The federal government has confirmed it plans to sell off some non-oil assets of the Federation to fund the 2021 budget. Finance Minister, Zainab Ahmed, made this known to stakeholders in a budget presentation made in Abuja this week.

The document of the presentation, titled, ‘Public Presentation of 2021 FGN Approved Budget – Breakdown and Highlights’ dated Jan. 12 was obtained by Premium Times.

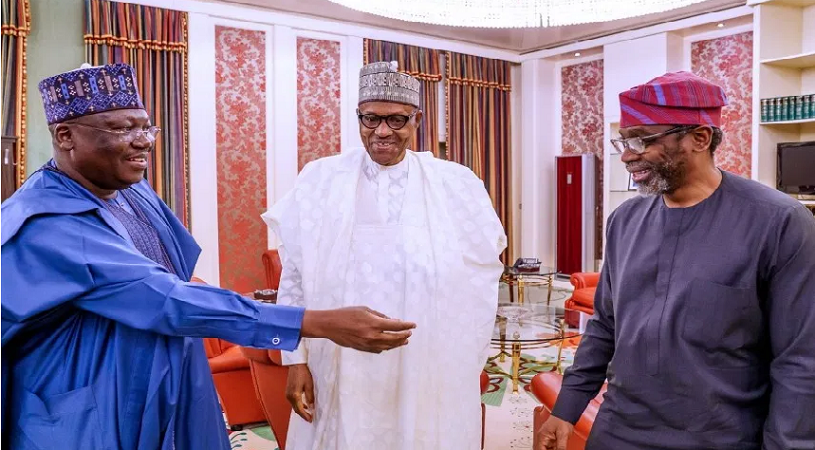

President Buhari presented the appropriation bill of N13.082 billion to the National Assembly in October, but it was increased by N505.61 billion to the total amount of N13.588 trillion which he signed into law in December.

A breakdown of the budget shows that recurrent expenditure will gulp N5.64 trillion, capital expenditure N4.125 trillion, debt servicing N3.324 trillion and statutory transfer N496.528 trillion.

Consequently, the approved budget was greeted with criticism as the federal government said it plans to engage in foreign and domestic borrowing to fund it. Ms. Ahmed said there is only about N7.97 trillion available to finance the budget.

The federal government said it would borrow N5.6 trillion from domestic and foreign sources to make up the total deficit of the 2021 budget. Ms. Zainab disclosed that Nigeria will borrow money from the World Bank, the Islamic Development Bank and countries like Brazil to finance the budget.

Government’s recent move to borrow funds from unclaimed dividends and dormant bank accounts also underscores its search for sources to borrow from. Ms. Ahmed said that the government is targeting about N850 billion from unclaimed dividends and dormant bank deposits.

Government’s plan to sell and lease assets comes at a time when its habit of borrowing to fund the budget has been repeatedly condemned.

The document said the government intends to fund the budget by selling and concessioning government-owned properties and non-oil assets.

Although the document does not specify the assets the government is considering to sell, Premium Times report noted an earlier event indicating some of the assets.

In November 2020, the Senate Committee on privatization headed by Senator Theodore Orji was presented with documents which show plans by the government to sell off some properties and assets of the federal government. Some of the assets include the Integrated Power Plants in Geregu, Omotosho, and Calabar, designated to be sold for N434 billion in 2021.

The documents also revealed plans to concession the National Arts Theatre, Tafawa Balewa Square, and all the River Basin Development Authorities at N836 million while National stadium in Lagos, the Moshood Abiola Stadium, Abuja, and two others were to be leased for N100 million.

The dispute between the Senate Committee on Privatization and the federal government has also been settled. The Committee said during the 2021 budget defense in November that it was not aware of the government’s plan to sell or concession some assets through the Bureau of Public Enterprise (BPE), and the chairman Orji said the BPE Director General Alex Okoh has refused to carry them along. The Clerk of the panel Sadia Abdullahi told Premium Times that the issue has been resolved.

She explained that Okoh reappeared before the panel to submit the necessary documents containing the list of national properties that are up for sale or concessioning as well as their prices. Ms. Abdullahi added that the committee, the BPE and the federal government are now all on the same page.

Apart from the plan to sell and lease assets, the government is also considering borrowing from special accounts. Last year, the federal government was seeking approval from the National Assembly to borrow from the pension fund, and it seems the plan is still alive as budget deficit remains a challenge in 2021.

Other means the government plans to use to finance the budget include the privatization of some public assets at N205.1 billion.

There are also Multilateral/Bilateral project-tied Loans put at N709.68 billion and New Borrowings of N4.7 trillion that involves N2.34 trillion domestic borrowing and N2.34 trillion foreign borrowing.

The government also plans to use N2.01 trillion share of oil revenue, N208.5 billion of NLNG Dividend, N2.65 billion from Mineral and Mining and N1.48 trillion non-oil revenue to fund the budget.

Apart from these, the government is counting on Company Income Tax (CIT) to generate N681.7 billion, Valued Added Tax (VAT), N238.4 billion, Customs N508.2 billion and Federation Account levies N60.5 billion to finance the budget.