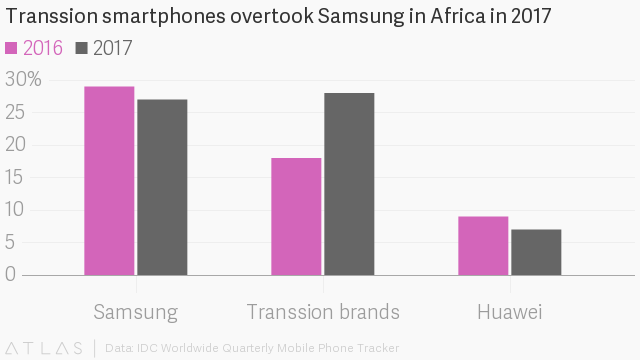

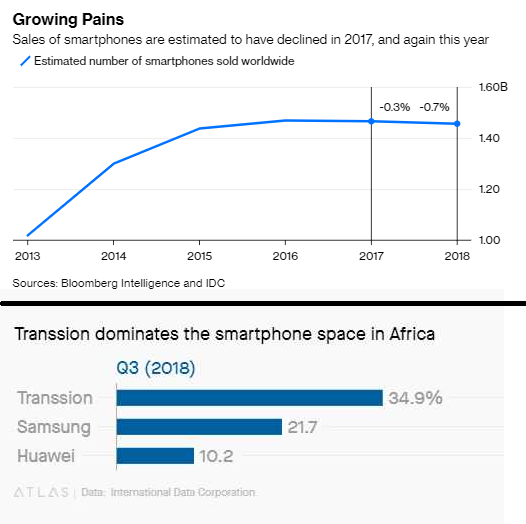

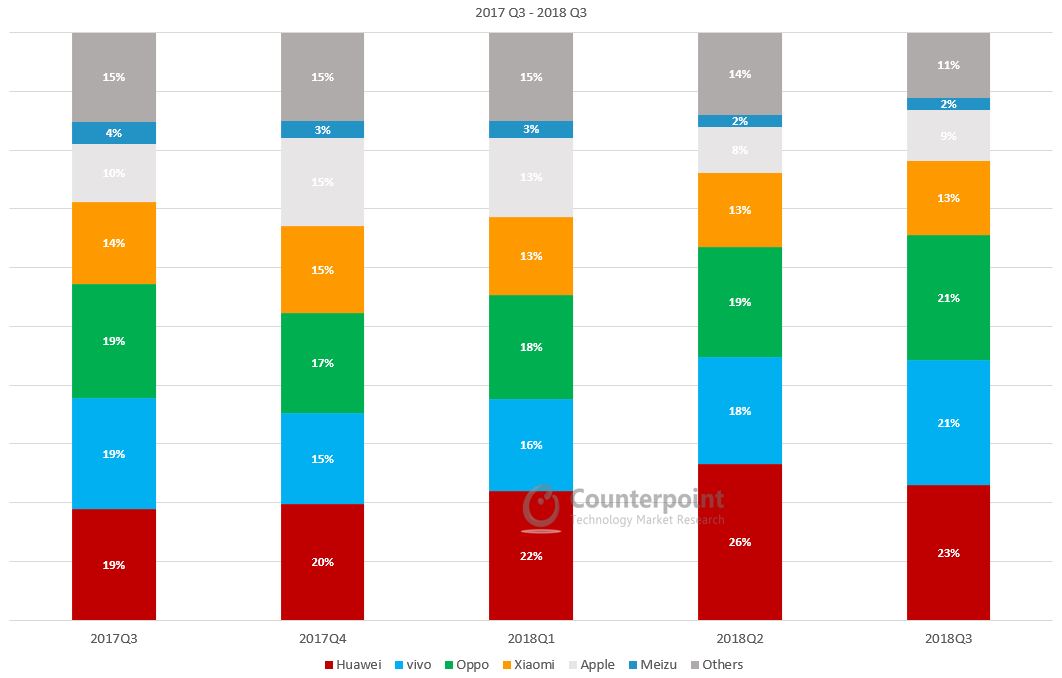

On the piece that Samsung will buy Tecno within 5 years, I have updated it with the core basis of my prediction. Largely, if Samsung cannot grow in U.S. and Europe*, the only remaining place is Africa. Samsung has no serious market share in China. It has struggled in Japan. And in India, Chinese firms are now winning there. So, if you look critically, it is only Africa that it has as a growth market. But since it is losing market share in Africa, it can buy itself out! Why save itself in Africa? It was doing better in the continent before it started fading. In the other markets, it never really did well.

