It is very intriguing when monopolies weep. It makes nice sound bites except that monetary values are lost, and jobs are always at risks. Many months ago, when TStv launched, with statements boasting of disruptions, I laughed. I called it a Goliath’s challenge, reminding Tekedia readers that TStv has no chance. MutiChoice through clusters of its properties are experts on dealing with distractions like TStv: it has GOtv to take care of TStv and if the Nigerian newbie elevates its game, DStv is there. But there is a competitor from the flank: Netflix.

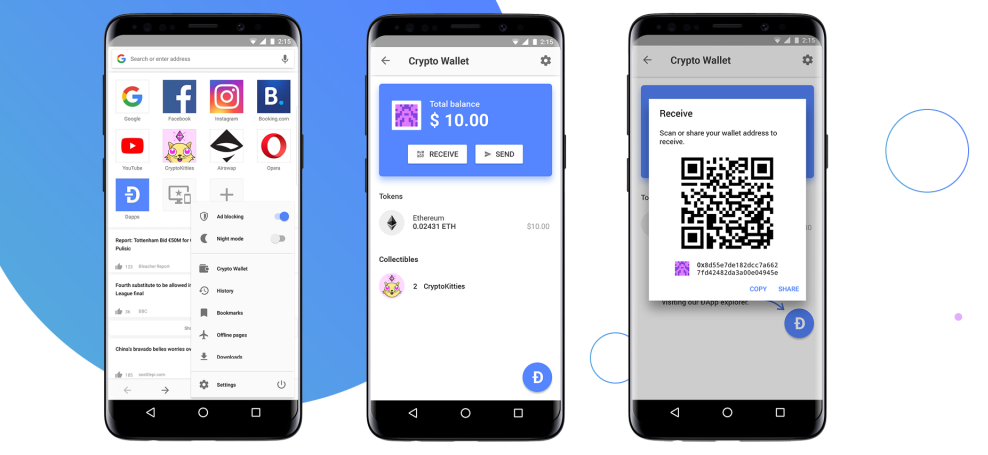

The video on demand players like iROKOtv and Netflix are also competitors. Anything that engages a customer time is a threat to pay TV.

That has just happened: MultiChoice properties are losing subscribers. It now needs help from government to regulate Netflix because the American video streaming pioneer is disrupting its business. Whenever you hear a monopoly asking for more regulations, just note that something is wrong.

MultiChoice, the pay-TV operator that continues to bleed subscribers, is fighting tooth and nail to remain relevant amid tough competition from online streaming services.

The pay-TV operator lost more than 100,000 premium subscribers in the previous financial year. It has lost a further 40,000 subscribers to date.

MultiChoice SA CEO Calvo Mawela attributed this loss of business to unregulated competition from video-streaming company Netflix, saying it had an unfair advantage as it was not under any regulatory pressure in SA.

However, MultiChoice, which owns DStv, said it was aware that failure to adapt its business model could make it a victim of digital disruption.

The MultiChoice Problem

The problem MultiChoice is facing today with the loss of subscribers is not really about Netflix. Simply, MultiChoice knew that the trajectory of entertainment was moving online and will continue to do so. Online is going to become the equilibrium state of “view entertainment”. Yet, MultiChoice did nothing. It is typical; I called it the monopoly hangover when I wrote about Interswitch. These entities are making so much money in the present model to creatively destroy it. Typically, someone else has to do it for them as that is the only way they can wake up.

Every product offered then by Interswitch was anchored on the premise that it was the only vehicle to connect companies online for payment, in Nigeria. You either take whatever you get or you stay offline. When we connected to GTPay, the company also needed to be supported by Interswitch. So, from banks to startups, Interswitch ruled the market. A one-product company, at its best, with many other things (electronic health records, etc) all linked to it, it had its moments.

The Game Ahead

Battling Netflix would not be easy. Hollywood represents the finest brand in the sector. Netflix is elevating the game with its original programming which would be a tough challenge for MutiChoice to match. Yet, it can innovate. It has launched DStv Now, a streaming version of the DStv product. It also plans to have pure video streaming product. But it is debatable how that would go. As I have noted in the Harvard Business Review, companies like Netflix operates on the winner-takes-all model. The implication is that once they come, you have limited chance to take them up unless you differentiate well. The only positive element here is that MultiChoice is not a small company; it is one of the largest corporations in the world. It has the financial capacity to take up Netflix if it wants. Its parent, Naspers, is the largest entity (by market cap) in Africa.

But focusing on Netflix misses the point for MultiChoice. YouTube, Instagram and Facebook are all competitors. Anything that engages people’s attentions online is a challenge. Pushing to regulate Netflix while leaving YouTube & Co would be catastrophic. Of course, Netflix has the best premium quality and it is fair to focus on it to drive the message home before regulators. But that would not be enough.

“As a country we have national objectives … if I was to be very narrow, I would say [to Icasa]: treat us like Netflix, so we do not have to pay tax or comply with black economic empowerment regulations,” he told the South African newspaper. “I am saying bring the likes of Netflix in the same net. Netflix does not employ even one person in this country, it doesn’t pay tax, they do not have to do any local content.”

We would be watching to see how South African regulators would regulate American companies. The challenge before MultiChoice is the problem of competing on the web where distribution is unbounded creating what I have called diminishing abundance of internet.

All Together

Many see the call for regulation from MultiChoice as a sign of weakness. Technically, it needs regulations to win because it has been badly challenged and disrupted. No monopoly asks for regulation unless it sees a problem in its path of domination.

This call for regulation is a common call from established monopolies who find their grip on a local market challenged by a tech disruptor, and MultiChoice is no different. At first the South African company tried to compete, launching its own streaming service as eyeballs moved online. Now it’s resorted to calling for stricter rules in its own market.

The problem is not really Netflix because only few Africans can afford to indulge on video online at the scale they could find value from Netflix: data is expensive and internet penetration remains low. In that space, MultiChoice products (DStv and GOtv) still lead because they are fairly cheaper when compared to Netflix. Of course the only way to live today and tomorrow is to innovate as the price of broadband continues to fall, meaning that more people will move online.

MultiChoice is not an underdog; it needs to compete through innovation. Its problem is not Netflix, rather all the clusters of digital ecosystems which entertain users at personalized levels which satellite-based cables cannot offer. The ability to watch only the things you want to watch, which online videos make possible, cannot be compared to cable TV products which show you things you may not like because of lack of personalization.