities will drive the payment service bank sector as it attempts to make the field competitive.

It is worthy of note that the key objective of the regulation is to enhance financial inclusion by increasing access to deposit products and payment/remittance services to small businesses, low income households and other financially excluded entities through high volume low value transactions in a secured technology-driven environment. Previously, the CBN has sought to drive financial inclusion by the introduction of microfinance banking, agency banking and mobile money operators amongst others. However there is still much to be desired.

According to a 2018 report by the Central Bank of Nigeria, 37% of Nigerians do not have access to financial services, and this is at a time when internet penetration and smart phone penetration are on the rise in Nigeria, with 103 million Nigerians using the internet as at May 2018. More aptly, more than 66 million Nigerians do not have bank accounts or lack access to basic financial services. This deficit has led the CBN to introduce various policies to ensure that this number is drastically reduced and more Nigerians are banked. Also, this becomes more pertinent noting the fact that the informal sector contributes to more than half of the GDP of Nigeria.

The payments bank idea/model has been incorporated in various jurisdictions and climes, and is based primarily on the success of Mpesa in sub-Saharan Africa. A study by Bill and Melinda Gates Foundation identified four reasons why Mpesa was hugely successful and was able to reach a level of penetration that banks in Kenya were unable to reach. One of the core reasons was the extremely high cost of transferring cash to the rural areas from the cities, there was also a perception of lack of safety in transferring such monies. Another reason was the high reputation and trust that Safaricom, a telecom company, had garnered over the years by the citizens, arguably more so than Kenyan banks. A third factor that enabled its success, was the fact that Kenyan banks were restricted from utilising banking correspondents beyond a certain distance, thereby limiting their scope of reach.

Perhaps the most important component that fueled the growth of Mpesa, was that for nearly five years, Safaricom enjoyed a monopoly because banks did not have branches in remote areas due to high costs and because it made Mpesa easily available by strategically tying up with those vendors who provided mobile phone services and recharge. When Mpesa was launched in 2007, there was no regulatory framework for mobile money operations. At that time, the regulator was confronted with two options: to allow for Mpesa to operate freely while keeping an eye on the evolution of the service, or to introduce regulations that may confine the development of the innovation. The regulator chose to adopt a relaxed framework, and therefore at the time, the Kenya Banking Act did not provide a basis to regulate products offered by non banks, and Mpesa was one of such very successful product. In November 2014, Mpesa transactions for the 11 months of 2014 were valued at KES 2.1 trillion, a 28% increase from 2013, and almost half the value of the country’s GDP.

As a result, Mpesa became the driving force in financial inclusion in Kenya. According to the 2016 FinAccess Household Survey, 75.3% of Kenyans are now formally included; which represents a 50% increase in the last 10 years.

In contrast, more than 3 years after the Reserve Bank of India (RBI)) granted in-principle payments bank licenses to several corporate entities, the sector is struggling to come into its own. While a few of those companies have opted out, the others haven’t recorded much growth, due largely to stiff regulations including imposition of certain penalties to slow deposit collection and delayed launches, stringent know-your-customer (KYC) norms and a competitive banking ecosystem, according to experts.

The CBN guidelines provide that Payment service banks are expected to leverage on mobile and digital channels to enhance financial inclusion and stimulate economic activities at the grassroots through the provision of financial services through technology, and help in attaining the policy objective of 20 per cent exclusion rate by 2020.

The structure provides that the PSBs are to operate mostly in the rural areas and operate through banking agents in line with the CBN’s agent banking requirements, while they are also at liberty to roll out agent networks with the prior approval of the CBN. They shall conform to best practice on data storage security and integrity while ensuring that the word ‘Payment Service Banks’ will be part of their name.

The guideline provides that the Payment service bank permissible activities include; to accept deposit, carry out payments and remittances, operate electronic wallet, invest in FGN and CBN securities, while the PSBs are expressly prohibited from granting any kind of loans, any foreign exchange dealings, accepting any form of electronic value (airtime), as a form of deposit or payment and establishing any subsidiary outside the CBN guidelines.