You can minimally add Apple iPhone in this paralysis of losing market share; Huawei overtook Apple few months ago on smartphone shipment. Despite Apple argument via the Tim Cook letter, the real issue is that many Chinese phone makers are making great phones at 60% of iPhone price. So, in Asia, few people want to spend money on iPhone when they can get really great ones at 60% of iPhone price.

Apple CEO Tim Cook released a statement, warning investors Wednesday that the company is lowering expectations for its first quarter 2019 performance: “While we anticipated some challenges in key emerging markets, we did not foresee the magnitude of the economic deceleration, particularly in Greater China. In fact, most of our revenue shortfall to our guidance, and over 100 percent of our year-over-year worldwide revenue decline, occurred in Greater China across iPhone, Mac and iPad.”

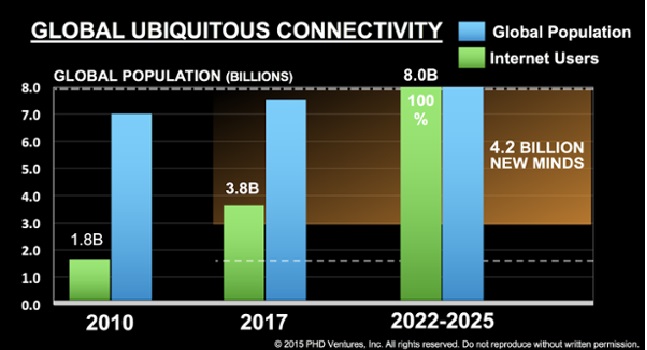

Notice the *: I added it because U.S. and Europe are strategically keeping Chinese brands out of their territories on the basis of national security. So, Huawei and Mi are not officially sold in U.S. through the big channels like telecom operators like AT&T and Verizon. If U.S. has allowed Huawei, Samsung and Apple would struggle at home. Americans like value and when they see how much Apple and Samsung are charging compared to the value on price and quality that Huawei offers, they would go for Huawei. The national security accusation is not strong since most of the phones sold in U.S. are actually made in China including Apple iPhone, and the ones sold by the telcos like Verizon and AT&T.

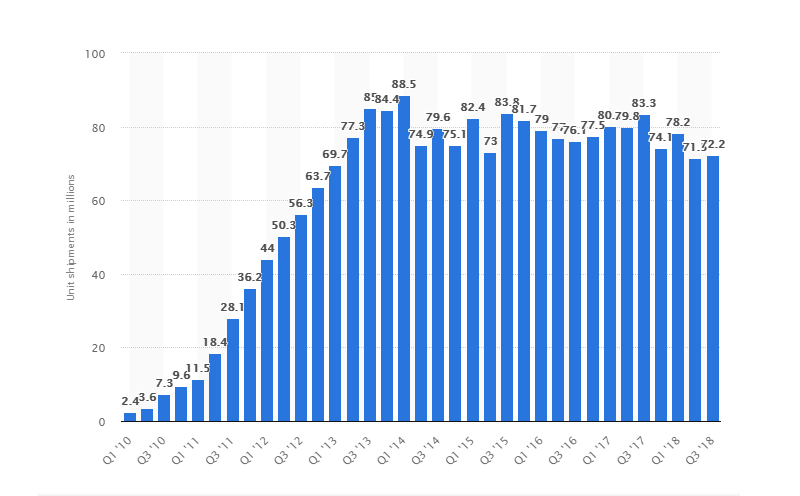

On the acquisition, how much would it cost? Looking at Tecno Mobile financials, it made (at most) $1 billion on revenue as at 2014, shipping 37 million units of phone in 2013. Samsung revenue in 2016 was $176 billion; the firm shipped 72 million phones in Q3 2018. Simply, Samsung can afford to acquire Tecno and make it Samsung Tecno with focus on Africa and Latin America. Samsung Galaxy is not cutting it here; Samsung Tecno is a better name! Maybe, it may cost it $6 billion to have Tecno in-house.