I discussed the mechanism of Internet business this week in a company retreat. It was more of economics than technology. A client is redesigning business systems and needed deeper insights on the fundamental constructs on what drives growth in digital firms, especially Internet ones. The whole elemental pillars and anchors which Adam Smith postulated, via the lens of industrial-age economies of the past, cannot necessarily work at optimum in modern digital economies. Yes, the factors of production and comparative advantages of nations remain but their impacts are largely marginal – knowledge has since emerged as the most impactful factor in modern economies. A man with knowledge is a FACTOR.

In the past, business was about controlling supply to move prices. Manufacturers had control of supply but they had limited direct control on the consumers [you can control how many newspapers you produce but you have no definite control on how many people would buy]. So, winning markets was really about managing and controlling distribution as most businesses were bounded and constrained by geography, creating advantages which were largely localized [the largest newspaper in a region controlled the top news of the day].

What is Price Elasticity? If a small change in price is accompanied by a large change in quantity demanded, the product is said to be elastic (or responsive to price changes). On the other hand, a product is deemed inelastic if a large change in price is accompanied by a small amount of change in quantity demanded

Price Elasticity

Consider an electricity utility in your neighborhood. The electricity company has absolute control on distribution, making it possible for it to control many aspects of the engagements with consumers. The local newspaper managed distribution, not just on the physical newspaper, but also the contents in the newspaper. Where you have great contents and the editors did not like the ideas, the contents die because the distribution of contents was controlled by the gatekeepers of media. If the few newspapers in town rejected the contents, there was no alternative path to get them to Demand (the readers). So, under that regime, the great power in commerce lied on supply because that was the only thing conglomerates and huge companies could control, assuming a free society.

No industry was excluded in this construct: educational systems controlled supply of available spaces in programs, turning down many qualified applicants. Cement companies, oil companies and banks controlled supplies of services and products, using that control to improve margins.

The Internet Age of Demand-Control Strategy

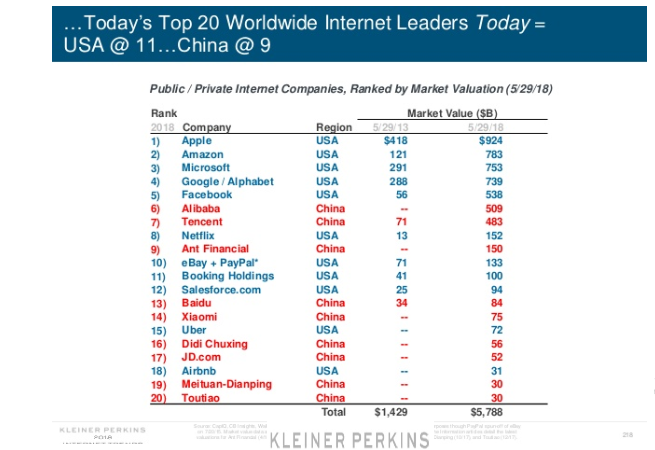

But today, the game has shifted from control of supply to control of demand for web-anchored consumer firms. And only companies with capabilities to control demand are going to win big. As shown in the table below, most of the greatest internet companies are simply controlling demand and that means controlling how supplies reach users and consumers.

A newspaper in the online space cannot have the old dominant impact it had which was possible because it controlled local distribution, creating scarcity of the product. A movie chain with theaters cannot have its old impact because unlike the physical theatres, the digital ones are unbounded and unconstrained. In other words, you cannot control supply because the web has made supply largely infinite. Because supplies of digital products are largely infinite, the game shifted from being driven by supply to one dictated by demand. There is an infinite copy of a digital movie unlike a disc version. So, when that supply is infinite, distribution loses the edge since anyone can have it. That infinite state happens because in the digital space, marginal cost goes to near-zero.

Simply, if the top five (print) Nigerian newspapers stop publishing online, not many will notice. But if they had done a similar thing, say twenty years ago, there would be serious upheavals. Then, they controlled the flow of information and were very powerful. Today, posting things online is largely unbounded, from Facebook to online blogs to digital native newspapers.

It comes down to aggregation: if the suppliers of local news are many, the challenge moves from the scarcity of the news to sorting out the supplier that adds value, since no person can technically visit all the individual websites before arriving at the most valuable one. Welcome Google which now becomes a gatekeeper, helping to make sense of the whole thing by guiding users to the right contents once they search. This is an evolution, shifting power from the old suppliers to a new set of entities which control access to demand.

Yes, the old companies which used to control distribution lose power [Google decides what content it shows users based on its algorithm]. Magically within the relationships, aggregators like Google and Facebook which make the unbounded supply manageable become the kingmakers. In the process, Google becomes more important to users than the newspapers (the suppliers of news) since Google helps to discover the papers. Because advertisers were all interested in access to demand (the users), the papers are cut-off (yes, disintermediated) as advertisers now spend more money advertising in Google.

All Together

If you plan to run an internet business, think about how you can control demand. You have already lost the power and capacity to control supply. Yes, anyone can use a credit card, irrespective of geography to buy anything online. The quantity you bring will not have material impact in the total pool in the market.

Nonetheless, you still need to find ways to create a separation. That could be by creating perception demand or simply by building massive data ecosystems which will give you access to be the digital kingmaker in a specialized sector since the ICT utilities like Google and Facebook, as I noted in a recent Harvard Business Review piece, have control of the broad internet.