The guidelines further opened the gateway for the participation of more companies as promoters including banking agents, telcos, retail chains e.g supermarkets, and downstream petroleum marketing companies, mobile money operators, fintech companies and financial holding companies. Where the entity is regulated, the entity must get a letter of no objection from its primary regulator.

The Payment service bank shall submit in connection with other requirements, a non refundable application fee of N500,000 and evidence of name reservation at CAC, further to which it may be granted an Approval-in-Principle. As at December 2018, over 30 firms had submitted name registration to CAC to be registered as payment Service Banks.

The requirements for the final license include non refundable fee of N2,000,000, CTC of certificate of incorporation, amongst others. There will also be a pre-licensing inspection to check the physical structure of the office building and infrastructure provided for take-off of the Payment service bank; sight the original copies of the documents submitted in support of the application for license; meet with the Board and Management team whose resumes had earlier been submitted to the CBN; verify the capital contributions of the promoters; and verify the integration of its infrastructure with the National Payments System.

The Financial Requirements for the Payment Service Banks include a minimum capital requirement of ?5,000,000,000.00. This is similar to the Payment Bank regulation in India where the minimum capital is Rs. 100 crore.

The guidelines also state that the provisions of the CBN code of corporate governance of banks shall be applicable to the PSBs and the Revised Assessment Criteria for Approved Person’s Regime for Financial Institutions shall be applicable to PSBs.

One of the challenges the payment service banks will face is in the area of ‘no lending’ as the PSBs are prohibited from any form of lending, and therefore the revenue stream may be limited, raising doubts over the model’s viability. The payment service banks also have restrictions with fund deployment as their investment is in stipulated government securities only. The guidelines states that PSBs shall maintain not less than 75% of their deposit liabilities in CBN securities, Treasury Bills (TBs) and other short-term federal government debt instruments, at any point in time. Another concern is the minimum capital requirement, which may be considered out-of-reach for some interested organizations.

The major opportunity for PSBs will be the sheer size of the market. To be successful, the Payment service bank system may require smart segmentation, both geographical and demographic, to offer tailor made products to bottom-of-pyramid (BOP), rural and unbanked Nigerians. Payment banks can also utilize the existing payments structure to move quickly, offer simplified payment solution and occupy a specific niche or segment.

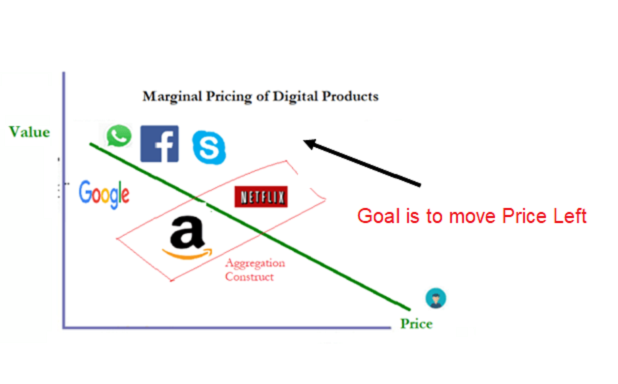

The telcos should note that while they may want to participate in the round, because they have the advantage of a large customer base, the type of relationship they are trying to build with the customers this time is distinct, while for the new players, acquiring critical mass may be a tall order. It is apparent that banking as we know it is changing, and technology is poised to change banking paradigms. A payment service banking license gives the licensee a vantage position to view these changes much better and address them.

One thing is clear though, the success of Mpesa advises that regulations, particularly as it concerns technology, should allow for innovation, and be flexible enough to accommodate new changes. Conversely, tough regulations would not provide the necessary enabling environment, may stifle growth of the payment service industry and ultimately defeat the main objective of financial inclusion.

Like this:

Like Loading...